Weekly US petroleum inventory data

- Prior was -4512K

- Gasoline -3322K vs -1000K expected

- Distillates +152K vs -1200K expected

- Refinery utilization -0.1% vs +0.3% expected

- Production unchanged at 10.7 mbpd

API data late yesterday:

- Crude -4264K

- Gasoline +4991K

- Distillates -964K

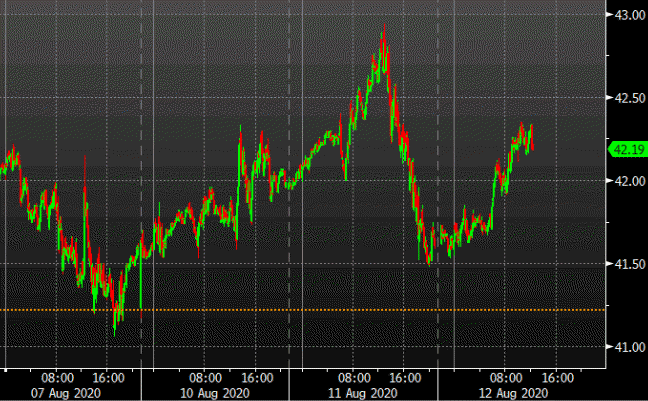

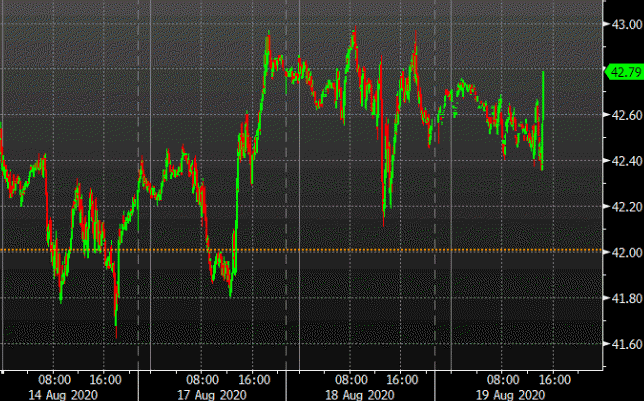

Crude rose about 20 cents on the headlines to $42.79 per barrel. The headline isn’t as bullish as anticipated but the gasoline drawdown was larger.

The OPEC JMMC meeting is also taking place right now with Russia’s Novak stressing the need for full compliance.