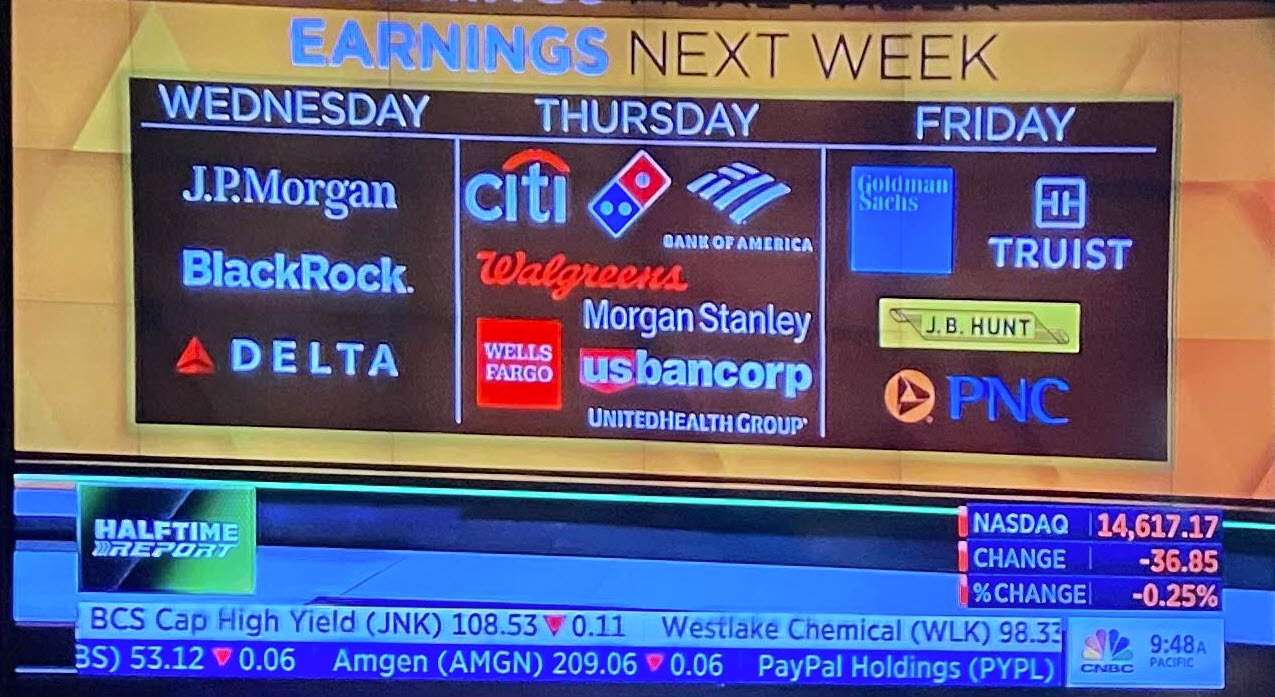

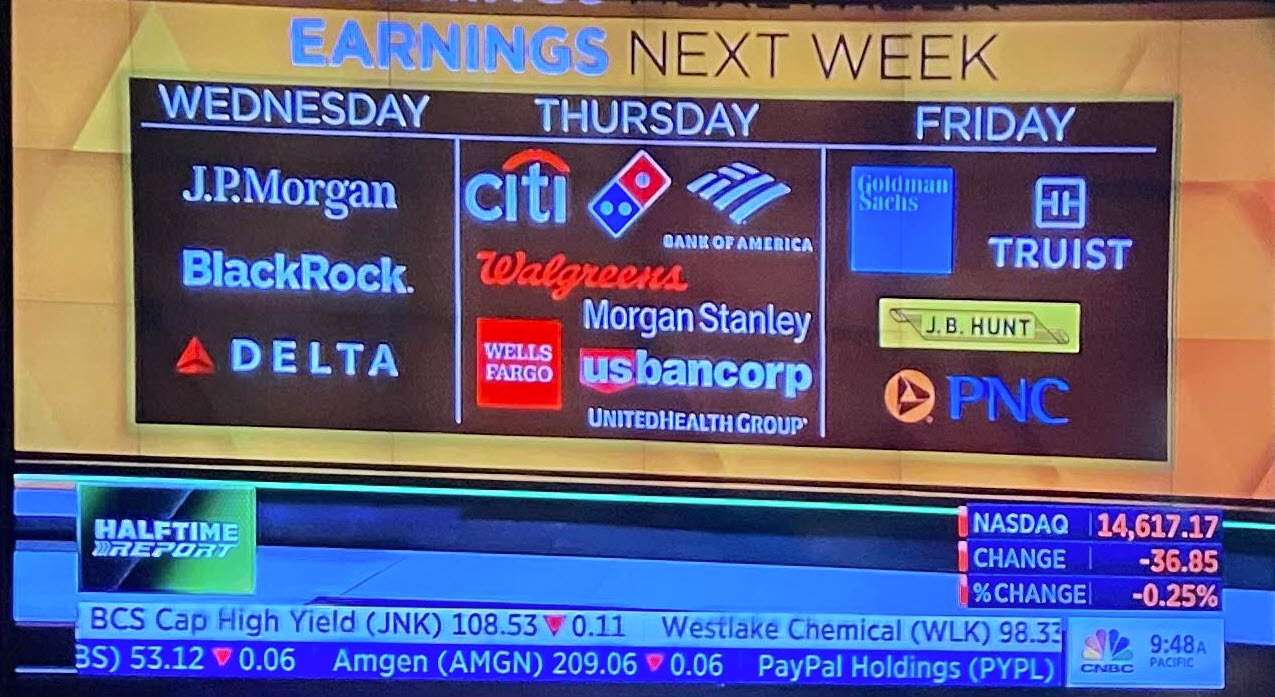

It seems like only yesterday we had the last earnings cycle

- J.P. Morgan

- BlackRock

- Delta Airlines

- Citi

- Domino’s pizza

- Bank of America

- Walgreens

- Morgan Stanley

- Wells Fargo

- U.S. Bancorp

- UnitedHealth Group

- Goldman Sachs

- PNC

- Truist

- JB Hunt

In a client note detailing the trends to keep an eye out for next year, strategists at the firm view that the dollar is to be hit by stronger global growth outside of the US and dwindling portfolio inflows.

May 12 (Reuters) – U.S. federal investigators are probing whether Morgan Stanley (MS.N) misled investors about mortgage derivative products it helped create and sometimes bet against, the Wall Street Journal said, citing people familiar with the matter.

Morgan Stanley arranged and marketed to investors pools of bond-related investments called collateralized debt obligations (CDOs), and its trading desk at times placed bets that their value would fall, the Journal said, citing traders.

Federal investigators are examining whether Morgan Stanley made proper representations about its roles in the mortgage derivative deals, the newspaper said.

Two particular deals — named after U.S. Presidents James Buchanan and Andrew Jackson — were scanned by the investigators, the paper said, citing a person familiar with the matter.

Morgan Stanley helped design the deals and bet against them, but did not market them to clients, according to the paper.

Traders called them the “Dead Presidents” deals, the Journal said. The firm made money on those deals, but any profit was far overshadowed by the $9 billion the firm lost on bullish mortgage bets in 2007, the paper said

citing a person familiar with the matter.

Morgan Stanley helped design the deals and bet against them, but did not market them to clients, according to the paper.

Traders called them the “Dead Presidents” deals, the Journal said. The firm made money on those deals, but any profit was far overshadowed by the $9 billion the firm lost on bullish mortgage bets in 2007, the paper said.

“We have not been contacted by the Justice Department about the transactions being raised by The Wall Street Journal and we have no knowledge of a Justice Department investigation into these transactions,” Morgan Stanley spokesman Mark Lake told Reuters by telephone.

Spokespeople for the Manhattan Attorney’s office and the U.S. Securities and Exchange Commission (SEC) declined to comment to the Journal.

Updated at 11:17/12th May/Baroda/India

Alice Schroeder is the author of “The Snowball: Warren Buffett and the Business of Life”, a former managing director at Morgan Stanley, and is a Bloomberg News columnist. Below is a great opinion piece she wrote for Bloomberg.

