- EU Summit: The European Council (heads of state) hold a virtual meeting on June 18 to ostensibly discuss the EU’s May 27 Recovery Fund proposal. Some have heralded the proposal as a key turning point in the evolution of Europe, and the possibility of a so-called Hamiltonian moment, a major set toward fiscal union, has been suggested. We have been less sanguine; recognizing the potential scaffolding for a greater union, but also that projecting emergency actions into the future is fraught with danger. Austria and Denmark, which have pushed back against grants instead of loans, could be won over by assurances that their rebates will remain intact. Others, including Eastern and Central European members, may be more difficult to persuade. Although expectations are running high, we suspect an agreement will remain elusive, in which case another try will be at the July summit, which, with a little luck, could be in person. Disappointment could weigh on the euro.

Archives of “International organizations” tag

rssJapan Quarterly Business Sentiment Index survey (Q2): large Japanese companies worst in 11 years

Business Sentiment Index (BSI) survey conducted by the Ministry of Finance and the Economic and Social Research Institute (a part of Japan’s Cabinet office) is conducted quarterly.

- worst result in 11 years

- 3rd quarter in a row in negative territory

- and for mid- to small-companies minus 61.1

- each also at their worst ever

Quarterly Business Sentiment Index (BSI) survey, conducted May 15

- This survey analyses business leaders’ assessments of and forecasts for the economy

- Its purpose is to get information for tracking economic trends

- It covers about 15,000 companies that have established their headquarters or principal offices in Japan and have capital stock of 10 million yen or more

Venezuela asks Bank of England to sell its gold

Venezuela is asking the Bank of England to sell part of the South American nation’s gold reserves, send the proceeds to the United Nations to help with the country’s coronavirus-fighting efforts

- It was not immediately evident how much gold Venezuela was asking the Bank of England to sell.

- Venezuela’s information ministry and central bank did not respond to requests for comment.

- The Bank of England said it does not comment on individual customer relationships.

IMF on coronavirus and the global economy – damage this year; sharp, rapid rebound

Comments from International Monetary Fund managing director Kristalina Georgieva over the weekend on the impact on the global economy

- could damage global economic growth this year

- a sharp and rapid economic rebound could follow

- “There may be a cut that we are still hoping would be in the 0.1-0.2 percentage space”

- full impact of the spreading disease would depend on how quickly it was contained – “I advise everybody not to jump to premature conclusions. There is still a great deal of uncertainty. We operate with scenarios, not yet with projections, ask me in 10 days”

- If the disease is “contained rapidly, there can be a sharp drop and a very rapid rebound”, in what is known as the V-shape

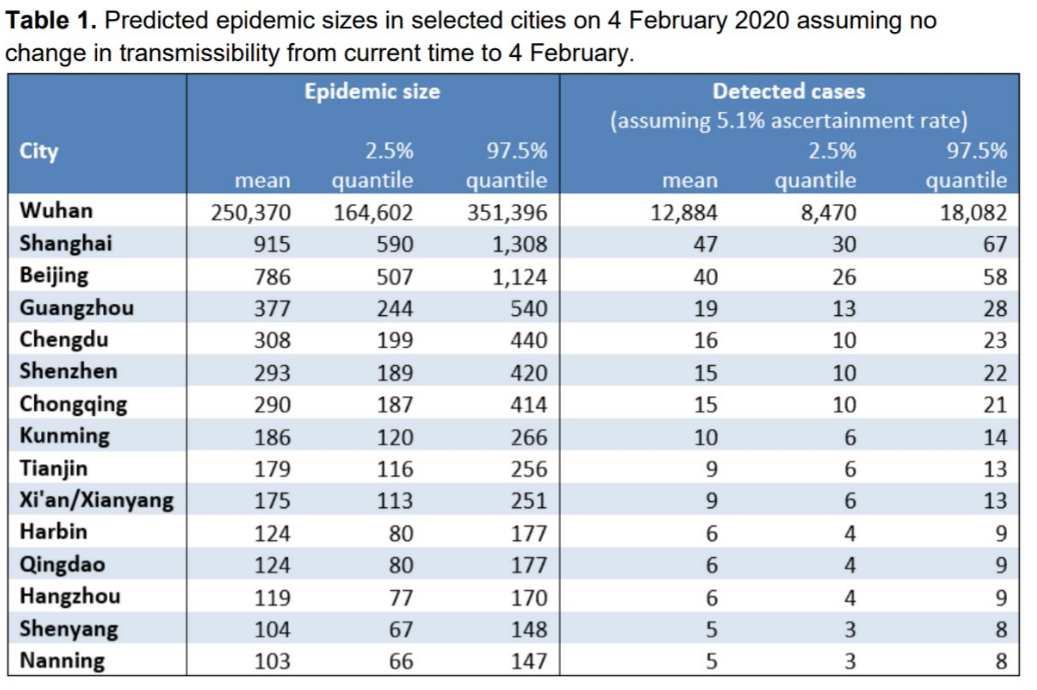

UK virus researchers estimate 250,000 people in Wuhan will have coronavirus in 13 days

