- EU Summit: The European Council (heads of state) hold a virtual meeting on June 18 to ostensibly discuss the EU’s May 27 Recovery Fund proposal. Some have heralded the proposal as a key turning point in the evolution of Europe, and the possibility of a so-called Hamiltonian moment, a major set toward fiscal union, has been suggested. We have been less sanguine; recognizing the potential scaffolding for a greater union, but also that projecting emergency actions into the future is fraught with danger. Austria and Denmark, which have pushed back against grants instead of loans, could be won over by assurances that their rebates will remain intact. Others, including Eastern and Central European members, may be more difficult to persuade. Although expectations are running high, we suspect an agreement will remain elusive, in which case another try will be at the July summit, which, with a little luck, could be in person. Disappointment could weigh on the euro.

Archives of “Organizations” tag

rssWhite House: G7 leaders agree to remain committed to global response to coronavirus

White House comments regarding G7 leaders

- G7 leaders agreed to remain committed to global response to humanitarian, economic calamity stemming from pandemic and to launch a strong and sustainable recovery

- leaders called for a thorough review and reform process that World Health Organization

- much of G7 leaders call centered on lack of transparency and chronic mismanagement of the pandemic by the World Health Organization

- G7 leaders discussed efforts to pool research on coronavirus by sharing data and making it publicly available

G7: “We will do whatever is necessary” to restore confidence

G7 statement

- We are taking action and enhancing coordination on domestic and international policy efforts to respond to epidemic

- We pledge to promote global trade and investment

- Says they are pushing liquidity support and fiscal expansion

Statement of G7 Finance Ministers and Central Bank Governors

Consistent with the direction from G7 Leaders, we are taking action and enhancing coordination on our dynamic domestic and international policy efforts to respond to the global health, economic, and financial impacts associated with the spread of the coronavirus disease 2019 (COVID-19). Collectively, G7 nations have already enacted a wide-ranging set of health, economic, and financial stability measures. We will do whatever is necessary to restore confidence and economic growth and to protect jobs, businesses, and the resilience of the financial system. We also pledge to promote global trade and investment to underpin prosperity.

Our nations are working together to fight the COVID-19 outbreak and mitigate its impact, treat those affected, and prevent further transmission. G7 finance ministries are helping advance this effort by providing the funding needed to respond to the situation. In particular, we recognize the urgent need to increase support for the rapid development, manufacture, and distribution of diagnostics, therapeutics, and a vaccine for COVID-19. We are providing bilateral and multilateral assistance to strengthen foreign governments’ prevention efforts and their health and emergency response systems.

The G7 is committed to deliver the fiscal effort necessary to help our economies rapidly recover and resume the path towards stronger and more sustainable economic growth. Alongside our nations’ efforts to expand health services, G7 finance ministries are undertaking, and recommend all countries undertake, liquidity support and fiscal expansion to mitigate the negative economic impacts associated with the spread of COVID-19.

IMF: Virus stimulus should be targeted for cash transfers, wage subsidies and tax relief

Comments from IMF chief economist Gopinath

- Governments need ‘substantial’ targeted measures to combat economic drag from virus

- Rate cuts and monetary stimulus may instill confidence but likely effective only after business conditions normalize

- Central banks should be ready to boost liquidity and other lending to small business

- Governments should consider temporary loan guarantees

IMF on coronavirus and the global economy – damage this year; sharp, rapid rebound

Comments from International Monetary Fund managing director Kristalina Georgieva over the weekend on the impact on the global economy

- could damage global economic growth this year

- a sharp and rapid economic rebound could follow

- “There may be a cut that we are still hoping would be in the 0.1-0.2 percentage space”

- full impact of the spreading disease would depend on how quickly it was contained – “I advise everybody not to jump to premature conclusions. There is still a great deal of uncertainty. We operate with scenarios, not yet with projections, ask me in 10 days”

- If the disease is “contained rapidly, there can be a sharp drop and a very rapid rebound”, in what is known as the V-shape

