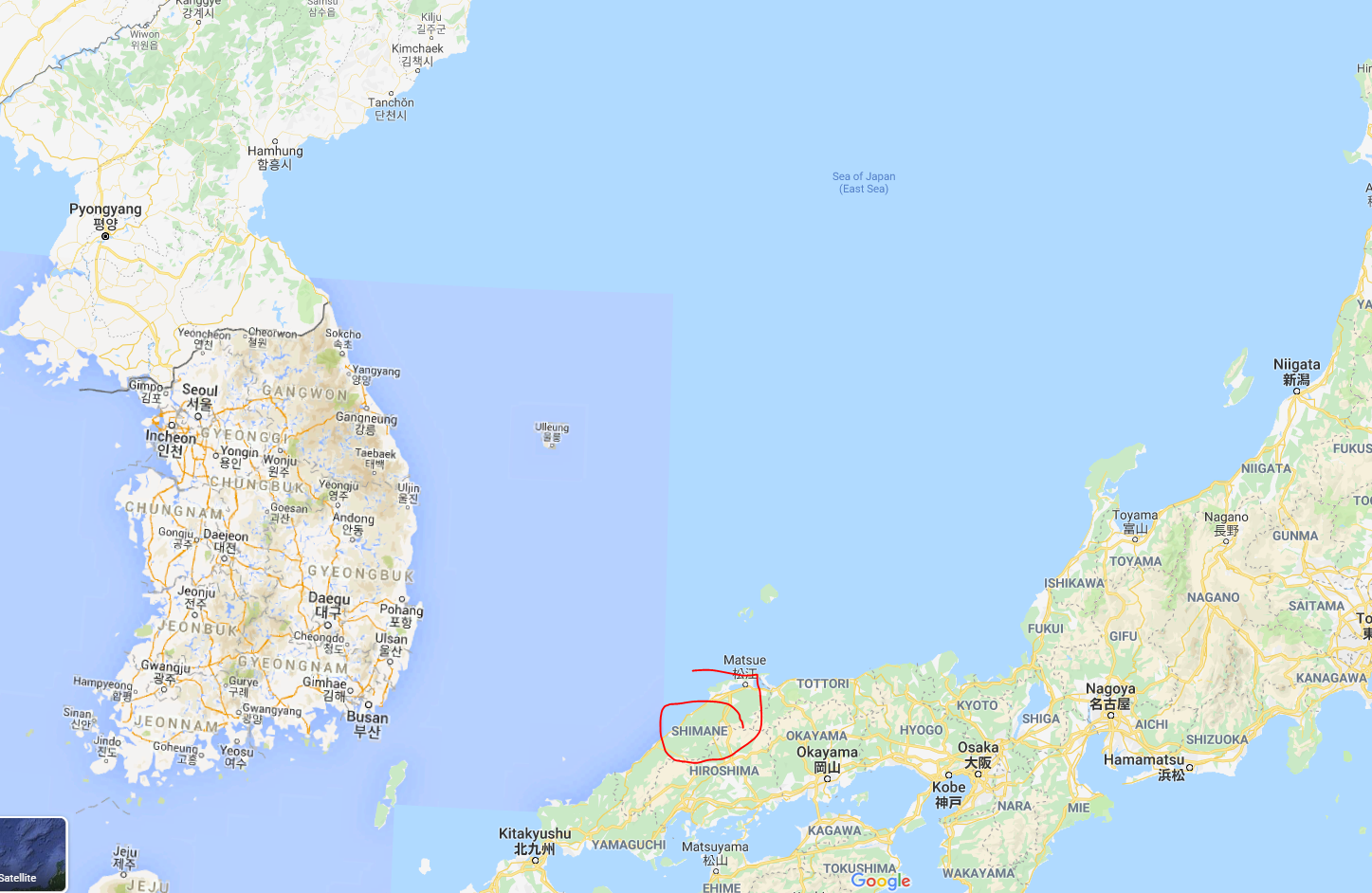

In the midst of the oil and equity markets gappage down came NK firing off a missile test

- Its now confirmed as three projectiles

- fired into the East Sea

- Apparently none have landed in Japan’s economic zone.