It will spread to nearby cities and countries next

Some geopolitical comments from China and France are hitting the news wires

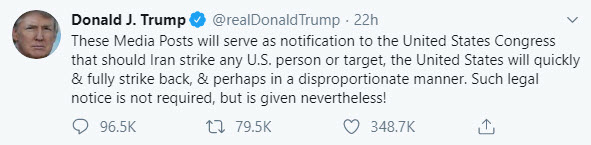

Speaking on the Middle East risks

- if tensions are not diffused today than there is a real risk of war in Middle East

- there is still room for diplomacy on Iran crisis

- Iran must refrain from reacting, start broader talks

- says Soleimani was a key player in destabilizing the region

- latest decision by Iranians enables them to enrich uranium without constraints

- we can question the validity of nuclear deal in long-term

- decision on triggering Iran nuclear deal dispute mechanism process will be made in coming days

- US unilateral use of force has violated international law and destabilizes the region

- Urges US not to use a further force in Middle East, calls on all parties to exercise maximum restraint

Finally, the Trump administration has said that they would provide closed-door briefing on Iran to the full US Senate on Wednesday. Secretary of State Pompeo, defense secretary Esper and CIA director Haspel, and Joint Chiefs of Staff chairman Milley will address the Senate.

International Monetary Fund wants Indian government to be more credible, transparent on fiscal numbers

New Delhi needs to become more “transparent” on the fiscal numbers as it is a “laggard” among the G20 peers on this front, a senior official from the International Monetary Fund said here on Wednesday.

The government has been missing its budgeted fiscal targets for the past few years and there is a need for a “credible fiscal consolidation” which is more ambitious as well, the official said, adding this is more so as government has not addressed how it will make up for the massive Rs 1.45 lakh crore tax giveaways in the form of corporate tax cuts.

The comments come amid allegations of the budget math not adding up with some pointing to a Rs 1.7 lakh crore hole in the estimates, and also over 100 economists questioning the official data computation.

“Fiscal transparency should be increased. It is fairly difficult for the private sector to get the full picture on fiscal standing,” the fund’s deputy director Anne-Mary Gulde said speaking at an NSE event here.

“India is somewhat lacking in a programme on G20 data initiative on fiscal transparency where comparative countries have all made greater progress,” she added.

She said there is also a need for more credible fiscal consolidation as such a move will help reduce the relatively high level of debt and free up financial resources for the private sector. (more…)

Forces of Movement at the Start of Q4 19

Schedule for Week of September 22, 2019

The key reports this week are August New Home sales, and the third estimate of Q2 GDP.

Other key indicators include Personal Income and Outlays for August and Case-Shiller house prices for July.

For manufacturing, the Richmond and Kansas City Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

9:00 AM ET: S&P/Case-Shiller House Price Index for July.

This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 2.1% year-over-year increase in the Comp 20 index for July.

9:00 AM: FHFA House Price Index for July 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for August from the Census Bureau.

This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 665 thousand SAAR, up from 635 thousand in July.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 211 thousand initial claims, up from 208 thousand the previous week.

8:30 AM: Gross Domestic Product, 2nd quarter 2018 (Third estimate). The consensus is that real GDP increased 2.0% annualized in Q2, unchanged from the second estimate of 2.0%.

10:00 AM: Pending Home Sales Index for August. The consensus is 0.6% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for September. This is the last of the regional surveys for September.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 1.2% decrease in durable goods orders.

8:30 AM: Personal Income and Outlays for August. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: University of Michigan’s Consumer sentiment index (Final for September). The consensus is for a reading of 92.0.

Read more at https://www.calculatedriskblog.com/2019/09/schedule-for-week-of-september-22-2019.html#ufpCwOoLSeldtU2e.99

Markets eventually need to deal with the China reality

The situation in Saudi Arabia and focus on the Fed has took the spotlight away from China’s economic worries to start the week

- China’s Premier Li says maintaining economic growth of 6% or more is very difficult

- China Industrial Production in August 4.4% y/y (expected +5.2%)

- China Retail sales for August: 7.5% y/y (expected +7.9%)