It’s been a while since I last posted an excerpt or quoted from one of the trading books I own. Tonight’s small excerpt is from the book: ‘Wall Street. Its Mysteries Revealed: Its Secrets Exposed’ published in New York, 1921 by William C. Moore. The book contains short and to the point chapters like: ‘The crowd mind’, ‘How the public speculates’, ‘Mental suggestion’ and ‘Market advice’ to name but a few. I chose the one on ‘Greed’ as I consider it great advice and timeless wisdom. Enjoy.

It’s been a while since I last posted an excerpt or quoted from one of the trading books I own. Tonight’s small excerpt is from the book: ‘Wall Street. Its Mysteries Revealed: Its Secrets Exposed’ published in New York, 1921 by William C. Moore. The book contains short and to the point chapters like: ‘The crowd mind’, ‘How the public speculates’, ‘Mental suggestion’ and ‘Market advice’ to name but a few. I chose the one on ‘Greed’ as I consider it great advice and timeless wisdom. Enjoy.

Greed p. 123-124

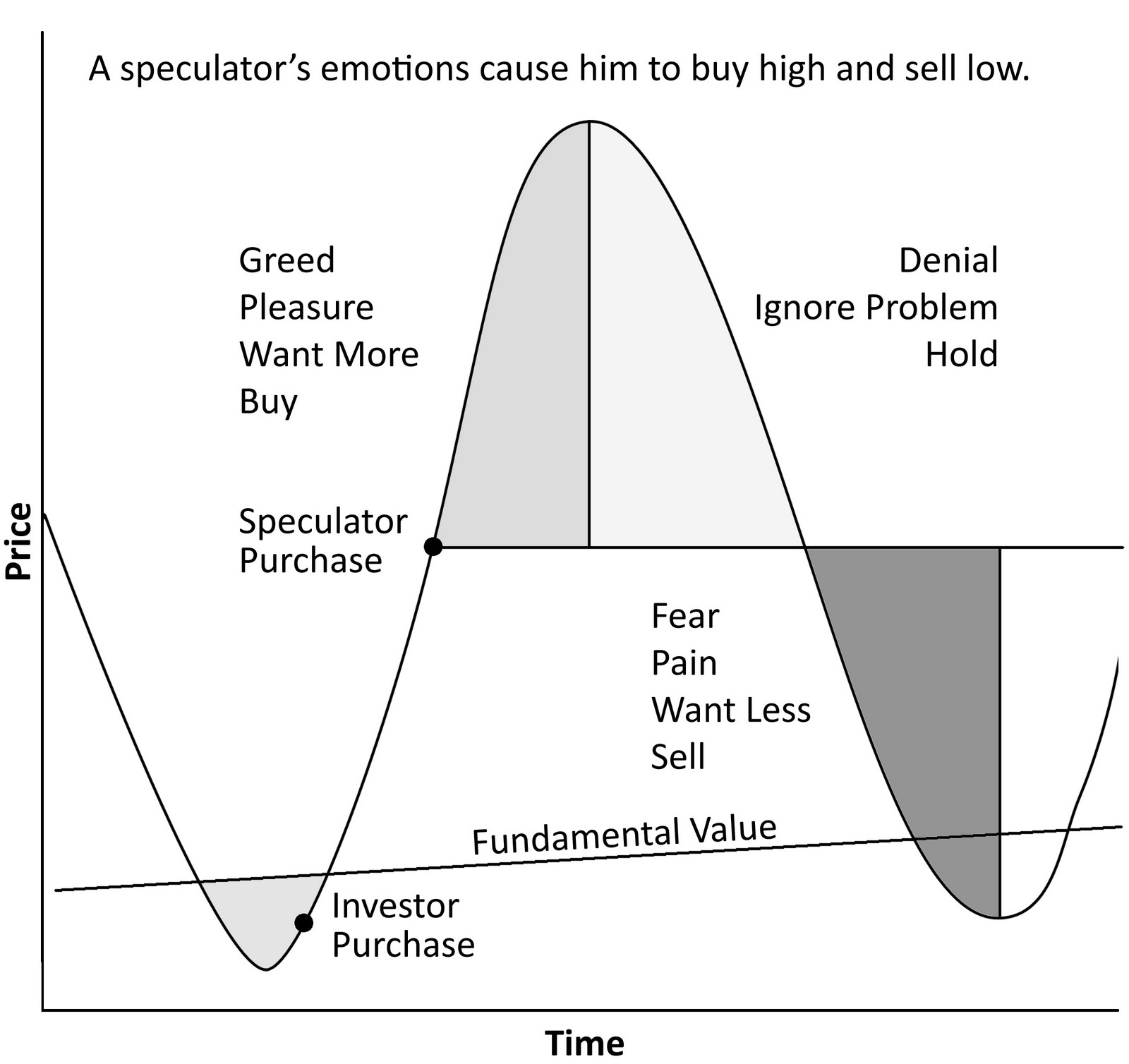

An avaricious or keen desire for profits is one of the most prevalent causes of failure in speculation. This weakness is general among traders. They desire “just a little more ” profit. If the stock or commodity bought advances, then that’s proof to them that it will advance further and so they hang on. They usually overstay and thus miss their market. If they fail to obtain the top price and it reacts, then they assure or console themselves by the expression: “Oh, it will come back.” It may “come back” but often it does not, and instead, declines to below the purchase price and frequently results in a loss. The same observations apply to a short sale for a further anticipated decline. It is a good policy to be satisfied with a reasonable profit and be willing to leave some for the other fellow. The market is always there and other opportunities for making profits will present themselves while the greedy trader is waiting to get the last eighth.

Greed leads to disaster in another way. A speculator has started in to buy at the inception of a bull movement. He makes money. The more he makes, the more avaricious he becomes as the market moves forward. His confidence in himself increases until he develops a mental state known in the vernacular as “big head” or “swelled head”. He now has unbounded confidence in himself and “plays the limit”. Soon thereafter the market culminates at the top and the trend reverses, but Mr. Swelled Head is ignorant of this, so continues to buy on set-backs instead of selling on rallies. A drastic slump follows and Mr. B.H. goes to the scrap pile – BUSTED.

Greed is a bottomless pit which exhausts the person in an endless effort to satisfy the need without ever reaching satisfaction. – Erich Fromm

The speculator’s chief enemies are always boring from within. It is inseparable from human nature to hope and to fear. In speculation when the market goes against you, you hope that every day will be the last day — and you lose more than you should had you not listened to hope — to the same ally that is so potent a success-bringer to empire builders and pioneers, big and little. And when the market goes your way you become fearful that the next day will take away your profit, and you get out — to soon. Fear keeps you from making as much money as you ought to. The successful trader has to fight these two deep-seated instincts. He has to reverse what you might call his natural impulses. Instead of hoping he must fear; instead of fearing he must hope. He must fear that his loss may develop into a much bigger loss, and hope that his profit may become a big profit.

