The S&P index did close at a new record high

The major indices are closing their unchanged levels give or take. The broader S&P index traded to a high of 4083.16. That was just short of the all-time high reached yesterday at 4086.23 (but it did close at a new record high).

- The NASDAQ index is down for the second consecutive day but with only modest declines over each day (the NASDAQ fell -0.05% yesterday and declined -0.07% today)

- The volatility index (VIX) trades at the lowest level since February 2020. The low reached 16.87% today

- S&P is up for the fourth of five sessions but only marginally today. The S&P fell -0.10% yesterday.

- The S&P index did close at a new all-time record high at 4079.95. That took out the high close from Monday at 4077.91.

- Dow closes higher for the third day in the last four

- S&P index rose 5.79 points or 0.14% at 4079.73. The high reached 4083.13. The low extended to 4006 8.31

- NASDAQ index fell -9.536 points or -0.07% at 13688.84. The high reached 13733.03. The low extended to 13653.58

- Dow rose 15.96 points or 0.05% at 33446.20 . The high reached 33521.76. The low extended to 33347.96

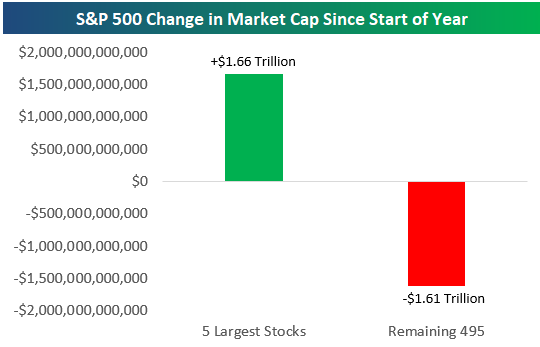

- Square, +3.6%

- Facebook, +2.23%

- Amazon, +1.72%

- alphabetic, +1.35%

- Apple, +1.34%

- Intel, +1.05%

- PayPal, +0.95%

- Microsoft, +0.82%

- Netflix, +0.45%

Major indices close higher

Major indices close higher