IQ to be correlated with rationality

Consider the following scenarios:

* We decide to enter a position at a particular price level, it hits that level, and we create an excuse and fail to take advantage of an opportunity;

* We set a stop loss on a position, but rationalize staying in the position when that level is hit, creating a loss that wipes out many days of gains;

* We establish a process for researching markets and keeping ourselves in peak condition, but become distracted by life events and fail to follow our process;

* We take an unplanned trade after losing money and widen our losses.

In each of these cases, we have what traders commonly call a loss of discipline. In fact, it is a failure of willpower: an inability to sustain intention.

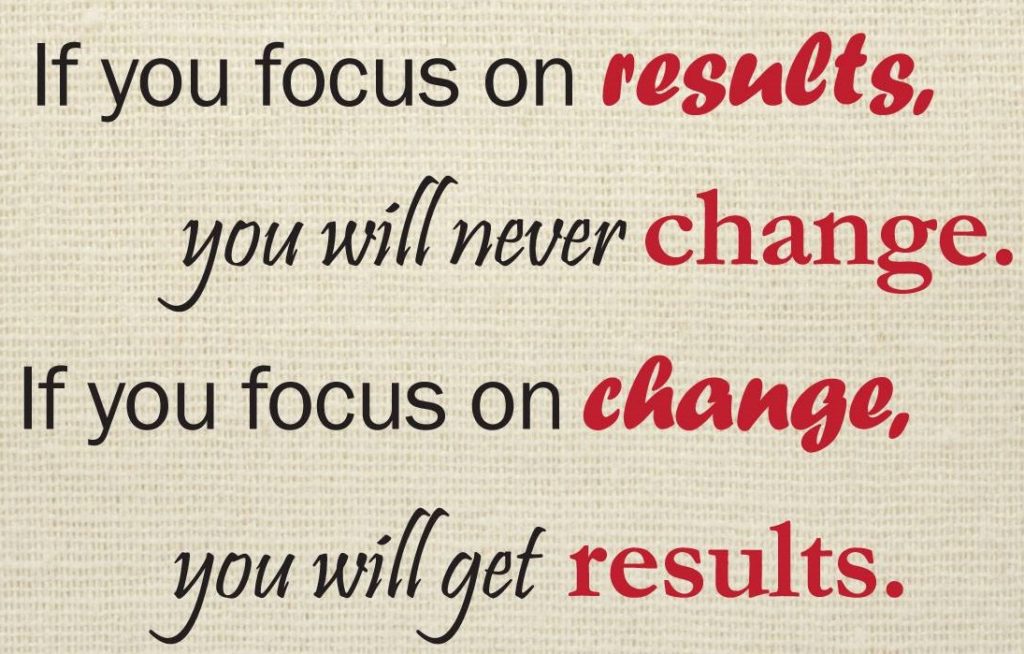

Our focused attention–our intentionality–is a finite resource. It becomes fatigued with use. When we frame trading problems as one of lack of discipline, we treat our challenges as character flaws. When we frame trading problems as one of lack of willpower, we open the door to strategies that preserve the willpower we possess and expand our level of willpower over time.

First, you need to find a systematic method which removes most (if not all) of the emotion and discretionary judgment from your trading. Be prepared… this could take years. Once you have identified a system that can be profitable over the course of time, then you have to develop a mindset in which you:

Technically Yours/ASR TEAM

Many new traders tend to think that that more complicated they make trading, the easier it will be to “solve” the markets. Instead, they should be listening to William of Ockham, and making things simpler. Simple, done correctly, can lead to more profits, and stand the test of time better than complicated approaches.