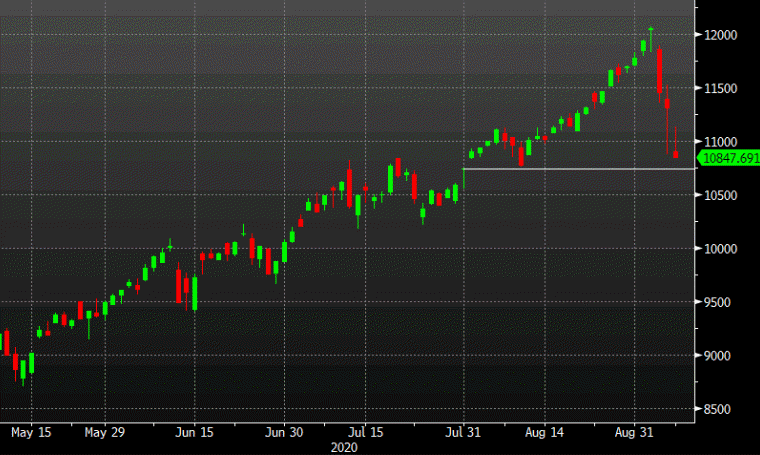

Yields quickly move back higher

The chart of 10-year yields is an interesting one. There was the consolidation pattern at the top that broke down this week but now it has rejected the first test of 1% and bounced 6 bps to 1.06%.

It’s now testing the bottom of the old range and we’ll soon find out of there will be a broader range of consolidation or it will range from 1.00%-1.06%.

Notably, the bond market was a step ahead of stocks this week and that break lower came well ahead of the rout in equities yesterday. There has been a great pass-through to FX, but keep an eye on yields from here.