US stocks were mixed as Federal Reserve officials cast doubts on further rate cuts and a reading on domestic manufacturing stoked concerns over the health of the economy. The S&P 500 ticked 0.1 per cent lower after drifting between gains and losses, with investors turning their attention to the central bank’s annual summit where chairman Jay Powell will speak on Friday. The Nasdaq Composite was down 0.4 per cent, while the Dow Jones Industrial Average rose 0.2 per cent on a rally in shares of Boeing. Central bankers from around the world have descended on Jackson Hole, Wyoming, for a policy symposium that is closely watched by investors seeking clues on monetary policy.

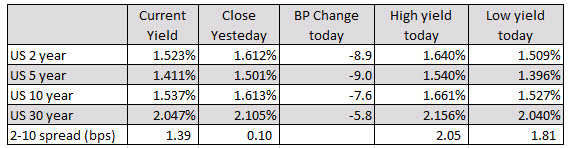

Market participants are looking for the Fed to follow its July rate cut with another one in September, but at the start of the Jackson Hole gathering on Thursday, Philadelphia Fed president Patrick Harker and Kansas City Fed president Esther George indicated in television interviews that they would not back further cuts. “My sense was we’ve added accommodation, and it wasn’t required in my view,” Ms George, one of two dissenters in the July decision, told CNBC. Mr Harker, who is not a voting member of the Fed’s policy setting committee, said he believes the federal funds rate is around its neutral level, adding: “I think we should stay here for a while and see how things play out.” The US 10- and two-year yield curve inverted for the second time this week following the remarks. The yield on the benchmark 10-year Treasury rose 3.3 basis points to 1.6097 per cent, while the policy-sensitive two-year yield was up 4.5bp at 1.6141 per cent. An inverted yield curve is considered a sign that investors expect a recession.