The S&P squeezes out a new record high. The Dow just misses

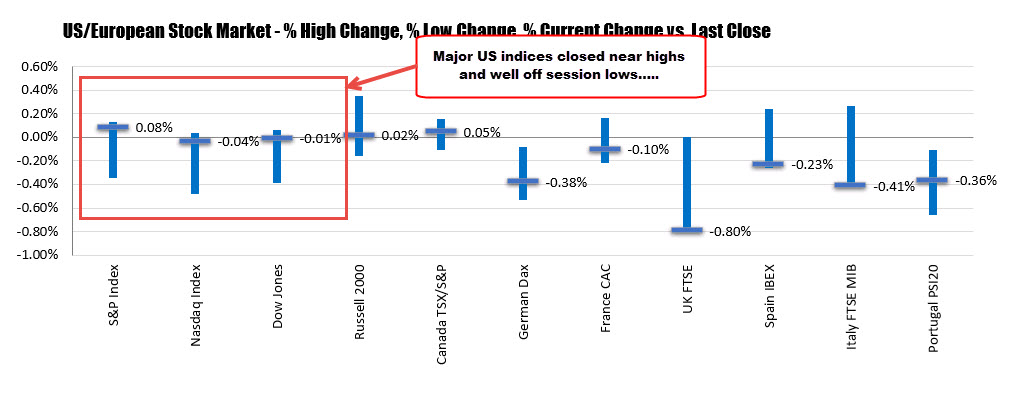

The US major indices are closing the session mixed/little changed after a down and up session.

Although little changed, the major indices did stage a comeback from much lower levels intraday.

The final provisional closes are showing:

- the S&P index +2.69 points or 0.09% at 3096.73. The high reached 3098.20. The low extended to 3083.26. The close was good enough for a new all-time record

- The Nasdaq index lagged a bit behind. It close down -3.081 points or -0.04% at 8479.02. Its high price reached 8485 .35. The low extended to 8441.582. The NASDAQ has failed to make new highs for 2 consecutive days

- The Dow closed down -1.63 points at 27781. 96. The high reached 27800.71. The low extended to 27676.97. The Dow close at a record yesterday. So the small decline today kept the index from a new record.

Below is a look at the % high, low and close for the North American and European major indices. The major indices in the US close near session highs and well off session lows.