Latest data released by Markit – 6 May 2020

- Composite PMI 13.6 vs 13.5 prelim

The preliminary release can be found

here. A tad better than initial estimates but again, it doesn’t take away the fact that the euro area economy saw a record contraction in business activity during the month of April. A summary to wrap your head around:

Markit notes that:

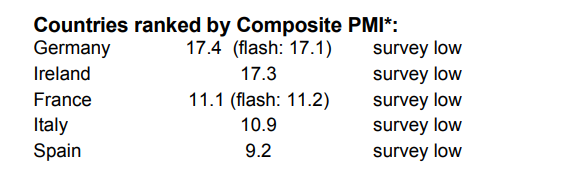

“The extent of the euro area economic downturn was laid bare by record downturns in every country surveyed in April, with output falling at unprecedented rates across the region’s manufacturing and services sectors.

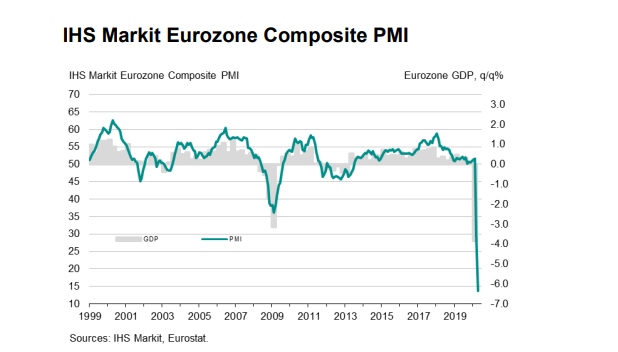

“With a large part of the region’s economy shut down while COVID-19 infections spiked higher, the economic data for April were inevitably going to be bad, but the scale of the decline is still shocking. The survey data are indicative of GDP falling at a quarterly rate of around 7.5%, far surpassing the worst decline seen in the global financial crisis. Jobs are also being lost at a rate never previously seen.

“Hopefully, with coronavirus curves flattening and governments making moves to ease lockdown restrictions, many sectors should start to see output and demand pick up. The process will be only very gradual, however, as governments juggle between reviving economies and preventing a second wave of infections. Most companies will inevitably need to work at levels well below full capacity and sectors such as retail, travel, tourism and recreation – already the hardest hit – will continue to be badly affected by social distancing.

“While the rate of decline may ease in coming months, we do not expect to see any material signs of recovery until the second half of the year, and it is likely to be several years before the output lost due to the