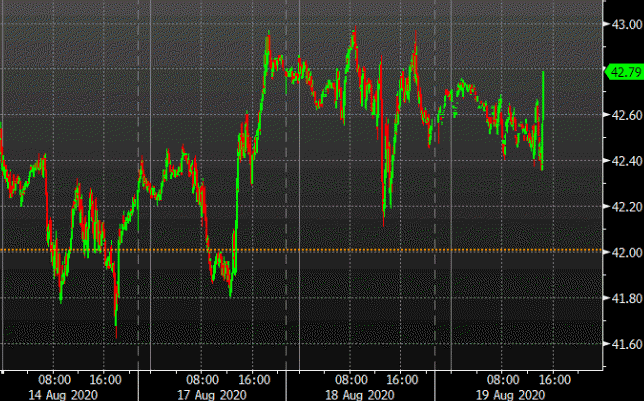

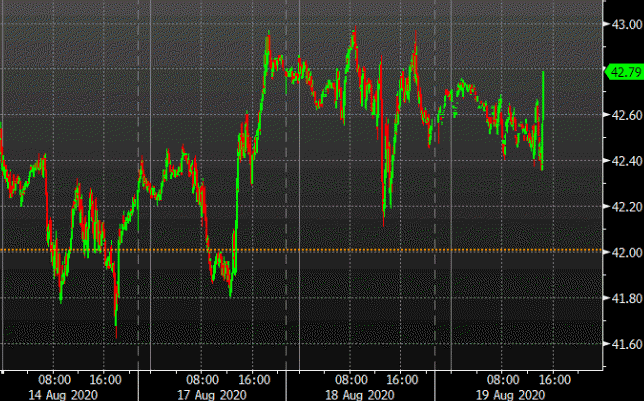

Weekly US petroleum inventory data

- Prior was -4512K

- Gasoline -3322K vs -1000K expected

- Distillates +152K vs -1200K expected

- Refinery utilization -0.1% vs +0.3% expected

- Production unchanged at 10.7 mbpd

- Crude -4264K

- Gasoline +4991K

- Distillates -964K

The Department of Energy will release their weekly inventory data.

Every writer knows that trying to express an idea in the fewest number of words is one of the hardest tasks. That is, in part, why there are editors. There is a legend that Ernest Hemingwaywon a bet by writing a six word short story:

For sale. Baby shoes. Never worn.

The folks at Snopes are skeptical of this legend, but the fact remains that the six word story is a compelling one, Hemingway or not.

Jason Zweig writing at Total Return asked a number of investment professionals to do something similar when it comes to expressing their investment philosophy in ten words or less. One might think that ten words would be too much of a constraint, but the participants did compelling work. Zweig wrote this:

Anything is possible, and the unexpected is inevitable. Proceed accordingly.

We also liked Elroy Dimson’s contribution as well:

Risk means more things can happen than will happen. (more…)