S&P says coronavirus outbreak will cut 0.5% from Australia’s real GDP growth in 2020

The ratings agency a bit downbeat on Australia’s GDP, but on the bright side:

- S&P says economic impact of coronavirus unlikely to negatively affect Australia’s sovereign rating

- says short, temporary delay in balancing government budget unlikely to strain Australia’s creditworthiness

IMF’s Georgieva: Uncertain situation is the new normal

IMF chief, Kristalina Georgieva, speaks in Davos

- Uncertainty is the major downside risk for global economy

- Wants to see governments stepping up action

- The world is more shock-prone as it is interconnected currently

- We are in a better place at the start of 2020 than in 2019

- Sees signs of trade, industrial slowdown bottoming out

- Consensus is that global rates will be low for longer

- Fed, PBOC have policy space

- Other countries need to look at fiscal tools more closely

World Health Organization: Delays decision on whether to declare coronavirus an int’l emergency

They will meet tomorrow.

- decision on whether to declare coronavirus outbreak and international emergency until Thursday

- The organization will meet tomorrow

- Coronavirus is an evolving and complex situation.

- Appreciates cooperation from Chinese Pres. Xi and prime minister Li

- Our team is on the ground in China as we speak to investigate the outbreak and get more information

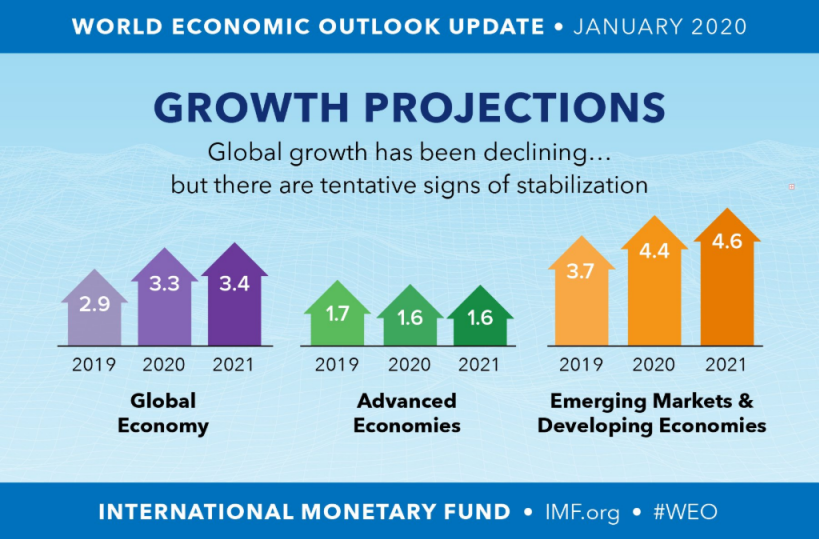

IMF: Growth is worse but at least uncertainty is lower

IMF lowers 2019 global growth estimate for the sixth straight quarter

- 2020 Eurozone GDP seen at 1.3% vs 1.4% in Oct due to manufacturing contraction in Germany

- Boosts China 2020 GDP to 6.0% from 5.8% on trade deal

- Cuts 2020 US GDP to 2.0% from 2.1%

- UK forecast unchanged at 1.4%

IMF trims 2020 global growth forecast to 3.3% from 3.4% previously in October

IMF attributes the slight downwards revision to a sharper-than-expected anticipated slowdown in India

- Sees tentative signs that manufacturing and global trade are bottoming out

- That is partially due to the US-China trade deal

- Sees risks less tilted to the downside than in October

- US-Iran tensions, social unrest and a flare-up in trade tensions are key concerns

- 2021 global growth forecast seen at 3.4% (3.6% previously)

- US 2020 growth forecast seen at 2.0% (2.1% previously)

- China 2020 growth forecast seen at 6.0% (5.8% previously)

- Euro area 2020 growth forecast seen at 1.3% (1.4% previously)

- UK 2020 growth forecast seen at 1.4% (unchanged)

- India 2020 growth forecast seen at 5.8% (7.0% previously)