Archives of “September 19, 2019” day

rssEuropean shares are ending the session higher on the day

German DAX, +0.5%. UK FTSE, +0.6%

The major European stock indices are ending the session higher on the day. The provisional closes are showing:

- German DAX, +0.5%

- France’s CAC, +0.6%

- UK’s FTSE, +0.66%

- Spain’s Ibex, +1.1%

- Italy’s FTSE MIB, +0.82%

- Spot gold up $5.29 or 0.35% at $1499.30. The precious metal has been trading above and below the 1500 level for most of the New York session

- WTI crude oil futures are up $0.45 or 0.77% at $58.56

- S&P index +10.53 points or 0.35% at 3017.36 The high reached 3021.99. The high close for the S&P is up at 3025 area.

- NASDAQ composite index is up 39.3 points or 0.48% at 8216.54. The high price extended 28237.43

- The Dow industrial average is up 80.60 points or 0.31% at 27228

Russia energy minister Novak: Russia sticking to OPEC+ deal in full

Crude oil is trading up $0.50 on the day

- Russia is committed to OPEC+ deal in full

- Talked to Saudi Arabia energy minister by phone on Wednesday

- The situation has stabilized following the tax and Saudi Arabia

- Saudi Arabia is not cutting its oil exports

- No decision to change global oil deal targets

Fed’s overnight repo was oversubscribed again

Fed funds effective rate

Wilbur Ross: China trade is more complicated than just soybeans

Comments by US commerce secretary, Wilbur Ross

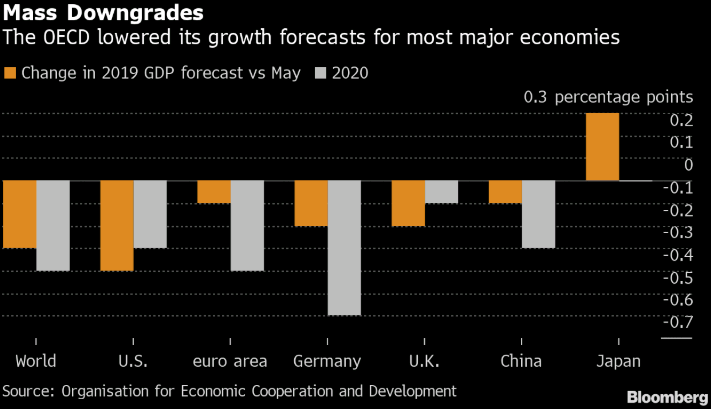

OECD sees global economy slipping towards weakest growth in a decade

OECD cuts forecasts to the global economy, warns of entrenched uncertainty

- 2019 global GDP growth at 2.9% (previously 3.2%)

- 2020 global GDP growth at 3.0% (previously 3.4%)

- 2019 US GDP growth at 2.4% (previously 2.8%)

- 2020 US GDP growth at 2.0% (previously 2.3%)

- 2019 China GDP growth at 6.1% (previously 6.2%)

- 2020 China GDP growth at 5.7% (previously 6.0%)

- 2019 Eurozone GDP growth at 1.1% (previously 1.2%)

- 2020 Eurozone GDP growth at 1.0% (previously 1.4%)

- 2019 Japan GDP growth at 1.0% (previously 0.7%)

- 2020 Japan GDP growth at 0.6% (unchanged)

- 2019 UK GDP growth at 1.0% (previously 1.2%)

- 2020 UK GDP growth at 0.9% (previously 1.0%)

Iran’s foreign minister questions US remarks: “Act of war” or “Agitation for war”?

Oil appears to be jumping on the tweet here by Zarif

The tweet reads:

“Act of war”or AGITATION for WAR?

Remnants of #B_Team (+ambitious allies) try to deceive @realdonaldtrump into war.

For their own sake, they should pray that they won’t get what they seek.

They’re still paying for much smaller #Yemen war they were too arrogant to end 4yrs ago.

Beijing expert says that China and US may be close to agreeing an interim trade deal

SCMP reports on the matter

The report cites views and commentary from the chief economist for the China Centre for International Economic Exchanges, Chen Wenling, who is a researcher affiliated with the Chinese government.

“Trump is likely to win the election, and it would a good news for China. He is completely clueless in fighting the trade war without any strategies or master plans, and he has bullied US allies.”

SNB leaves policy rate unchanged at -0.75%

SNB announces its latest monetary policy decision – 19 September 2019

- Prior -0.75%

- Sight deposits rate unchanged at -0.75%

- Willing to intervene and will remain active in FX market as necessary

- Expansionary monetary policy continues to be necessary

- Trade tensions could further hurt global economic mood

- Franc remains highly valued

- 2019 GDP forecast at 0.5% to 1.0%; previously 1.5%

- 2019 inflation forecast at 0.4%; previously 0.6%

- 2020 inflation forecast at 0.2%; previously 0.7%

- 2021 inflation forecast at 0.6%; previously 1.1%

Brazil’s central bank cuts benchmark rate by 50bps

Banco Central do Brasil: “That’s not a rate cut, THIS is a rate cut!”

- decision was unanimous

- consolidation of benign inflation outlook should give room for additional policy stimulus

- says economic data since last meeting consistent with gradual recovery

- global economic outlook uncertain, risks of greater slowdown persist

- underlying inflation at comfortable levels

- sees inflation moving back to target over the relevant time horizon, which includes 2020 calendar yearbut sees inflation risk in both directions

Headlines via Reuters