Jeffrey A. Hirsch is best known as the editor-in-chief of the Stock Trader’s Almanac. He draws on the extensive research behind that yearly publication for The Little Book of Stock Market Cycles: How to Take Advantage of Time-Proven Market Patterns (Wiley, 2012).

Let’s get Hirsch’s most controversial call—that the Dow will reach 38,820 by the year 2025—out of the way right at the beginning. He claims that this “is not a market forecast; it is an expectation that human ingenuity will overcome adversity, just as it has on countless past occasions.” (p. 66) The operative equation is “War and Peace + Inflation + Secular Bull Market + Enabling Technology = 500% Super Boom Move.” (p. 67) But don’t buy that magnificent villa overlooking the Pacific or the Ferrari you’ve been coveting just yet. “[A]fter stalling near 14,000-resistance in 2012-2013, Dow 8,000 is likely to come under fire in 2013-2014 as we withdraw from Afghanistan. Resistance will likely be met in 2015-2017 near 13,000 to 14,000. Another test of 8,000-support in 2017-2018 is expected as inflation begins to level off and the next super boom commences. By 2020, we should be testing 15,000 and after a brief pullback be on our way to 25,000 in 2022. A bear market in midterm 2022 should be followed by a three- to four-year tear toward Dow 40,000.” (pp. 67-68) In brief, if Hirsch’s scenario plays out, we’ve got quite a wait for the market to catch up with our dreams.

The bulk of Hirsch’s book describes the most effective market seasonalities. Take, for instance, the presidential election cycle. Since 1913, from the post-election year high to the midterm low the Dow has lost 20.9% on average. By contrast, from the midterm low to the preelection high, the Dow has gained nearly 50% on average since 1914. (more…)

Archives of “secular bull market” tag

rssWhy Your Babies May Live to 120 Years Old

Our genes harbor many secrets to a long and healthy life. And now scientists are beginning to uncover them.

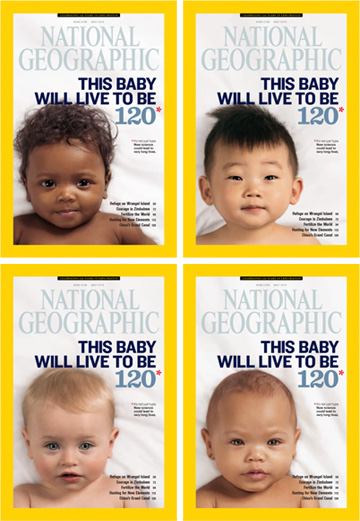

The cover story in National Geographic this month is off the hook – if you’re a believer in the big healthcare secular bull market and fascinated by demography’s effects on economics (as we are), you’re going to want to check this out. They did four different covers, pretty cool:

Longevity (National Geographic)

Why Warren Buffett should be your role model

Some people have claimed that Warren Buffett made all his money from the 80’s and 90’s bull market. He happened to be at the right place at the right time, they say.

Some people have claimed that Warren Buffett made all his money from the 80’s and 90’s bull market. He happened to be at the right place at the right time, they say.

If so, how come nobody came close? There were lots of people at the right place and right time like Buffett. They are what we call baby boomers!

It really isn’t about bull markets that Buffett made his money. He started out in the early 70’s. (The secular bull market started over 10 years after that).

The first few years, he was making 50-100% returns per year.

So if he were to do a redo, his results wouldn’t be that much different 40 years later.