Negative moves in stocks… Yields move lower… Gold moves higher

- Trump/Xi meeting to sign US–China trade deal could be delayed until December as discussions continue over terms and venue

- Still possible US – China trade deal pack will not be reached, but deal more likely than not

- Europe a likely venue for the Trump-Xi meeting with Switzerland and Sweden among sites under consideration. Iowa is not a likely

- Push for more tariffs rollbacks not seen derailing progress toward trade deal

- Believes China sees quick trade deal as best chance for favorable terms, given Trump’s electoral and impeachment pressures

The stocks have moved to a new session lows (modest declines are picking up steam a bit).

- S&P index fell to a low of 3067.26. We currently trade at 3069.5

- NASDAQ fell to a low of 8387.61. We currently trade at 8389.32

- Dow fell to 27420.17 with the price currently at 27435

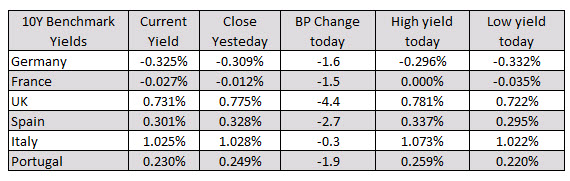

US yields moved lower as well with the 10 year at 1.824%, -3.5 basis points.

Gold prices have moved higher with spot gold up $9 or 0.61% at $1493 currently.

WTI crude oil futures have moved lower they trading near session lows at $56.33 (currently at $56.42).

The USDJPY has moved to a new session low at 108.83. The 200 hour moving average comes in at 108.659. There is a risk off in risk pairs like USDCAD, AUDUSD and NZDUSD.