1. “Accept everything just the way it is.”

= accept the market reality in front of you.

2. “Do not seek pleasure for its own sake.”

= don’t trade for pleasure

3. “Do not, under any circumstances, depend on a partial feeling.”

= don’t jump or out of trade on shallow half-baked impulsive feelings.

4. “Think lightly of yourself and deeply of the world.”

= don’t take your trading skills too seriously, take the ability of market to surprise seriously.

5. “Be detached from desire your whole life long.”

= make money, but don’t let money make you.

6. “Do not regret what you have done.”

= smile at your mistake, laugh off your profit.

7. “Never be jealous.”

= what you’ve got is good and enough and incomparable

8. “Never let yourself be saddened by a separation.”

= a loss is never final. it either stays back as lesson or returns as profit.

9. “Resentment and complaint are appropriate neither for oneself or others.”

= accept the reality, keep the power with yourself by not complaining.

10. “In all things have no preferences.”

= don’t measure your profit or loss, just measure them by the lesson or experience.

11. “Do not act following customary beliefs.”

= dare to think!

12. “Do not collect weapons or practice with weapons beyond what is useful.”

= a handful of tools are enough if you are willing to submit.

13. “Do not fear death.”

= do not fear unforeseen loss.

14. “Do not seek to possess either goods or fiefs for your old age.”

= don’t trade under pressure to accumulate profit. if you remain alive, markets will always be there. just keep learning the game.

15. “Respect Buddha and the gods without counting on their help.”

= respect luck, acknowledge god’s blessing, but don’t drag them in the market.

The markets are nothing more than a reflection of cumulative sum of human reactions to financial data inflow. As a trader, you are part of it, and millions like you create that entity that appears to be moving so intelligently in all time frames.

The markets are nothing more than a reflection of cumulative sum of human reactions to financial data inflow. As a trader, you are part of it, and millions like you create that entity that appears to be moving so intelligently in all time frames.

So how it is possible that you and millions like you can create the greatest illusionist, the market, and ironically fight against it in every moment of your trading life.

In other words, the market becomes the ultimate enemy of yours and you fight it all the time? As an unit reflection of the market’s image, can you defeat yourself?

Your fight can only be as good as your best, but you create your enemy with your best as well.

That is why this is an endless game because no one can win it all the time as no one can keep beating himself all the time… UNLESS YOU ARE A SELFLESS PERSON. (more…)

“The best way to insure you’ll take on difficult tasks is to ritualize them — build specific, inviolable times at which you do them, so that over time you do them without having to squander energy thinking about them.” The best time to prepare for trading is before the market opens or late in the evening after you have had a break from the close. Execution is based on proper preparation. If you are properly prepared for the battle then the execution will be a synch. Remember: trading is war PREPARE your weapons.

If you wish to excel at trading it is going to take a lot of hard work but we all know that anything really worth having comes with a sacrifice of one thing for another. As Mr Swartz sums it up: “If you want to be really good at something, it’s going to involve relentlessly pushing past your comfort zone, along with frustration, struggle, setbacks and failures. That’s true as long as you want to continue to improve, or even maintain a high level of excellence. The reward is that being really good at something you’ve earned through your own hard work can be immensely satisfying.”

This business is war with every trade. Are you asleep at the wheel or are you going to fight? I really like taking your money. The choice is yours.

The truth is, I don’t know you from Adam. I’m probably not going to be on the other side of your trade. But, we ARE in battle with every trade. We DO have to prepare to fight or we’re an easy kill. We have to have a PLAN for using our WEAPONS on the field or we’re dead.

This blog entry is an intro to a series on system development. We’re going to walk through the steps to creating a realistic, functional plan for trading the markets. Then, we’re going to look at our weapons and how to use them most effectively when the edge is in our favor.

I will fight and win, will you?