Google commercials have always been quite engaging. Google India is out with a 3.5 minute heart-warming advertisement titled ‘Google Search: Reunion’. The Reunion advertisement tells you a story of how two friends got separated during the time of India and Pakistan partition. The Indian grand daughter Suman plans to bring them together again and uses Google search as the medium to search for her grand fathers long lost friend in Pakistan. She succeeds using Google search and its allied services.

Reports suggest this is the first in the series of 5 advertisements. The video is touching half a million views in just a day of its launch.

Archives of “business” tag

rssActive Traders-Must Read These 42 Points

What if you could read the principles for success for some of the world’s greatest traders? Well you can, here is how author Jack Schwager summed up the the similarities of the ‘Market Wizards’ he spent years interviewing in his second book.

The following is an summarized excerpt from Jack D Schwager’s book, The New Market Wizards. I highly recommend this book for all active traders.

- First Things First

You sure you really want to trade ? It is common for people who think they want to trade to discover that they really don’t. - Examine Your Motives

Why do you really want to trade ? Did you say excitement ? Then don’t waste your money in market, you might be better off riding a roller coaster or taking up hand gliding.

The market is a stern master. You need to do almost everything right to win. If parts of you are pulling in opposite directions, the game is lost before you start. - Match The Trading Method To Your Personality

It is critical to choose a method that is consistent with your your own personality and conflict level. - It Is Absolutely Necessary To Have An Edge

You cant win without an edge, even with the world’s greatest discipline and money management skills. If you don’t have an edge, all that money management and discipline will do for you is to guarantee that you will gradually bleed to death. Incidentally, if you don’t know what your edge is, you don’t have one. - Derive A Method

To have an edge, you must have a method. The type of method is not important, but having one is critical-and, of course, the method must have an edge. - Developing A Method Is Hard Work

Shortcuts rarely lead to trading success. Developing your own approach requires research, observation, and thought. Expect the process to take lots of time and hard work. Expect many dead ends and multiple failures before you find a successful trading approach that is right for you. Remember that you are playing against tens of thousands of professionals. Why should you be any better ? If it were that easy, there would be a lot more millionaire traders. - Skill Versus Hard Work

The general rule is that exceptional performance requires both natural talent and hard work to realize its potential. If the innate skill is lacking, hard work may provide proficiency, but not excellence.

Virtually anyone can become a net profitable trader, but only a few have the inborn talent to become supertraders ! For this reason, it may be possible to teach trading success, but only upto a point. Be realistic in your goals. - Good Trading Should Be Effortless

Hard work refers to the preparatory process – the research and observation necessary to become a good trader – not to the trading itself.

“In trading, just as in archery, whenever there is effort, force, straining, struggling, or trying, it’s wrong. You’re out of sync; you’re out of harmony with the market. The perfect trade is one that requires no effort.” - Money Management and Risk Control

Money management is even more important than the trading method.

Get Rs 25000 right now or flip a coin with a 50/50 chance of winning Rs 50000. Which do you go for?

Think of an answer before reading further.

Think of an answer before reading further.

Now. You have the choice of definitely losing RS 25000 or flipping a coin with a 50/50 chance of losing Rs 50000. Which option do you take?

If you answered both questions the same way, congratulations, you have a rational attitude toward gains and losses. That’s good news if you’re a trader.

Studies show that most people will pick receiving Rs 25000 while opting to take the chance of losing Rs 50000 or nothing. It’s called loss aversion and it’s because negative reactions to loss impact our psyches twice as hard as the rush of making gains does.

Master that psychological part of trading and you’re one step closer to being the trader you want to be.

12 Insights About Markets and Life

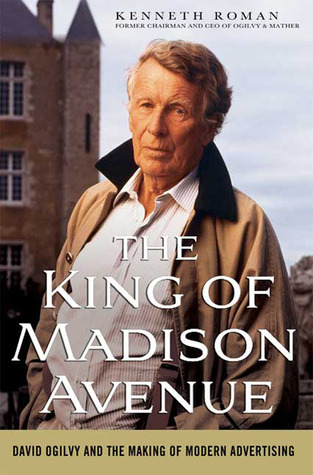

12 insights about markets and life from reading Ken Roman’s The King of Madison Avenue and The Unpublished David Ogilvy.

