* Everyone is wrong in the markets at times. The difference between the great traders and the unsuccessful ones is in how long they stay wrong.

* Addictive traders get high from action; great traders get high from mastering markets–and mastering themselves.

* Great traders do their best work when they are not trading; unsuccessful traders do not work when they are not trading.

* Every loss of discipline is a self-betrayal; great traders are true to themselves and stay disciplined as a result.

* Great traders focus on the two things they can always control: when they play and how much they bet.

You will never achieve greatness by minimizing your weaknesses. At best that will bring you to average. The path to greatness lies inmaximizing strengths: becoming more of who you are when you are at your best. Here are five things I look for in successful new traders.

Archives of “finance” tag

rss8 ways to measure your trading performance

1. Number of winning vs losing trades

The success rate of your trades is an important number to have in order to monitor improvements in other areas of trading.

There’s a general view that you’ll want to win more often than you lose – but there are many successful traders out there who’ll take lots of small losses and fewer bigger winners. What matters is how this figure balances with your average win/loss size (see number 3 below).

2. Largest number of consecutive winners and losers

Take a look at when these happened – what were the market conditions at the time?

This will give you a picture of what markets you’re good at trading, and which ones you should be wary of. How can you protect yourself against the poor market conditions, and maximize the benefits of the good conditions?

3. Average win size vs average loss size

I often bang on about how the 2:1 risk-reward principle should be viewed as an ‘aim’ rather than a ‘rule’.

Achieving double the reward on winners than the loss on losers is a tough call for any trading strategy to maintain – it’s certainly a lot harder than many trading gurus would have you believe.

However, if your losses are too big and keep wiping out all your gains –you’ve got a problem. This figure needs to be carefully balanced with your success rate (number 1, above) to achieve profitability.

4. Largest and longest draw-down periods (more…)

To Trade or Not to Trade: The Most Important Question

In trading activity alone does not make money, the right activity at the right time is what makes money. Many times the right thing, is to do nothing.

In your actual trading you have to do four things very well to make money.

You have to know when to get in.

Only enter trades that have the highest probability of success and the best risk/reward ratio. Buy the best monster stocks during up trends. Short the fallen leaders when the game changes and they are under the 50 day. Buy the monster stocks at the gift of the 200 day moving average. Short down trending junk stocks. Go where the trends are.

You have to know when to get out. (more…)

Go For the Big Move, Even If You Know Most Moves Are Small

- Every time you assume a market position in the direction of the major trend, you should premise that the market could have major profit potential and you should play your strategy accordingly. By doing so, you will be encouraged to hold the position and not look for short-term trades.

- Your perception tells you to hold every with-the-trend position, looking for the big move. Your sense of reality tells you that most trades are not destined for the big move. But, since you don’t know in advance which trade will be wildly successful and since you know that some of them will be, the strategy of choice is to assume each with-the-trend trade can be the ‘big one’; and let your stops take you out of those trades which fizzle.

- The annals of financial markets are replete with real time examples of markets that started most unimpressively, but then developed into full scale mega-moves. Meanwhile, most of the original participants who may have climbed on board at the very inception of the move, got out at the first profit opportunity and then watched as the market continued to move very substantially, but certainly without them.

The Universal Principles of Successful Trading – 5 Points

A book review for Brent Penfold’s book “The Universal Principles of Successful Trading: Essential Knowledge for All Traders in All Markets”

This book is excellent for traders that are ready to accept its lessons. You need a foundation in trading to understand the importance of what the book is advising, and take the principles seriously with an open mind. Once you are through the rainbow and butterfly phase of trading, and realize that you will not be a millionaire in a year, this book will help you get focused and become serious about trading.

Here are the six universal principles of successful traders:

1). Preparation

Author Brent Penfold is in the minority, believing risk management is the #1 priority in trading. Brent believes that once you get your trading system and position size in place, you must use the amount you will risk on each trade to determine your risk of ruin. The book shows exactly how to figure this out using Excel. He believes that if your risk of ruin is not zero, then you will eventually blow out your account. Risking 1% to 2% of your capital in any one trade usually gives you a zero percent risk of ruin, but it also depends on your systems win/loss ratio. Make sure to test any system with a minimum of 30 trades and then determine your risk of ruin. I would advise a larger sample size in multiple market environments. A trend following system that looks brilliant in a trending market may result in a 50% draw down in a choppy or range bound market.

2). Enlightenment

Your most important goal is to lower your risk ruin to zero. In trading, the trader with the best ability to cut losses short wins. Simple trading strategies work the best based on traditional support and resistance levels, while trading with the trend on either reversals or break outs. The 10% of winning traders in the market win by treading where others fear; buying on break outs when they first occur, and going short when a new low is made. Buying into key reversals when a security finds support or resistance, and reverses at the end of a monster trend, is also a tactic of winning traders.

