The dollar squeeze in emerging markets is where the problem is at

Indonesia is one of the EM countries where they have higher dollar-denominated debt than they do FX reserves. That is not a good spot to be in during this kind of market environment.

Indonesia is one of the EM countries where they have higher dollar-denominated debt than they do FX reserves. That is not a good spot to be in during this kind of market environment.

Market patterns don’t reverse in 10-year cycles like clockwork; there’s no guarantee that the coming decade will be the opposite of the one that just ended. But before you bet that the future will be like the past, it’s worth remembering that this decade hasn’t turned out the way investors predicted it would 10 years ago.

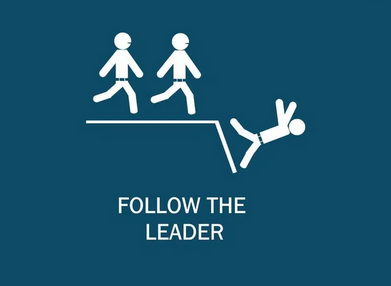

Like other emerging market nations, it has entered a vicious cycle in which market skepticism creates higher borrowing costs and actually pushes the country closer to the abyss, its demise becoming a self fulfilling prophecy. Once that momentum begins, it is very hard to stop the decline in confidence.

Like other emerging market nations, it has entered a vicious cycle in which market skepticism creates higher borrowing costs and actually pushes the country closer to the abyss, its demise becoming a self fulfilling prophecy. Once that momentum begins, it is very hard to stop the decline in confidence. About the author: Cliff Wachtel

Marc Faber mentions Brazil as an interesting emerging market in this video interview.This interview simply reinforces my determination.

Don’t miss to watch :Just listen carefully at 4:28….Enjoy !!

Read a PDF of the IMF’s recent report here.

The International Monetary Fund (IMF) highlighted the fact that low interest rates in the U.S., plus an apparent “one-way” bet against the dollar has created a global dollar carry-trade that is driving capital flows into emerging markets.

If not handled properly, this will lead to emerging market asset bubbles, which arguably have already begun to inflate.

We’ve highlighted before how places like Hong Kong are seeing property prices go through the roof due to low U.S. interest rates. (more…)