How does basketball exactly relate to golf and perhaps trading successfully? Well, you’re going to soon find out!

In this article, Michael provides 10 rules for maximizing competitiveness and if you’ve been trading for any period of time, you’ll instantly recognize their value to trading successfully. In fact, here’s my personal take on how Jordan’s rules directly relate to making us all better traders:

Focus on the little things. It is true, if you focus on the little things (finding and exploiting attractive entry points, proper position sizing, sticking to stop loss levels, unbiased chart analysis, etc.) they’ll all add up to contribute to your big picture success and bottom line. When the pressure is on and tension and stress is high, traders must rely on the basic skills they’ve developed through constant practice to make the tough trades. That practice and constant dedication to improve oneself will make a world of difference when opportunities are the most plentiful.

Have total confidence in what you can do. As Michael says “If you have 100 percent confidence that you can pull off a shot, most of the time you will.” I couldn’t agree more. While we all make trades based on imperfect information and conflicting data, at all times we must be 100% confident in the trades we make. There’s a good reason why so many traders say you must always “trade to win” instead of “trading not to lose.” There’s a huge difference. In addition, the only way to have confidence you really need in the trades you make is to actually do the work the leads up to making those trades in the first place.

Don’t think about the prize; think about the work. Novice traders focus on how much money they stand to gain or lose from trading while great traders focus simply on the process of trading well and to their best of their ability. That’s a key difference. Sometimes a good trader will be very unhappy even if they make money in a particular trade because they didn’t trade it well or the trade violated their strategy and they got away with it whereas a novice trader will simply focus on the profits or losses no matter how and why they earned them. Money, and the rewards the flow from successful trading, are a low priority to the successful trader – instead trading well and trading even better the next time are the two top priorities. (more…)

There are three related hurdles for traders.

There are three related hurdles for traders.

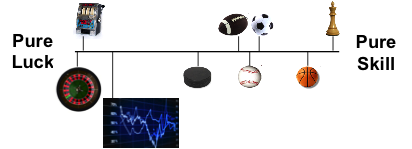

The difference between a trader and a gambler is frequency. A gambler does it once. A trader is committed to take the natural fluctuations in their bottom line. A gambler gives up control and takes little responsibility for the outcome. A trader sees the outcome as a learning experience. A chance to take that knowledge and let it pay over time. A gambler sees a success as a pay day. A trader see it is an opportunity. A gambler focuses on luck, a trader focus on repeatable actions. A traders can tell the difference between an aberration, for a gambler there is no distinction.

The difference between a trader and a gambler is frequency. A gambler does it once. A trader is committed to take the natural fluctuations in their bottom line. A gambler gives up control and takes little responsibility for the outcome. A trader sees the outcome as a learning experience. A chance to take that knowledge and let it pay over time. A gambler sees a success as a pay day. A trader see it is an opportunity. A gambler focuses on luck, a trader focus on repeatable actions. A traders can tell the difference between an aberration, for a gambler there is no distinction.

One of the easiest mistakes any trader can make is not a ‘trading’ mistake at all. Rather, the mistake is complacency with his or her trading skills and knowledge. Unfortunately, trading is not like riding a bike – you can (and will) forget how. Obviously you’ll always know how to enter orders, but the efficiency and accuracy of your trading will diminish without constant renewal of your trading mindset.

One of the easiest mistakes any trader can make is not a ‘trading’ mistake at all. Rather, the mistake is complacency with his or her trading skills and knowledge. Unfortunately, trading is not like riding a bike – you can (and will) forget how. Obviously you’ll always know how to enter orders, but the efficiency and accuracy of your trading will diminish without constant renewal of your trading mindset.