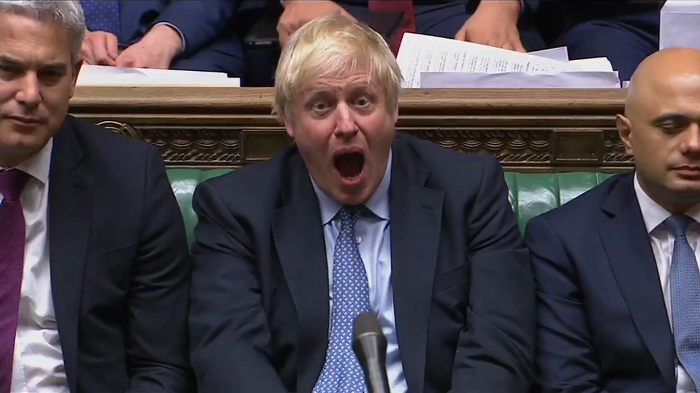

What if I told you that a no-deal Brexit now hinges on Boris Johnson winning the parliamentary vote tomorrow?

Before we get into the thick of things, let us set out what exactly is at stake tomorrow. Clearly, Boris Johnson’s Brexit deal motion is the main event but what does it mean really?

If lawmakers do vote to pass the motion, it means that they have technically voted in favour of a Brexit deal but there is still the issue of ratification and getting Johnson’s deal through the necessary legislative hoops – that includes voting on the withdrawal agreement.

The issue with all of this is related to the Benn Act. Now, the Benn Act requires Johnson to request an extension if Johnson cannot get parliament to agree on a Brexit deal. Hence, if the deal is rejected tomorrow, then there is no issue.

However, if the deal is approved, this is where things may yet get a little tricky.

In such an event, Johnson isn’t compelled to seek an extension and if there are hurdles he cannot overcome in getting his deal to be ratified and implemented, he could just let things run its course and we get towards a no-deal Brexit after 31 October.

Logically, you would think that he would seek a technical extension to get a deal through but possibly and certainly are two different words with very distinct connotations.

He could possibly seek an extension to work out any potential legislative issues and buy enough time to get his deal over the line legally but it doesn’t mean that he will certainly do so.

Is there any way to avoid this altogether?

This is where the vote on the Letwin amendment tomorrow may be rather consequential.

The Letwin amendment sets out that the government is to request an extension of the Brexit deadline, if a deal is passed, up until all the necessary legislative hurdles are overcome to officially put such a deal into place.

In essence, it is an added insurance in case Johnson has other plans up his sleeve.

This means that even if Johnson’s vote passes tomorrow but fails to get through any potential legislative complications by 31 October, he will still be compelled to request for an extension to the Brexit deadline.

While the drama involved in all of this is certainly captivating, it must be said that if we do see Johnson’s deal being passed tomorrow, it is pretty much a given that it should make it through all the significant legislative hurdles and be ratified in due time.

The timeline may now say it should be done by 31 October (two weeks) and that certainly could be plausible if lawmakers decide to work overtime.

That said, even if that isn’t enough time, a technical extension just to get the deal implemented is almost surely the most likely outcome – barring any unforeseen circumstances.