Archives of “Economy of the United States” tag

rssDovish testimony from Powell, 3 rate cuts on the way, starting with 25bps in July

That’s the expectation from Bank of America / Merrill Lynch for the FOMC after Fed Chair Powell’s testimony on Wednesday

- “hinting strongly at an upcoming cut“

- expect a 25bp cut in July (31st)

- and cuts thereafter at each of the following two meetings (September17-18 and October 29-30)

- cumulative 75bp of easing

- The Fed seems to be willing to dismiss the better data from the US and instead is focusing on the weaker global data.

- Indeed, when Powell was asked if the strong jobs report changed his views on cuts, he stated “no”.

France’s plan to tax tech companies could lead to the US imposing new tariffs on the country

U.S. President Donald Trump has asked for an investigation into France’s planned tax on technology companies

- could potentially lead to the United States imposing new tariffs or other trade restrictions

- US Trade Representative Lighthizer to set up the investigation

- Questioning if France’s digital-tax plan would hurt US technology companies

- A Section 301 investigation, will assess if France’s levy poses an unfair trade practice

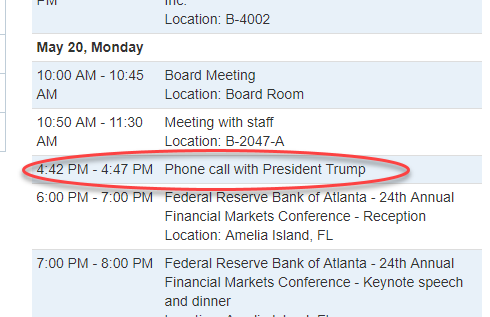

Trump and Powell spoke for five minutes on May 20

No word on what they spoke about

Here was the news wrap from May 20. There wasn’t much going on that day but Trump and Powell did both speak later that evening. Here were the comments from Powell. He also said that it was premature to make judgement on trade & tariff impacts on path for monetary policy.

Trump, China & the Fed

I think it’s entirely possible we leave Osaka with a mild escalation -something like expanded 10% tariffs – enough to scare both China & the Fed into more stimulus & a 50bps cut. Then walk it back in 2020 with a juiced economy. Same playbook as Iran/SA

The chaps at China’s Global Times say US growth claims are fake news

if these guys are setting the tone for the talks between Xi and Trump … well Monday early markets could be very interesting indeed!

- The claims that US growth will accelerate are false.

- Instead growth in 2019 will fall.

- And growth in 2020 will be even lower than in 2019 – a serious issue for Trump as 2020 is an election year

"Governments Control Markets; There Is No Price Discovery Anymore"-Must Watch Video

In this 38 minute interview Lars Schall, for Matterhorn Asset Management, speaks with Dr Pippa Malmgren, a US financial advisor and policy expert based in London. Dr Malmgren has been a member of the U.S. President’s Working Group on Financial Markets (a.k.a. the “Plunge Protection Team”). They address, inter alia:

- Malmgren’s recent book “Signals: the breakdown of the social contract and the rise of geopolitics”;

- the “inflation vs deflation” debate

- the closer ties between Russia and China

- the future of the Euro

- Germany’s gold reserves

- and the phenomenon of “financial repression”

- Moreover, Dr Malmgren explains what she foresees as the endgame of the financial crisis.

Amazon CEO Jeff Bezos: Secrets to Success

Quotable Quotes from Ed Seykota

I was reading a bit more about Ed Seykota after seeing The Whipsaw Song.

Ed Seykota became famous after appearing in Jack Schwager’s Wall Street Wizards book. He has an Electrical Engineering degree from MIT and was one of the pioneers of systems trading. He supposedly returned 250,000% over 16 years for one of the accounts he managed.

Below I have categorized some of the quotes that I have come across.

Ed Seykota’s Trading Style

- My style is basically trend following, with some special pattern recognition and money management

algorithms. - In order of importance to me are: (1) the long-term trend, (2) the current chart pattern, and (3) picking a good spot to buy or sell. Those are the three primary components of my trading. Way down in very distant fourth place are my fundamental ideas and, quite likely, on balance, they have cost me money.

- I consider trend following to be a subset of charting. Charting is a little like surfing. You don’t have to know a

lot about the physics of tides, resonance, and fluid dynamics in order to catch a good wave. You just have to be able to sense when it’s happening and then have the drive to act at the right time. - Common patterns transcend individual market behavior (my note: i.e. price patterns are similar across different markets).

Overall Rules

- Trade with the long-term trend.

- Cut your losses.

- Let your profits ride.

- Bet as much as you can handle and no more.

Buying on Breakouts (more…)

20 Signs That The Global Economic Crisis Is Starting To Catch Fire

If you have been waiting for the “global economic crisis” to begin, just open up your eyes and look around. I know that most Americans tend to ignore what happens in the rest of the world because they consider it to be “irrelevant” to their daily lives, but the truth is that the massive economic problems that are currently sweeping across Europe, Asia and South America are going to be affecting all of us here in the U.S. very soon. Sadly, most of the big news organizations in this country seem to be more concerned about the fate of Justin Bieber’s wax statue in Times Square than about the horrible financial nightmare that is gripping emerging markets all over the planet. After a brief period of relative calm, we are beginning to see signs of global financial instability that are unlike anything that we have witnessed since the financial crisis of 2008. As you will see below, the problems are not just isolated to a few countries. This is truly a global phenomenon.

Over the past few years, the Federal Reserve and other global central banks have inflated an unprecedented financial bubble with their reckless money printing. Much of this “hot money” poured into emerging markets all over the world. But now that the Federal Reserve has begun “tapering” quantitative easing, investors are taking this as a sign that the party is ending. Money is being pulled out of emerging markets all over the globe at a staggering pace and this is creating a tremendous amount of financial instability. In addition, the economic problems that have been steadily growing over the past few years in established economies throughout Europe and Asia just continue to escalate. The following are 20 signs that the global economic crisis is starting to catch fire…

#1 The unemployment rate in Greece has hit a brand new record high of 28 percent. (more…)