The prices of rare-earth metals have tumbled from their June highs after China, a key refiner, resumed the import of ores from Myanmar in September but supply concerns continue to plague the market.

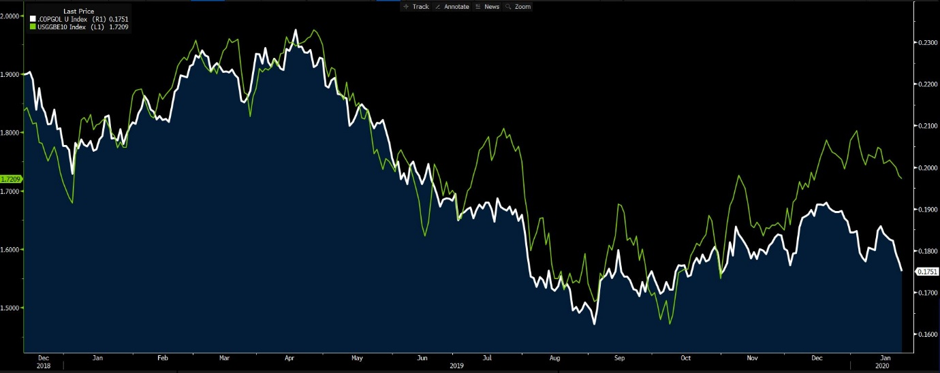

In mid-November, neodymium, an ingredient of permanent magnets used in electric vehicle motors, was traded at around $54 per kilogram, while dysprosium, which is added to improve permanent magnets’ heat resistance, was traded at around $230 per kilogram. Both values were 20% lower than their recent highs in June, and at their lowest points since April.

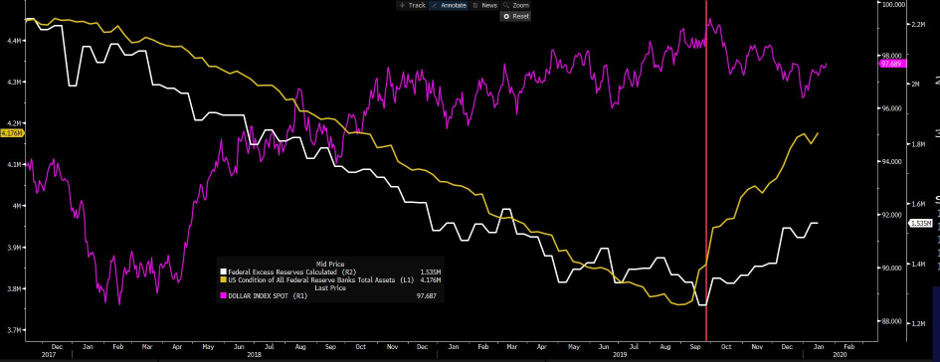

China’s Yunnan Province, which borders Myanmar, suspended imports of all resources, including rare-earth ores, from its neighbor in November 2018. It was thought that this move was a crackdown on the smuggling of rare-earth metals into China from mines in neighboring Kachin State and other places in Myanmar, where many Chinese were working.

Rare-earth ores mined in Myanmar contain high concentrations of dysprosium, which is mined in only limited areas in China. Myanmar had become an attractive source for Chinese refiners as its rare metals are traded at relatively low prices due to cheap labor and loose environmental protection.

The suspension of imports from Myanmar has pushed up dysprosium prices since the start of the year, paving the way for soaring rare-earth metal prices in May and June over speculation that China could announce a ban on imports. Rare-earth metal prices are particularly susceptible to movements in China’s market, given its small size and the country’s dominance.

But the suspension was abruptly lifted in late September and even now, traders have few clues as to the reasons behind China’s move. “I have no idea what is going on,” said Yutaka Kawasaki, general manager of Samwood, a Japanese trading house that deals in rare earth. (more…)