3). Developing a trading style

You must choose your own personal style of trading: swing trading, trend trading, etc. You must also trade based on your chosen time frame: intraday, short term, medium term, or long term. (more…)

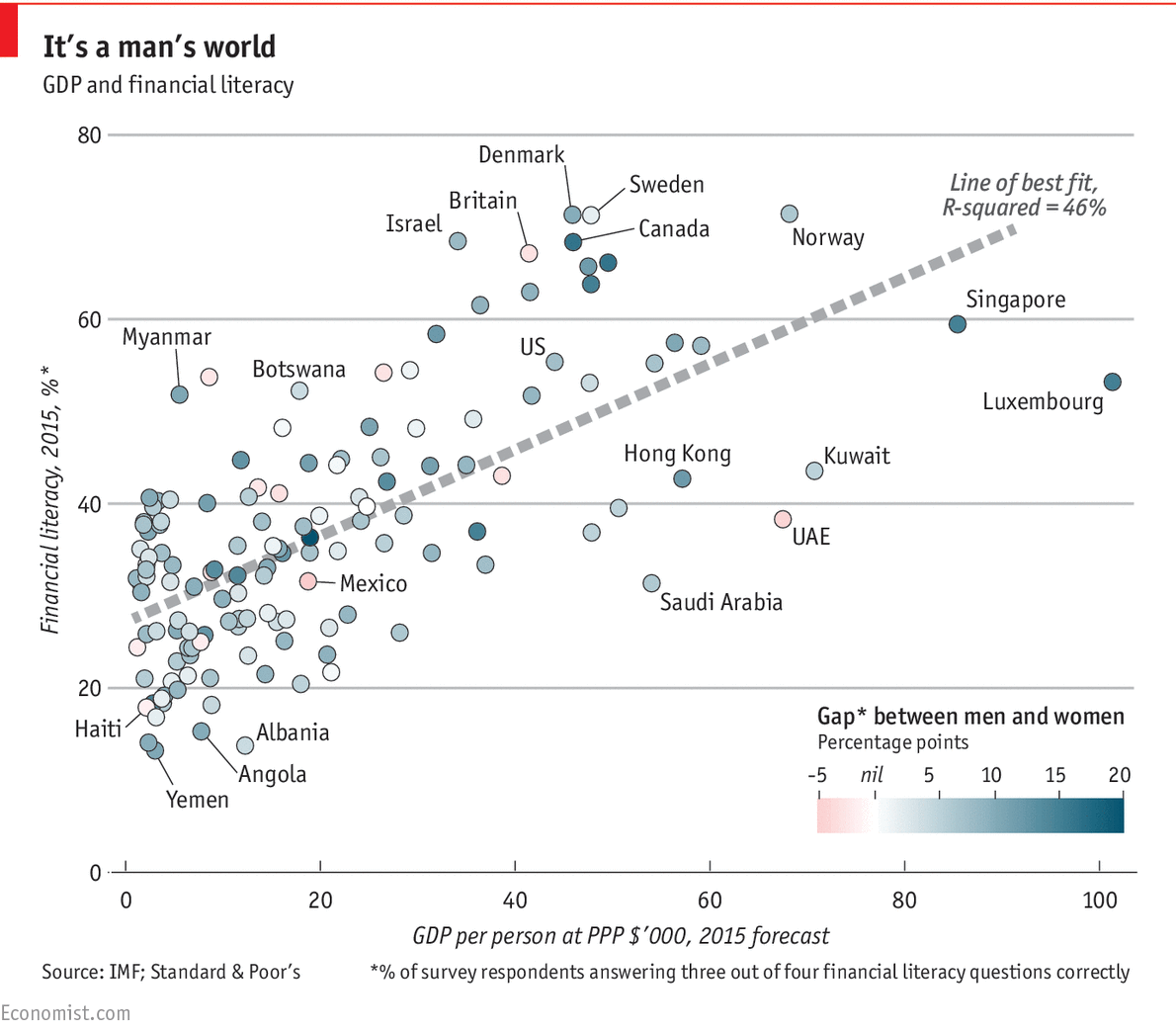

Global Financial Literacy

Links For Traders

- Less Is More: A Case for Concentrated Portfolios

- Eurozone can’t survive in current form, says PIMCO

- Finding Surer Footing

- Use a computer rather than your brain: Fund manager

- Do you know what you know?

- Return Dispersion, Counterintuitive Correlation

- Hedge Funds: Don’t Call Us a Hedge Fund

- How to Protect Your Portfolio Against Loss

- Thinking Sideways

- Learning to Love Investment Bubbles: What if Sir Isaac Newton had been a Trendfollower?

10 Characteristics of Successful Traders

1) The amount of time spent on their trading outside of trading hours (preparation, reading, etc.);

2) Dedicated periods to reviewing trading performance and making adjustments to shifting market conditions;

3) The ability to stop trading when not trading well to institute reviews and when conviction is lacking;

4) The ability to become more aggressive and risk taking when trading well and with conviction;

5) A keen awareness of risk management in the sizing of positions and in daily, weekly, and monthly loss limits, as well as loss limits per position;

6) Ongoing ability to learn new skills, markets, and strategies; (more…)

5 Great Things about Great Traders

Everyone is wrong in the markets at times. The difference between the great traders and the unsuccessful ones is in how long they stay wrong.

* Addictive traders get high from action; great traders get high from mastering markets–and mastering themselves.

* Great traders do their best work when they are not trading; unsuccessful traders do not work when they are not trading.

* Every loss of discipline is a self-betrayal; great traders are true to themselves and stay disciplined as a result.

* Great traders focus on the two things they can always control: when they play and how much they bet.

How To Overcome A Market Bias

DON’T ASSUME THERE IS A RATIONAL REASON BEHIND THE MARKET DIRECTION

Market direction is simply the way the market is moving at any given time during the day, and can change at any moment. Market direction is based on the number of trades that take place at certain prices, no more no less. That is why when you think you have the direction called, the markets change and move in a new direction.

When a trader remains focused on what is happening, they remain focused on their own trades without wasting energy trying to understand why. The market will move where the market will move, one thing is for sure, the market does not need to have a rational reason why it is moving in a direction. Overcoming the need to rationalize a reason behind a market direction will serve to support a stronger trading plan.

SHOW UP EVERY DAY AND MAKE YOUR TRADING ASSUMPTION BASED ON WHAT YOU ARE SEEING (more…)