Brexit still hangs in the balance

- UK affirmed at AA

- See 1.1% GDP this year with upside risks

- Lower 2020 growth forecast to 1.2% from 1.5% on Brexit uncertainty and slower global growth

- Full report

Fitch is warning about more spending even if Brexit is resolved. They say that austerity fatigue and Brexit preparations are set to reverse the path of expenditure restraint seen since 2010.

They also warn that a positive Brexit resolution is still uncertain but overall there is a more-positive spin in the report:

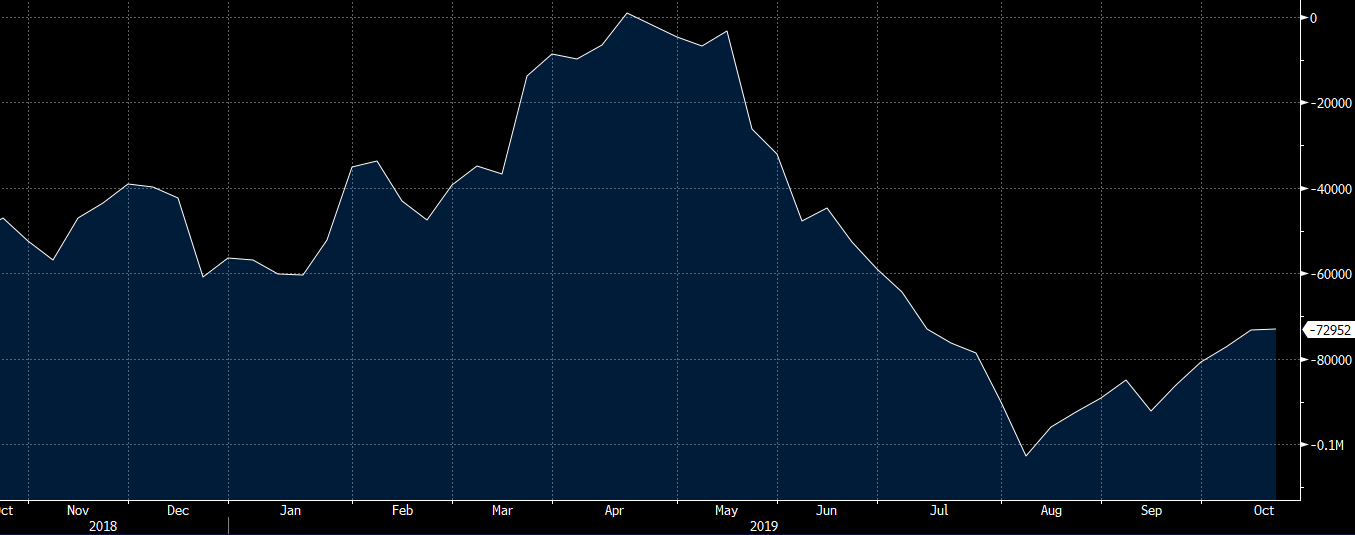

Recent data revisions suggest the UK economy has been more resilient to post-referendum Brexit uncertainty than previously thought. Sizeable revisions to business investment indicate firms started to reduce investment from mid-2017 rather than in 2015 as the previous vintage suggested. The overall level of business investment is 3.3% above end-2015 according to the new data. The household saving ratio was also revised up to 6.2% in 1Q19 from 4.4% under the previous vintage. Households appear to have been more cautious than previously believed. This suggests that the household sector is in a somewhat stronger position to withstand the impact of a potential economic shock.