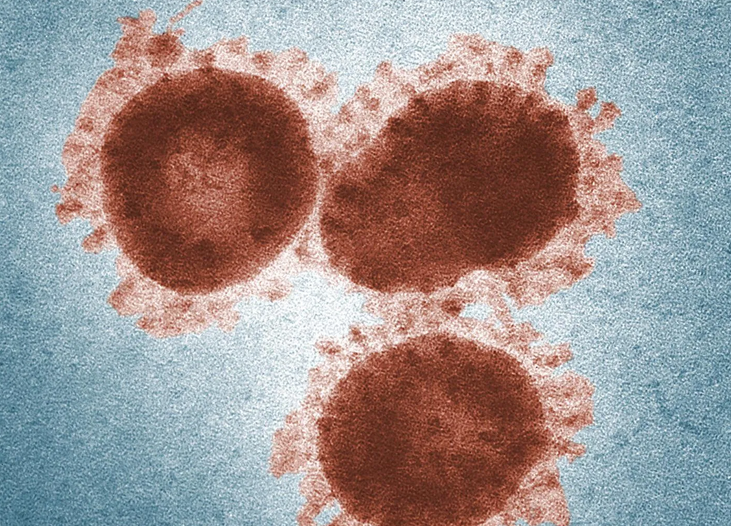

Coronavirus has a fear factor

According to a quick google search around 50,000+ people die from the flu each year. It is mainly the old or the already unwell who are most susceptible to the virus. In 2003 the total number of SARS death was 700+ from a total sample of 8000+ cases. Here is a quote from the World Health Organisation on a person’s chances of dieing from SARS during the outbreak if they caught the disease.

The likelihood of dying from SARS in a given area has been shown to depend on the profile of the cases, including the age group most affected and the presence of underlying disease. Based on data received by WHO to date, the case fatality ratio is estimated to be less than 1% in persons aged 24 years or younger, 6% in persons aged 25 to 44 years, 15% in persons aged 45 to 64 years, and greater than 50% in persons aged 65 years and older

So far, 17 people have died due to the Coronavirus and this is a concern. The total number of coronavirus cases is rising all the time and the fear factor alone should weigh on equity markets. People will not want to travel around if they can avoid it as the disease spreads. I was surprised that on January 22 the Asian markets closed higher, even though the case load doubled. The Jan 23 response made much more sense to me in the Asian markets as they fell sharply lower ahead of the Chinese New Year Holidays. Sadly, it now seems almost inevitable that we will have a sharp increase in cases over this travelling time.

Triple top in Nikkei

A triple top in the Nikkei makes an attractive level for shorts if and when the coronavirus fear factor takes hold. Furthermore, it is still too early for folks to fully grasp the implications of the disease and unknowns remain.