12 insights about markets and life from reading Ken Roman’s The King of Madison Avenue and The Unpublished David Ogilvy.

1. Be unorthodox and imaginative in your hiring. Ready to hire people with unusual backgrounds. Would you hire this man for an advertising executive? “He is 38 and unemployed. He dropped out of college. Has been a cook, a salesman, a diplomat and a farmer. Knows nothing about marketing. And has never written any copy. Is interested in advertising as a career at the age of 38, and is ready to go to work cheap.” It was Ogilvy himself who 3 years later became the most famous copywriter in the world and built the eighth biggest ad agency.

2. Treat women as if they are as knowledgeable as your wife when you advertise to them. They don’t like to be talked down to or treated as robots. Peter Lynch and Jim Cramer are not the only investors who got 10 baggers from their wives.

3. The purpose of advertising is to sell a product. Make sure you go for the sale. Forget about aesthetics. Learn from the mail order ads where everything is tested, and no ad continues unless it pays it way. Forget about the 3rd and 4th moments in your quantitative measures and concentrate on making a profit on your trades.

4. Don’t show off or try to be funny. It doesn’t go well in print. It demeans the readers’ intelligence. If you show off in a trade or competition, it will defuse your energy, and take you away from the bottom line. (more…)

What is a ‘Zero-Sum Game’?

Zero-sum games are the total opposite of win-win situations – such as an agreement that creates value between two counter-parties – or lose-lose situations, like war and mutually destructive relationships for instance. In real life, however, things are not always so clear-cut, and winners and losers are often difficult to quantify. New traders get confused and do not understand that in trading, profits come from the people on the other side of your trade that are making the wrong decision. The reason that trading is difficult is because you have to out smart someone to get their money, how you do this is what gives you your edge if you are profitable. In all financial markets buyers and sellers are always equal and the time frame in which they are trading determines if their decision was the right or wrong one at the time of their trade. Your entry is someone else’s exit and your losses are in some one else’s account as profits.

A zero-sum game is a situation where one person’s gain is always equivalent to another person’s loss, so the total wealth for the players and participants in the game is always a net change of zero as a whole. The financial contract markets of futures and options are a zero-sum game with several million players. Zero-sum games are found in game theory, but are less common than non-zero sum games. Poker and gambling are popular examples of what a zero-sum game is since the sum of the amounts won by some players equals the combined losses of the others. The money at a poker table at the start of the game does not grow it is just redistributed to the winners from the losers by the end of the game. All of the casino’s profits come from the gambler’s losses and all the gamblers profits are taken from the casino. Games like chess and tennis also fit this model becasue there is one winner and one loser they are always equal. In the financial markets, option contracts and future contracts are examples of zero-sum games, excluding transaction costs, for every long contract their is someone short the same contract. Some one has to sell a contract to create open interest and someone has to buy it, there has to be a winner and a loser at all times, one long and one short. Brokers and market makers disrupt the perfect balance of winners and losers by taking commissions or profiting from the bid/ask spreads. But, for every person who profits on a contract’s value going in their direction, there is a counter-party who loses who is on the other side. (more…)

The PROPER Use Of Hope and Fear

If you’ve been involved in the markets for any length of time you will no doubt have heard of the twin pillars of market psychology, Hope and Fear (or sometimes Greed and Fear).

In fact, if you’ve ever been involved in an endeavour where you have something on the line – a business, a wager, a job, or even a date – you will have experienced Hope and Fear in some form and the devastation it can play on your psychology.

Experiencing Hope

For most traders, Hope looks like this:

They’ve just bought a stock or commodity, and they hope that it goes up. Of course, this is the name of the game, we all hope it goes up if we are buying! But then the stock starts to fall, and instead of selling out, the trader holds on with the hope that it will rise again. The more the stock falls, the more they hope and pray that it will rise.

But they don’t realise – Hope does not equal Action. And only our Actions make money in the stock market.

Experiencing Fear (more…)

5 Trading Frustrations and Solutions

Top Trader Frustrations

- I cannot trade my plan!

- You need to develop the skill to execute your trading plan under duress.

- Use visualization exercise to see yourself successfully executing your trading plan during the day. The greater level of detail a trader uses in their visualization exercise the greater its effectiveness.

- I cut my winning trades too early!