The speculator’s chief enemies are always boring from within. It is inseparable from human nature to hope and to fear. In speculation when the market goes against you, you hope that every day will be the last day — and you lose more than you should had you not listened to hope — to the same ally that is so potent a success-bringer to empire builders and pioneers, big and little. And when the market goes your way you become fearful that the next day will take away your profit, and you get out — to soon. Fear keeps you from making as much money as you ought to. The successful trader has to fight these two deep-seated instincts. He has to reverse what you might call his natural impulses. Instead of hoping he must fear; instead of fearing he must hope. He must fear that his loss may develop into a much bigger loss, and hope that his profit may become a big profit. His list of ‘Essential Qualities of the Speculator’ and ‘Laws Absolute” show the timeless value of his insight:

His list of ‘Essential Qualities of the Speculator’ and ‘Laws Absolute” show the timeless value of his insight: 1. Never Overtrade. To take an interest larger than the capital justifies is to invite disaster. With such an interest a fluctuation in the market unnerves the operator, and his judgment becomes worthless.

1. Never Overtrade. To take an interest larger than the capital justifies is to invite disaster. With such an interest a fluctuation in the market unnerves the operator, and his judgment becomes worthless.  The speculator’s chief enemies are always boring from within. It is inseparable from human nature to hope and to fear. In speculation when the market goes against you you hope that every day will be the last day — and you lose more than you should had you not listened to hope — to the same ally that is so potent a success-bringer to empire builders and pioneers, big and little. And when the market goes your way you become fearful that the next day will take away your profit, and get out — too soon. Fear keeps you from making as much money as you ought to. The successful trader has to fight these two deep-seated instincts. He has to reverse what you might call his natural impulses. Instead of hoping he must fear; instead of fearing he must hope. He must fear that his loss may develop into a much bigger loss, and hope that his profit may become a big profit. It is absolutely wrong to gamble in stocks the way the average man does.

The speculator’s chief enemies are always boring from within. It is inseparable from human nature to hope and to fear. In speculation when the market goes against you you hope that every day will be the last day — and you lose more than you should had you not listened to hope — to the same ally that is so potent a success-bringer to empire builders and pioneers, big and little. And when the market goes your way you become fearful that the next day will take away your profit, and get out — too soon. Fear keeps you from making as much money as you ought to. The successful trader has to fight these two deep-seated instincts. He has to reverse what you might call his natural impulses. Instead of hoping he must fear; instead of fearing he must hope. He must fear that his loss may develop into a much bigger loss, and hope that his profit may become a big profit. It is absolutely wrong to gamble in stocks the way the average man does.