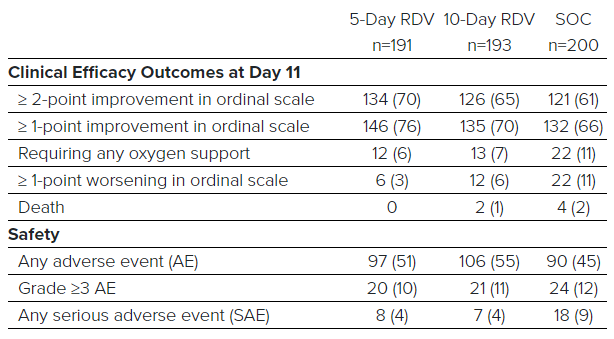

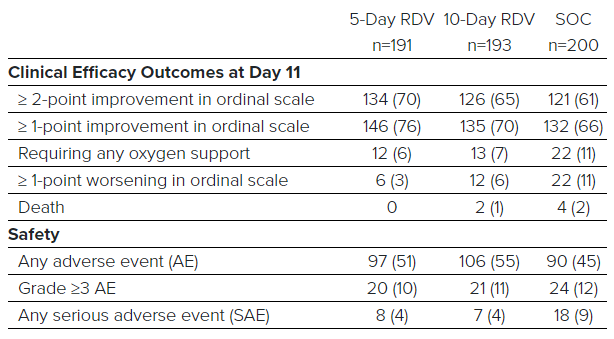

Results of the latest study

We’ve all heard it before: You just need more winning trades than losing trades in order to be profitable….

Wrong.

There’s a common misconception out there that more winners than losers automatically results in a profitable account. I personally don’t think that’s the case at all. In fact, the more important thing to worry about is how big those losers are relative to your winners. You can have more winners than losers but have your losers result in massive drawdowns that your winners can’t make up for. I can’t begin to tell you how many horror stories I’ve heard about just 1 or 2 trades completely ruining a portfolio filled with all these other winners. So to me, I believe that as long as you keep your losers small, you can have plenty of them and still keep an extremely profitable account.

And this really just plays into the importance of risk management. I know I harp on this a lot, but it’s so true. The only thing that matters is managing your risk. I don’t care how you come to your conclusions. It’s irrelevant. And I get nasty emails sometimes from people disagreeing with my methodology. But the truth is, who cares how we come to our conclusions? Balance sheets, income statements or lunar cycles – it doesn’t matter to me. I just want to know where we’re wrong. At what price is the original thesis incorrect? And therefore, how much are we risking to put on this position? (more…)

Skin in the Game is Nassim Nicholas Taleb’s (NNT) fifth book in what he calls the Incerto, and it’s the most digestible I’ve read thus far (having read all but Fooled by Randomness). This one focuses more on asymmetry (and symmetry) in everyday life, particularly on the matters of career, ethics, and life in general.

What does that mean? Basically, rules for how to detect if something is pseudo-science (scientism), rules for how you should endeavour to conduct yourself in your career in business, and mental models for thinking about risk in these categories and in life in general.

Having now read most of his books, part of the reason this was digestible was that I’m familiar with his general premises; I would recommend reading his other books first, but this one will tie them together. Highly recommend.

Not being a hero means less glory, but ultimate far more profit, because if you have the patience to wait for the (non-heroic) optimal moment — which is almost never the initial turning point, which heroes love to call out — you can more effectively scale up and put leverage to work in your favor.

Not being a hero in respect to adverse price action — dumping positions quickly that aren’t working out as planned — also lets you safely deploy more size in general, which in turn allows for more effective pyramiding and greater profits from the very same move the hero took with less size (because he got chewed up so many times trying to catch the damn turn). (more…)

Renegade Economist’s “Four Horsemen” documentary lifts the lid on how the world really works. “Four Horsemen is a breathtakingly composed jeremiad against the folly of Neo-classical economics and the threats it represents to all we should hold dear.” Free from mainstream media propaganda — the film doesn’t bash bankers, criticize politicians or get involved in conspiracy theories. It ignites the debate about how to usher a new economic paradigm into the world which would dramatically improve the quality of life for billions. Since it is becoming abundantly clear that we will never return to ‘business as usual’, 23 international thinkers, government advisers and Wall Street money-men break their silence and explain how to establish a moral and just society.

