Dow and S&P down for the 3rd day in a row

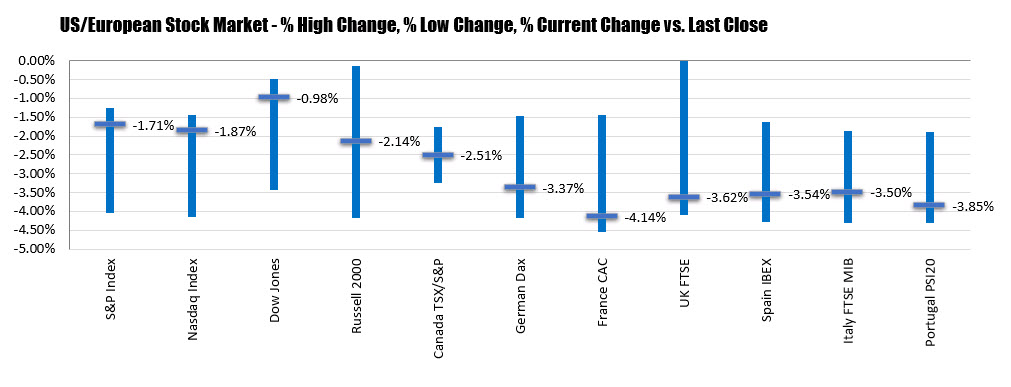

The major indices had there worst day since March 16 as concerns about the growth prospects and increases in coronavirus cases weigh on equities. Initial jobless claims should another 1.5 million increase which certainly did not help.

- The Dow is closing at the lowest level since May 27.

- The Dow and S&P are down for the 3rd day in a row

- all 30 of the Dow stocks close lower with Boeing the weakest at -16.42%

- worst day since March 16 for the major indices

- The NASDAQ index snapped it’s a 4 day win streak

- Dow and S&P on track for its worst week in 3 months

- S&P index closes below its 200 day moving average at 3013

- the Dow industrial average is within 300 points of a 10% decline from the high (24824 is the level)

- the Dow industrial average fell back below its 100 day moving average at 25123.55, but is closing just above that level at 25128.13

- S&P index -188.04 points or -5.89% up 3002.10. The low for the day reached 2999.49. The high was way up at 3123.53

- NASDAQ index fell -527.62 points or -5.27% to 9492.72. That was just above the low for the day at 9491.30. The high was up at 9868.02

- The Dow industrial average fell 1861.82 points or -6.9% to 25128.13. The low for the day reached 25082.72. The high was up at 26294.08

- Boeing, -16.42%

- United Airlines, -16.09%

- Delta Air Lines, -14.01%

- Citigroup, -13.37%

- Schlumberger, -11.60%

- Southwest Airlines, -11.58%

- Marriott, -10.91%

- Fiat Chrysler, -10.10%

- Bank of America, -10.0%

- Ford Motor, -9.9%

- Wells Fargo, -9.83%

- PNC financial, -9.62%

- Goldman Sachs, -9.14%

- IBM, -9.12%

- J.P. Morgan, -8.37%

- Zoom increase by 0.54%

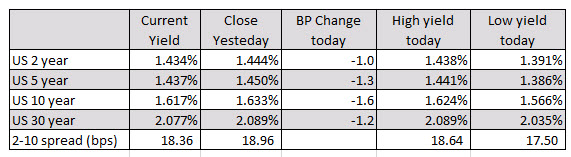

In other markets:

In other markets:

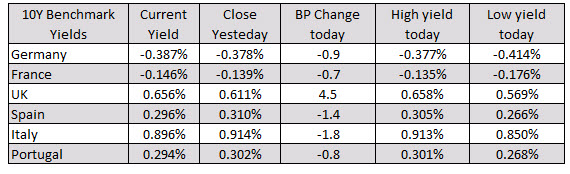

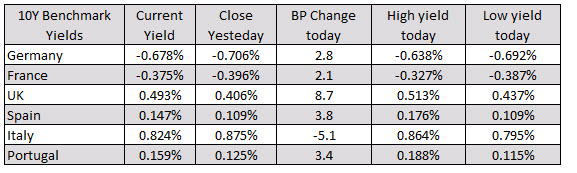

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit: A snapshot of the forex market shows that the GBP is still the strongest of the majors (but off earlier higher levels). The JPY and USD remain the weakest. The CAD has gotten stronger on stronger oil and a was dovish Bank of Canada statement.

A snapshot of the forex market shows that the GBP is still the strongest of the majors (but off earlier higher levels). The JPY and USD remain the weakest. The CAD has gotten stronger on stronger oil and a was dovish Bank of Canada statement.