North Korea have fired off another round of ballistic missile tests Saturday morning NK time.

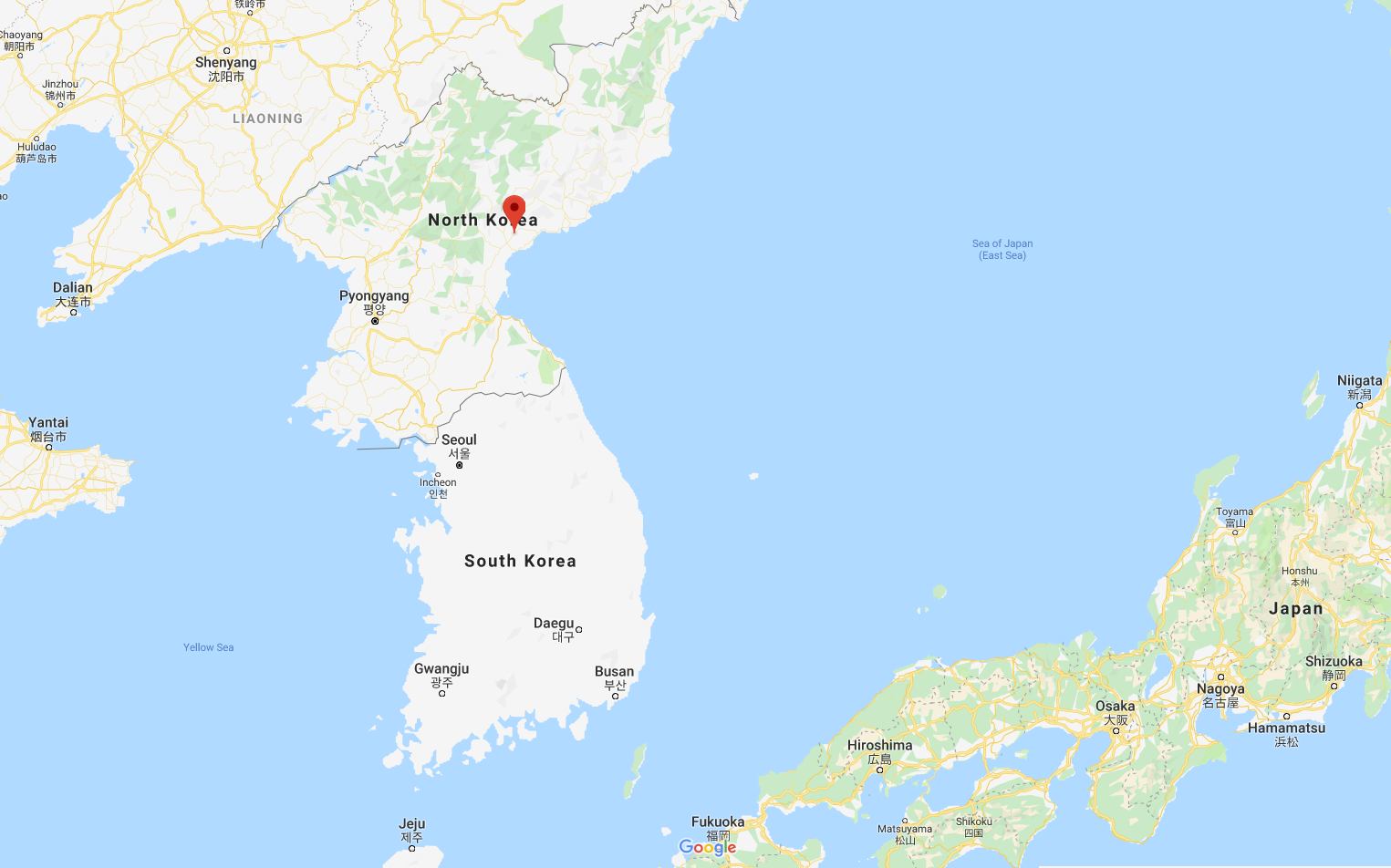

- at least two short range missiles fired into the sea

- off the NK east coast, Hamhung area

North Korea tested ballistic missiles earlier this week also. North Korea have been firing them quite regularly ever since the June 30 meeting between North Korean dictator Kim Jong Un and US President Trump.

—

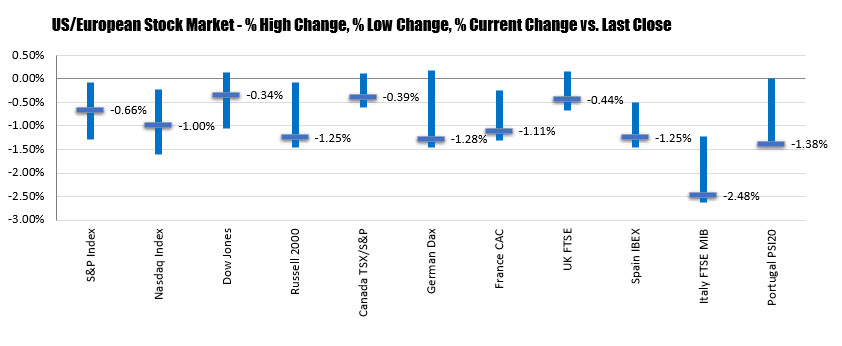

While this is a yen positive (rising geopolitical tensions prompt flows to liquidity) the market has become a bit jaded with the regular tests.