Forex futures positioning data for the week ending May 26, 2020

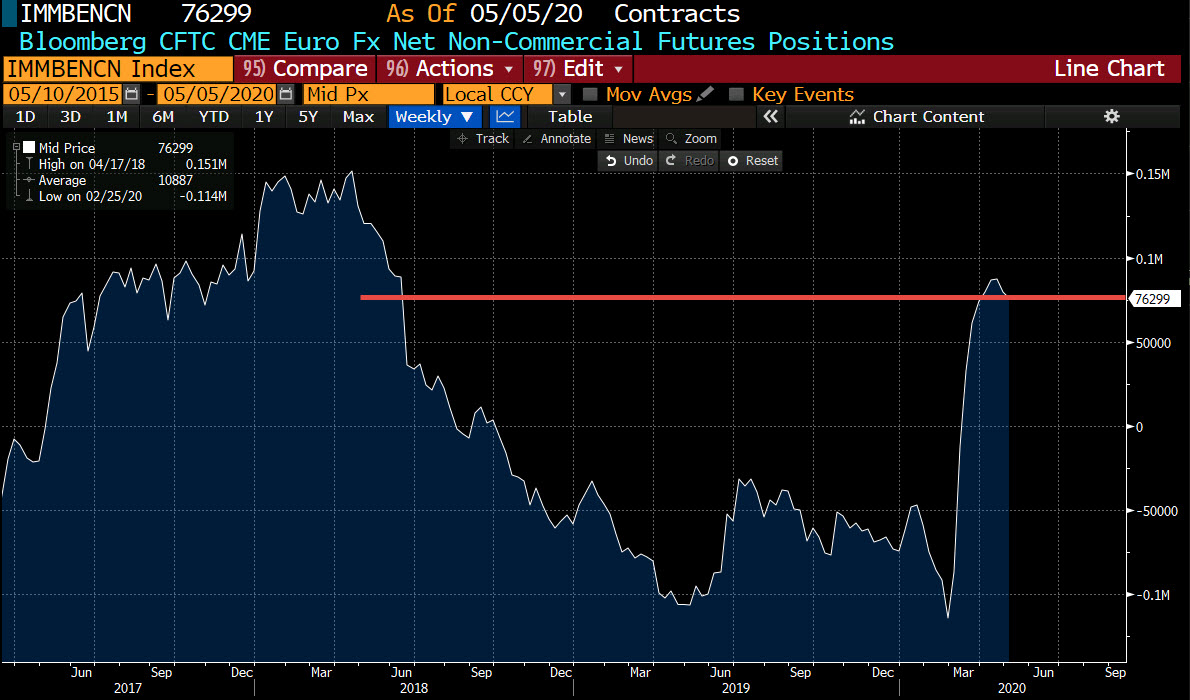

- EUR long 75K vs 72K long last week. Longs increased by 3K

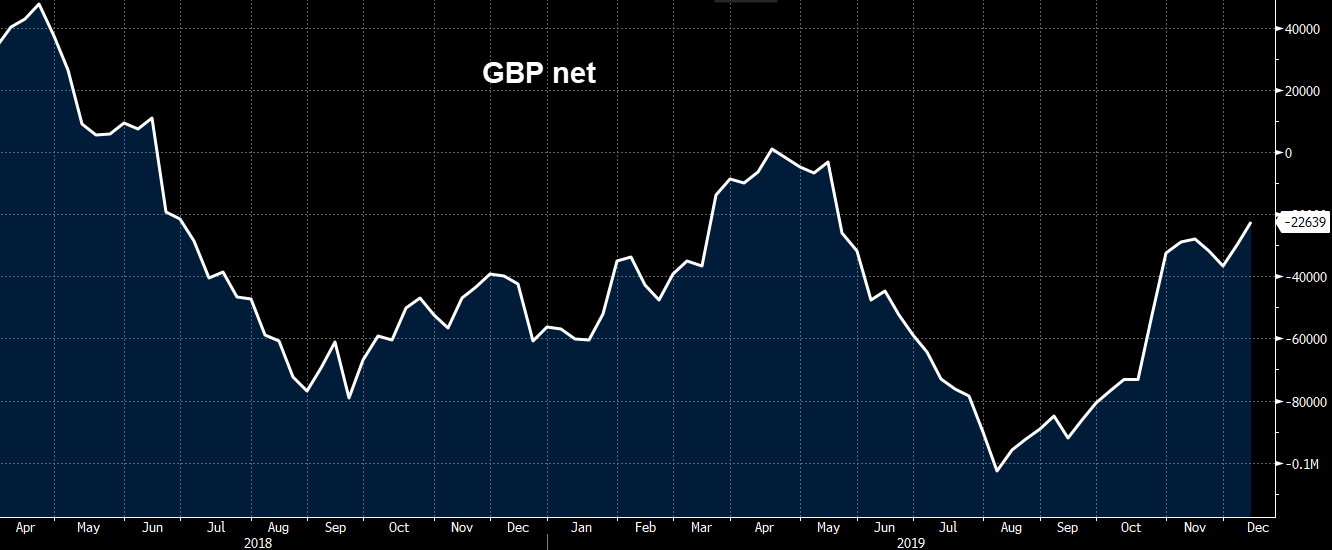

- GBP short 22K vs 19K short last week. Shorts increased by 3K

- JPY long 35K vs 28K long last week. Longs increased by 7K

- CHF long 9K vs 9K long last week. Unchanged

- AUD short 40k vs 39K short last week. Shorts increased by 1K

- NZD short 15K vs 16K short last week. Shorts trimmed by 1K

- CAD short 34k vs 35K short last week. Shorts trimmed by 1K

Highlights for the week:

- EUR remains the largest speculative position at 75 him K followed by the AUD at 40K. The traders are long EUR (short USDs) and short AUD (long USDs). The JPY is the next largest position at 35K. The speculative position is long JPY (short USD).

- There are three currencies that are long vs the USD (EUR, JPY an CHF) and 4 currencies that are short vs the USD (GBP, AUD, NZD and CAD).