This is probably the most recurrent concept mentioned in trading literature, but what does it mean exactly? “Discipline is any training intended to produce a specific character or pattern of behaviour, especially training that produces moral, physical, or mental development in a particular direction”*, i.e.: to be disciplined you need a specific set of rules to follow. Without rules, discipline is an empty concept!! In order to be disciplined, a trader first needs to set the rules that he will need to follow. Here we come back to the necessity of first working out a methodology, and then applying the rules to make the most out of it. This is usually called the “Trading Plan” and it is the foundation of any successful trader. Many would-be traders find it hard to write down a specific trading plan since it is very far from the typical “easy money” illusion that many people have about trading. Being able to articulate a precise, step-by-step plan is the result of intensive (more…)

This is probably the most recurrent concept mentioned in trading literature, but what does it mean exactly? “Discipline is any training intended to produce a specific character or pattern of behaviour, especially training that produces moral, physical, or mental development in a particular direction”*, i.e.: to be disciplined you need a specific set of rules to follow. Without rules, discipline is an empty concept!! In order to be disciplined, a trader first needs to set the rules that he will need to follow. Here we come back to the necessity of first working out a methodology, and then applying the rules to make the most out of it. This is usually called the “Trading Plan” and it is the foundation of any successful trader. Many would-be traders find it hard to write down a specific trading plan since it is very far from the typical “easy money” illusion that many people have about trading. Being able to articulate a precise, step-by-step plan is the result of intensive (more…)

Many people come up to me, the most recent being a superior Greek Trader, Mr. Lambis, telling me that their two favorite books are Reminiscences of a Stock Operator and Edspec. I tell them they are cruel by being kind. Here’s why.

“History Lessons for Investors: An annotated reissue of Edwin LeFevre’s

Reminiscences of a Stock Operator is reviewed by hedge-fund manager and

author Victor Niederhoffer.”

IMAGINE THAT MASTER NOVELIST and chess

aficionado Vladimir Nabokov wrote a fictional memoir about

Capablanca—the 1920s world champion who never made a mistake on the

board—and that Bobby Fisher then published an updated and annotated

version, incorporating all of the important developments of modern

chess strategy, along with a foreword by Anatoly Karpov.A similar multilayered feast on investment is now available, with minor differences. Edwin Lefevre’s Reminiscences of a Stock Operator

is a novel told in the first person by a character inspired by

legendary trader Jesse Livermore. This classic is now graced with

extensive annotations by investment advisor Jon Markman and a foreword

by hedge-fund manager Paul Tudor Jones.The result is big and beautiful, cutting across two centuries of

booms and busts and market and economic history, with a myriad of

vintage historical photos and instructive historical charts throughout.One of Lefevre’s favorite adages is that there’s nothing new on Wall

Street. The similarity between the financial panic of 2008 and the 1907

panic recounted in the book is a prime example.The numerous squeezes, manipulations,

insider trading, government hauling in of scapegoats and frauds settled

for pennies on the dollar that Lefevre and Markman recount are horses

that are found as well in the modern stable.

Similes and metaphors play an important role in both the internal thought-process of a day trader as well as in communication between two traders. To describe the emotional reactions coupled to the movement of a stock in likeness to a rollercoaster, or to compare averaging down in hopes of breaking even to digging one’s self out of a hole is to use simile to quickly illustrate a particular situation as clearly and succinctly as possible. Every trader uses these analogies, each having his own favorites, and they are used to add structure to an environment that often lacks useful tools for explaining particular occurrences.

Sports metaphors also play an important role in quickly passing information to another trader with a small chance for confusion. Traders use base-hit as a metaphor to describe a solid but ultimately small-scale win in the market, and home run for when a trade is “out of the park”.

Ultimately, metaphors and similes can be used by a trader to keep his mind in the right place, and maintain emotional control. By metaphorically comparing trading to baseball or basketball, the Michael Jordan truism about never missing a shot he didn’t take or Babe Ruth’s statistical record for strikeouts helps the trader keep in the back of his mind the inalienable reality that he won’t get a hit every time he swings the bat. (more…)