The significance of market timing can’t be depicted by just a single thing. There are a few reasons why anybody intrigued by trading rates and products, Forex, ETF’s and stocks would need to sharpen their market timing aptitudes. The greatest single imperative reason that rings a bell is that of limiting your hazard presentation. At the point when there is a considerable measure of cash at hazard, it is anything but difficult to begin questioning your unique explanations behind putting on the trade when the market begins moving against your position. On the off chance that you have been trading for any time span, undoubtedly you have encountered the feelings I portray. Initially, maybe you do a little pattern estimating utilizing some Gann or Fibonacci strategy, or your most loved marker. You feel entirely sure about the choice to go long the market at a specific cost and along these lines, you enter correctly as arranged. Market timing is the system of settling on the purchase or offer choices of monetary resources (frequently stocks) by endeavoring to foresee future market value developments. The expectation might be founded on a viewpoint of a market or monetary conditions coming about because of the specialized or principal investigator. This is a venture methodology in light of the standpoint for a total market, as opposed to for a specific monetary resource.

The significance of market timing can’t be depicted by just a single thing. There are a few reasons why anybody intrigued by trading rates and products, Forex, ETF’s and stocks would need to sharpen their market timing aptitudes. The greatest single imperative reason that rings a bell is that of limiting your hazard presentation. At the point when there is a considerable measure of cash at hazard, it is anything but difficult to begin questioning your unique explanations behind putting on the trade when the market begins moving against your position. On the off chance that you have been trading for any time span, undoubtedly you have encountered the feelings I portray. Initially, maybe you do a little pattern estimating utilizing some Gann or Fibonacci strategy, or your most loved marker. You feel entirely sure about the choice to go long the market at a specific cost and along these lines, you enter correctly as arranged. Market timing is the system of settling on the purchase or offer choices of monetary resources (frequently stocks) by endeavoring to foresee future market value developments. The expectation might be founded on a viewpoint of a market or monetary conditions coming about because of the specialized or principal investigator. This is a venture methodology in light of the standpoint for a total market, as opposed to for a specific monetary resource.

Timing is Built upon Financial Strategies

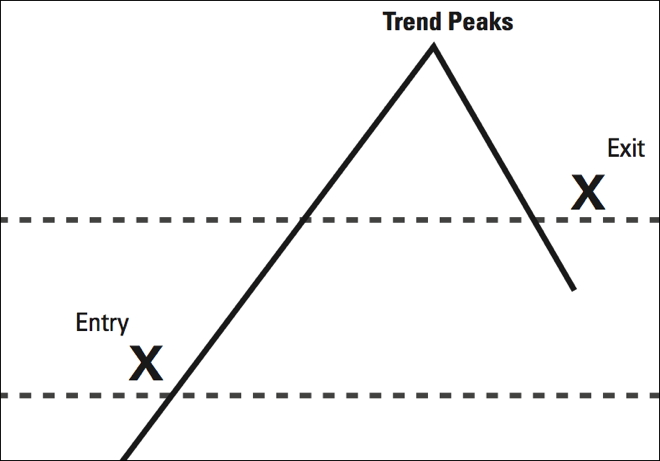

Regardless of whether the market timing is ever a practical speculation methodology is disputable. Some may consider showcase timing to be a type of betting in view of immaculate shot since they don’t put stock in underestimated or exaggerated markets. The effective market speculation guarantees that money related costs dependably show irregular walk conduct and hence can’t be anticipated with consistency. The market clock looks to offer at the ‘top’ and purchase at the ‘base’. In this way, if financing costs increment, the market clock may offer a few or the greater part of his stocks and buy more securities to exploit what might be a ‘crested’ market for stocks and the start of a blast for securities. Market clocks trust here and now value developments are critical and frequently unsurprising; this is the reason they regularly allude to factual inconsistencies, repeating designs, and other information that backings a connection between’s sure data and stock costs. A market clock’s speculation skyline can be months, days, or even hours or minutes. Latent financial specialists, then again, assess a speculation’s long haul potential and depend more on the key investigation of the organization behind the security, for example, the organization’s long haul procedure, the nature of its items, or the organization’s associations with the administration when choosing whether to purchase or offer. (more…)

The significance of market timing can’t be depicted by just a single thing. There are a few reasons why anybody intrigued by trading rates and products, Forex, ETF’s and stocks would need to sharpen their market timing aptitudes. The greatest single imperative reason that rings a bell is that of limiting your hazard presentation. At the point when there is a considerable measure of cash at hazard, it is anything but difficult to begin questioning your unique explanations behind putting on the trade when the market begins moving against your position. On the off chance that you have been trading for any time span, undoubtedly you have encountered the feelings I portray. Initially, maybe you do a little pattern estimating utilizing some Gann or Fibonacci strategy, or your most loved marker. You feel entirely sure about the choice to go long the market at a specific cost and along these lines, you enter correctly as arranged. Market timing is the system of settling on the purchase or offer choices of monetary resources (frequently stocks) by endeavoring to foresee future market value developments. The expectation might be founded on a viewpoint of a market or monetary conditions coming about because of the specialized or principal investigator. This is a venture methodology in light of the standpoint for a total market, as opposed to for a specific monetary resource.

The significance of market timing can’t be depicted by just a single thing. There are a few reasons why anybody intrigued by trading rates and products, Forex, ETF’s and stocks would need to sharpen their market timing aptitudes. The greatest single imperative reason that rings a bell is that of limiting your hazard presentation. At the point when there is a considerable measure of cash at hazard, it is anything but difficult to begin questioning your unique explanations behind putting on the trade when the market begins moving against your position. On the off chance that you have been trading for any time span, undoubtedly you have encountered the feelings I portray. Initially, maybe you do a little pattern estimating utilizing some Gann or Fibonacci strategy, or your most loved marker. You feel entirely sure about the choice to go long the market at a specific cost and along these lines, you enter correctly as arranged. Market timing is the system of settling on the purchase or offer choices of monetary resources (frequently stocks) by endeavoring to foresee future market value developments. The expectation might be founded on a viewpoint of a market or monetary conditions coming about because of the specialized or principal investigator. This is a venture methodology in light of the standpoint for a total market, as opposed to for a specific monetary resource.