Archives of “February 14, 2019” day

rssAsia’s fastest growing cities are mostly in India ,But Just See…What Happens on Rainy Days ?

There are 3 Types of Traders

What kind of person you are “outside the charts” will help determine what kind of trader you will be “inside the charts”.

If you are of the first kind, “the wills”, you will overcome all the obstacles on your way to consistent success. You will accept, even embrace, uncertainty as the driving force behind the next big opportunity for gain. You will lose gracefully and move on to the next trade, knowing that trading is a game of probabilities and possibilities; not certainties and absolutes. You will leave money on the table, thankful for what you were able to gain; not bitter by what was left. If you are of the first kind you will succeed. You will indeed.

If you are of the second kind, “the won’ts”, you will look for the always elusive easy road to riches. You won’t believe in the effort required to become a disciplined trader, driven by solid habits repeated daily. You won’t apply the skill necessary for managing risk as that would require planning and preparation, something you just do not have time for. You won’t develop your own well defined trading edge, depending instead upon others to do it for you. If you are of the second kind your opposition to anything other than what is easy will make it quite difficult to succeed when times get tough, and they will but you won’t.

If you are of the third kind, “the can’ts”, you will blame everyone and everything for your failures. You can’t succeed because you are too busy finding fault in any trading strategy that produces a loss. You can’t succeed because anyone who does so has some special knowledge or gift that you obviously cannot possess. You can’t succeed because the market is rigged. If you are of the third kind…quit. You are a quitter with a quitter’s attitude. Be in the majority. Be a can’t. It’s easy.

So, what kind of person (trader) are you?

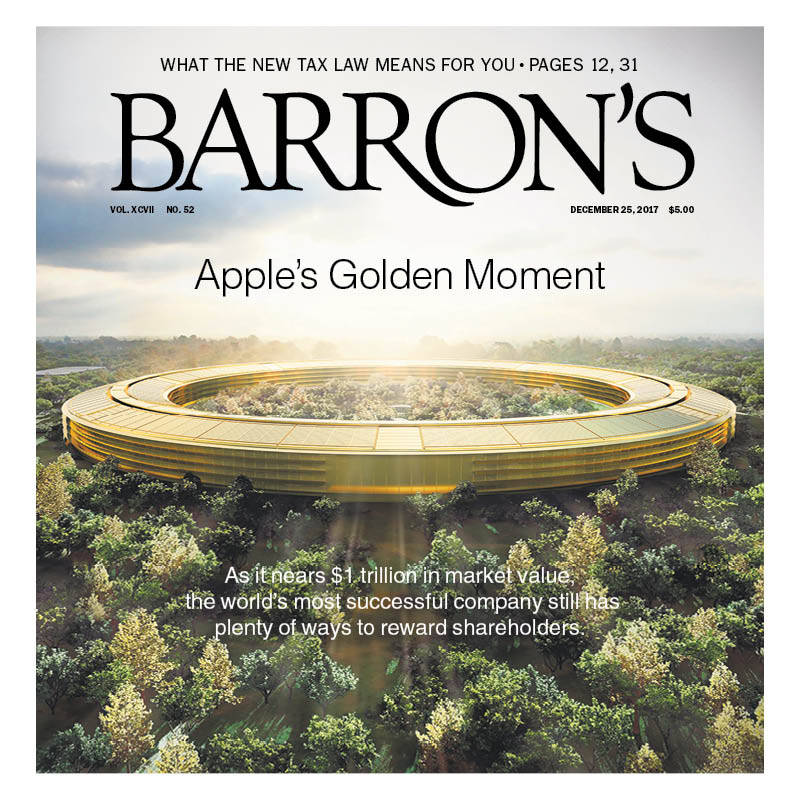

Barron’s $1 Trillion Dollar Apple Cover

Barron’s cover showing Apple’s new “golden” headquarters generated a truckload of commentary, including a lot of previously debunked nonsense; Josh has a good round up here.

This is important stuff. Why? Because separating reality from bullshit is the key to making better informed and more intelligent investment decisions.

I will have a lot more on this later today, but just note that the HQ Indicator is spurious, the Magazine Cover Indicator is widely misunderstood, and there is no such thing as a Single Company Magazine Cover Indicator (SCMCI).

The SC

1981 – Present: Which of these 138 Apple/Steve Jobs Magazine Covers is the Sell Signal?

Source: Kuo Design

Know your faults

I recently sat down and made a list of all my trading faults. If you have a capacity for honest self assessment you will know what they are. I then created a goal for each of the things on my list which was its opposite.

So for me consistent journal writing and record keeping I knew was not that great. I have bursts of it, then either have no time or get bored – and I also think that accurate journal writing is fuel for the rocket of personal development so I MUST do that. I worked out that half the problem was not having a consistent format that I was happy with so I think I’ve fixed that.

There were a few other things, but that was the process. Create a list of your known issues and reverse them, and focus more on those goals than anything else.

Good & Great Traders

Major Signals Chart -Candle Stick

What Do Prices “Know” That You Don’t?

Four Main Reasons Why Traders Fail

# They do not understand that the markets are a mirror of life on a chart. Markets are a living thing and reflect crowd behaviour, you , the trader are one of the crowd too.

# They fail to understand their own personality and what that means for their trading style. It can make THE difference between success and failure as a trader.

# They fail to notice how they transfer their feelings and emotions to their trading and believe that the emotions they pick up from other traders and the markets are theirs. Feelings are unpopular with traders, big mistake!

# They have unresolved psychological blockages which they supress with superficial positive thinking and learned discipline. We all have blocks, to think that you are the one who has not is dangerous arrogance.

# And finally….

..add to this one most important point for the beginning trader: Under capitalisation due to unrealistic expectations and poor trader training. The recipe for trading failure is complete.

Ignoring The Herd

Sir John Templeton said, “To buy when others are despondently selling and to sell when others are euphorically buying takes the greatest courage, but provides the greatest profit.”

Then, this is what Warren Buffett says, “The less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own affairs.” In other words, Buffett is urging us to do the opposite of what others do: to be contrarians.

“Buy low, sell high” is the time-honoured dictum, but investors who are swept up in market cycles too often do just the opposite. Here is what Howard Marks writes in his book, The Most Important Thing –

“The proper response lies in contrarian behaviour: buy when they hate ’em, and sell when they love ’em. “Once-in-a-lifetime” market extremes seem to occur once every decade or so— not often enough for an investor to build a career around capitalizing on them. But attempting to do so should be an important component of any investor’s approach.”

Now, of course, being a contrarian is not going to be a profitable strategy at all times. After all, much of the time there aren’t great market excesses to bet against. And even when an excess does develop, it’s important to remember that “overpriced” is incredibly different from “going down tomorrow.” (more…)