- Have profit targets

- Take partial profits

- Measure each day the missed profits that you could have obtained if you didn’t miss a setup, or if you didn’t cut your winning trades too early.

- I am not consistent with my trading

- Establish a playbook with setups that work for you, and setups that don’t work for you.

- Define the risk that you should take in setups based on whether they are A+, B, C setups (based on risk/reward and % win rate).

- Track the amount of risk that you are taking on similar trades, so that the results can be properly analyzed. Risk 30% of your intraday stop loss on a A+ setup, 20% on a B setup, 10% on a C setup, 5% on a Feeler trade.

- Do a trade review

- Did I trade the best stocks today?

- Did I recognize the market structure?

- Did I push myself outside the comfort zone?

- Things I did well

- Things I could improve

- I cannot find a profitable trading system

- Trading is a probability game, setups don’t work all the time, so don’t keep trying and throwing away trading setups without thoroughly testing them.

- Get exposed to lots of different setups and trade the setups that make the most sense to you and works best for you.

- I lack the confidence to take trades

- Have a detailed trading plan, place orders in advance in possible.

- Put on feeler trades with 5-10% of the risk that you normally put on. Once you start to become more comfortable you can then put on your regular trades again.

How to Become a More Disciplined Trader-15 points

1.Treat trading as a business.

2. Get someone to keep you on track.

3. Review your trades.

4. Set reasonable trading goals.

5. Tackle the easy problems first.

6. Review your performance.

7. Make trading rules and keep them visible at all times.

8. Make a trading plan.

9. Make a game plan.

10. Have a trading strategy to follow.

11. Ask yourself before every trade, “Is this the right thing to do?”

12. Do your homework.

13. Work hard to improve.

14. Use hypnosis.

15. Just do it.

2 Ways to Fail at Trading

Misunderstanding how trading works. Trading is a game of probabilities. No matter what methodology you are using—fundamental, macro or technical; highly quantitative, intuitive, seat of pants, or blend; long term, short term, daytrading—at the end of the day, the expected value of your trades has to be positive, or you aren’t going to make money. There is no free lunch. Though you may get lucky (or unlucky) on a set of trades, over a large set of trades, the Law of Large Numbers rules with an iron fist. There is no way to “game” the system. You can’t take small trades with tiny risk, you can’t sell time premium, you can’t find some magic technical pattern. Yes, all of these things can be part of a working methodology, but that methodology has to have a positive expectancy. To put it simply, it has to work. (Now, you can see that points 1-4 are really basically the same point!)

Be overconfident. Markets punish hubris and overconfidence with remarkable consistency. (Victor Niederhoffer has written poignantly on this subject.) Overconfidence can hit in many ways. Industry statistics show that most small trading accounts lose money, so, you have to ask yourself, why will you be different? (Hint: answers like “I have a passion for markets. I was successful in this business or this sport. I’m a driven, detail-oriented person,” are probably not strong enough answers. Dig deep. Why will you succeed where so many others have tried and failed?) Overconfidence can creep in in other ways too. After a long string of winning trades, some traders are tempted to get more aggressive and increase their risk… and now they are trading too big, so bad things happen. There’s a sweet spot here—you have to have a degree of confidence, you can’t be afraid, but you have to stay humble. If you don’t, the market will make you humble, one way or another.

5 Quotes From Market Wizard Jeff Yass

“The basic concept that applies to both poker and option trading is that the primary object is not winning the most hands, but rather maximizing your gains.” – Jeff Yass

I’m not sure whether I learned this concept about trading and then applied it to poker or if it happened the other way around. Either way, this is something that has always been at the forefront of my mind with respect to both. My goal in poker is never to win the most hands, but to make sure that the pot is as large as possible when I do win.

I really liked that Yass described situations in poker where you have nothing to gain from betting and the check/raise is the best play. This is a concept that I have always had a strong grasp on. There are many situations in both trading and poker where pushing all of your chips in is not the optimal move in terms of long term survival. I need to keep that in mind.

“I learned more about option trading strategy by playing poker than I did in all my college economics courses combined.” – Jeff Yass

I often joke about all the things I didn’t learn in college. This is an interesting take on that. It makes me question whether there is some aspect of my life that I could apply to trading and improve my performance. I think that it can be broken down to the fact that I simply think different than normal people. This is why things like location independent work, the paleo diet, and trend following are so interesting to me. (more…)