Forex trading is on the rise in Africa

In recent years there has been a significant rise in demand for forex trading in Africa, with the majority of the estimated 1.3 million traders in Africa residing in South Africa and Nigeria.

Not only is the number of traders and investors across Africa increasing, but the number of foreign investors is also on the rise, strengthening Africa’s currencies as well as the economy greatly.

With the South African Rand being one of the top 20 most traded currencies in the world at the moment, Africa offers one of the largest markets for forex trading globally.

Some of the world’s largest forex brokers, such as FXTM and HotForex, have become regulated with the Financial Sector Conduct Authority (FSCA) of South Africa, one of the most respected financial authorities in the industry.

With the increase in forex trading in Africa, the FSCA has responded responsibly and enforced a new licensing regime known as the Over the Counter Derivative Provider license (ODP).

The ODP forces all brokers with a local presence to provide transaction data such as price, instrument type, leverage ratios as well as the name and residence of the investor, to the FSCA to ensure safe and legal trading practices.

The FSCA allows these brokers to offer services not only in South Africa, but also to other African countries such as Nigeria, Ghana and Kenya.

- View a list of regulated forex brokers in Nigeria

The European Securities and Markets Authority (ESMA) enforced new restriction laws on the maximum leverage ratios allowed for European traders, forcing traders to look to other markets.

These new restrictions only allow leverage ratios of 30:1 for major currency pairs, 20:1 for non-major currency pairs and gold, and 2:1 for cryptocurrencies. Leverage ratios as low as these have a massive negative impact on potential profits.

Added to this, the provision of bonuses, promotions and binary options was also banned.

The FSCA allows brokers to offer unlimited leverage ratios, which can potentially maximise funds greatly, and has led to more residents being prompted to start trading the African markets.

Although there are minor restrictions in some African countries to prevent fraudulent activities, there is no complete forex trading ban in Africa, which allows nearly anyone to profit from these ever-growing markets.

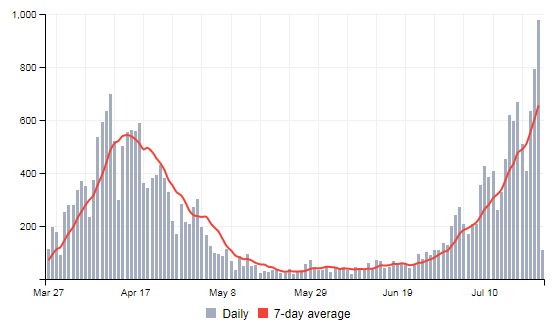

Recent lockdown measures as a result of the COVID-19 pandemic and the resulting unemployment have prompted people to explore new opportunities to earn money.

The forex market is easily accessible, holds endless opportunities to make money with little required capital and traded 24 hours, five days a week, allowing people to trade either full-time or part-time.

Where forex trading was always expensive and originally done by large companies and high net-worth investors, it is now more affordable than ever, with some brokers charging no minimum deposits and minimal banking fees.

Another incentive to enter the world of forex trading is the multitude of free tools to ensure success, such as trading courses, demo accounts and webinars that educate beginners on how to trade, use strategies and analyse markets.

Trading is made easy with the internet becoming more accessible across the African continent. All one needs is a smart phone, pc, laptop or tablet, and a good internet connection, to trade from anywhere in Africa and the rest of the world.