Alice Schroeder is the author of “The Snowball: Warren Buffett and the Business of Life”, a former managing director at Morgan Stanley, and is a Bloomberg News columnist. Below is a great opinion piece she wrote for Bloomberg.

Read more here:

A group of university students I spoke to recently asked if it was possible to make a living on Wall Street without compromising your values. I had to tell them no.

Wall Street has many decent, honorable people, but they work in a system that fundamentally compromises people’s ethics. The high pay is like an anesthetic that numbs you from feeling how you are being corrupted. Not only that, many honest people who work there would agree with an even more extreme statement: It’s hard to make a living legally on Wall Street. (more…)

Below, we share a presentation from Morgan Stanley’s Jim Caron, Measuring Risk: Extracting Market Sentiment from the Interest Rate Markets, in which the credit strategist provides a much more detailed framework of what critical credit signals are and how to interpret them. We recommend that all those still trading, either with their own, or other people’s money, familiarize themselves with this 27-page overview.

(Instead of Watching TV -Cricket Match -Movies ,Traders just read this -)

His latest take on the facebook IPO is here. His points are in bold.

1. Say goodbye to the individual investor on Wall Street. Mr. Cuban argues that because the media hyped the FB IPO that Wall Street is to blame. OK, I agree the IPO was hyped. But is that Wall Streets fault? Isn’t it the media’s fault? Isn’t it the buyers fault for not doing their due diligence? Didn’t Morgan Stanley spend millions propping up the stock the first day?

No one has long term success by reading any single piece of media, especially without knowing the writers intentions.

Here is a brief explanation on how the market works. If there are more buyers than sellers it goes up or vice versa. Or more important right now, if they have the means to buy.

2. The Valuation Bubble in Silicon Valley is bursting – but not for the reasons you think. The idea of private investment seems great but the execution is far off. The value of any market is liquidity. That has to be one of the important factors when making an investment. You know why futures are gaining popularity and what will eventually lead to their demise? A central market place and the lack thereof. Their spawns will kill the market and liquidity. The less central a market place the more likely the forces within that market are able to take control.

Mark agrees with me on liquidity but my interpretation is that he makes an argument against his point not for it. Didn’t the public market do a much better job at pricing? Didn’t the private market fail more dramatically than the public is this case? (Some one that knows the details better than I, when they went public did private shares get converted 1 to 1? If it did not get converted 1 to 1 let me know and I will gladly change it)

I believe Shark Tank is a great reason why Wall Street will always exist. I do not feel bad for the euntrepreuners and or the Sharks. Each assume the other person will add value. Wall Street assumes the same thing but to more people But as Mr. Cuban already knows, not everyone can win. But would they do better if there were 10 sharks or 100 sharks? Would more companies get funded?

If you allow people to be stupid, they will continue to be stupid. Howard Lindzon wrote a post as well that I disagreed with on the basis of access. They are both a lot more successful than I so I could be wrong. Also both of those guys should know that you are more likely to get screwed privately than publicly. I think this might be changing but it hasn’t yet. Open is not bad, closed is not bad, bad is bad. Liquidity and cash is always king, deeper markets should lead to better pricing. (more…)

Don’t Miss to Read :

Different catalysts matter for the different time frames. In short-term perspective, price momentum is the most powerful catalyst. Short-term could sometimes be a couple years in the market. Here are a few wise words, written in 2004, by someone who has been on both sides of the table – as a shareholder and company owner:

For years, a company’s price can have less to do with a company’s real prospects than with the excitement it and its supporters are able to generate among investors. That lesson was reinforced as I saw the Gandalf experience repeated with many different stocks over the next 10 years. Brokers and bankers market and sell stocks. Unless demand can be manufactured, the

stock will decline.

If the value of a stock is what people will pay for it, then Broadcast.com was fairly valued. We were able to work with Morgan Stanley to create volume around the stock. Volume creates demand. Stocks don’t go up because companies do well or do poorly. Stocks go up and down depending on supply and demand. If a stock is marketed well enough to create more demand from buyers than there are sellers, the stock will go up. What about fundamentals? Fundamentals is a word invented by sellers to find buyers. (more…)