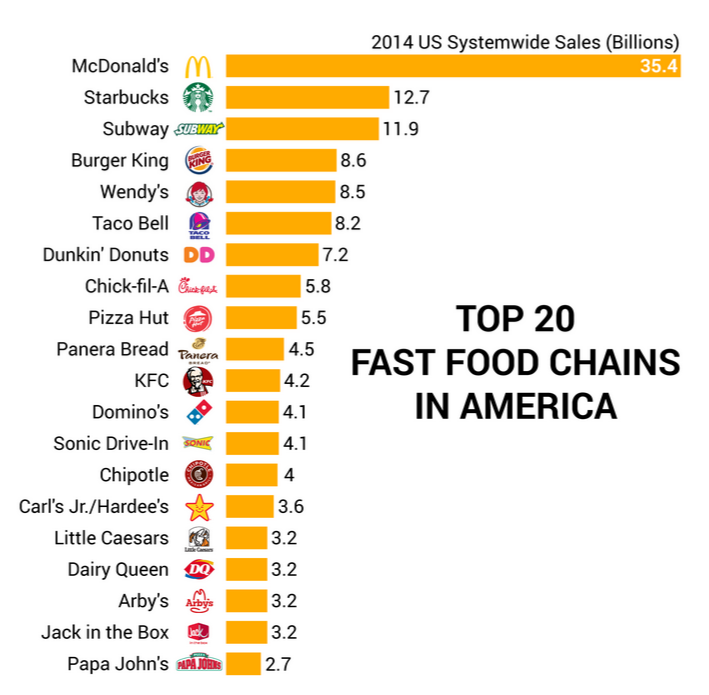

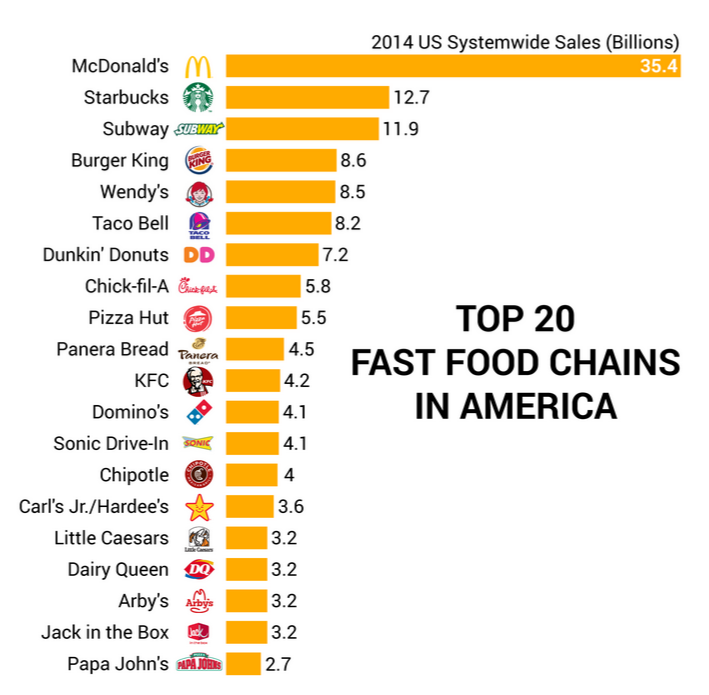

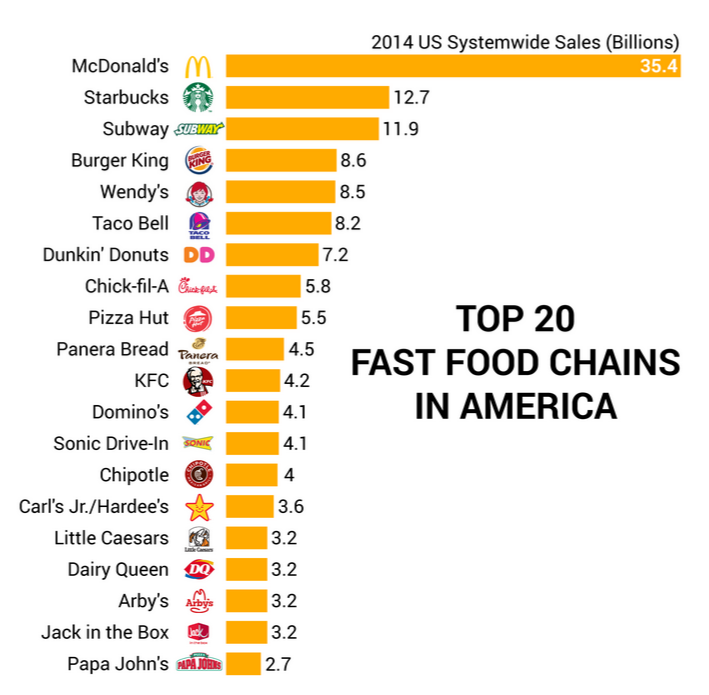

Top 20 Fast Food Chains in America.McDonald's Annual US Sales $ 35.4 Billions

Many times, good traders make the right trade but still lose, but it is okay because they will win in the long term because their method is tested, their risk is managed, and their mind set is right for long term trading success. They have developed the skills of a successful trader. Other times a new trader with no skills makes a trade based on a hunch and wins big, the danger is that the new trader will confuse luck with skill. The delusion begins with winning on a few trades, the new trader trades bigger, and bigger, until their luck runs out and they are wiped out. We need to all keep a good understanding of whether we traded will the right skill set or we just got lucky.

Traders with skill have large gains after 100 trades and are relatively quiet, traders that were lucky have huge gains after a few trades and are very loud, then very quiet for the next few trades that usually bring their account to zero.

Traders with skill risk 1% to 2% of their trading capital per trade and win in the long term, traders that are just lucky risk the majority of their account for a few big wins in the short term but lose in the long term when their luck runs out.

Traders with skill use a successful method with different stocks, currencies, commodities, future markets while traders with just luck are only successful with one lucky pick in one of those markets and when its up trend ends their winning streak ends. (more…)

The lesson here is straightforward. Trade less frequently and trade smaller than you think you should.

Of these two, trading smaller size is easier to grasp and much more intuitive. If you are risking less, then your P&L won’t swing as wildly, allowing you to stay more level-headed and to make better decisions without getting scared or euphoric. You also are unlikely to lose as much during a bad run, allowing you to sidestep potential catastrophic losses and to stay in the game, both financial and psychologically. Ultimately, it’s steep drawdowns that end careers. If you can avoid big declines In your equity and be in the right place psychologically to bounce back, then you will have a long and successful career.

But trading less frequently is equally important. By making it a priority to trade less frequently, you are making sure that you think harder and deliberate before entering and exiting a position. This allows you to focus on executing your methodology, rather just impulsively leaping into and out of positions. That should boost the quality of each trade and in turn, your overall success.

You are also making sure that you are picking your spots, thereby boosting the percentage of your trades that are winners. Even a small increase in your win rate, e.g. from 40% to 43%, would mean a measurable improvement in profitability. Having more winners, and having those extra winners generate bigger gains on average than the losers, can mean the difference between a so-so year and a great year.