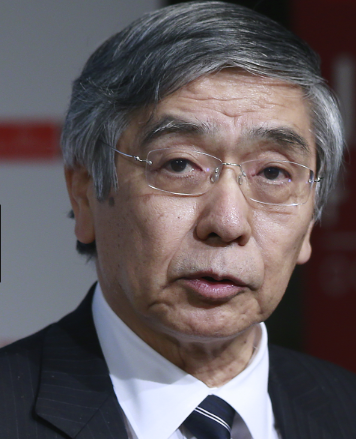

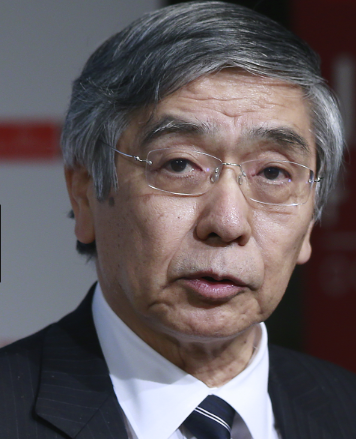

BOJ Governor Kuroda remarks on cryptocurrency now

- Japan is not in need of BOJ digital currency now

- BOJ will continue to study digital currency

- no plan to issue yen-based digital currency

Non-manufacturers index +13 in August vs +25 in July

Manufacturers November index seen at +3, non-manufacturers seen unchanged

AMSTERDAM – The latest economic data suggests that recession is returning to most advanced economies, with financial markets now reaching levels of stress unseen since the collapse of Lehman Brothers in 2008. The risks of an economic and financial crisis even worse than the previous one – now involving not just the private sector, but also near-insolvent sovereigns – are significant. So, what can be done to minimize the fallout of another economic contraction and prevent a deeper depression and financial meltdown?

AMSTERDAM – The latest economic data suggests that recession is returning to most advanced economies, with financial markets now reaching levels of stress unseen since the collapse of Lehman Brothers in 2008. The risks of an economic and financial crisis even worse than the previous one – now involving not just the private sector, but also near-insolvent sovereigns – are significant. So, what can be done to minimize the fallout of another economic contraction and prevent a deeper depression and financial meltdown?

First, we must accept that austerity measures, necessary to avoid a fiscal train wreck, have recessionary effects on output. So, if countries in the eurozone’s periphery are forced to undertake fiscal austerity, countries able to provide short-term stimulus should do so and postpone their own austerity efforts. These countries include the United States, the United Kingdom, Germany, the core of the eurozone, and Japan. Infrastructure banks that finance needed public infrastructure should be created as well.

Second, while monetary policy has limited impact when the problems are excessive debt and insolvency rather than illiquidity, credit easing, rather than just quantitative easing, can be helpful. The European Central Bank should reverse its mistaken decision to hike interest rates. More monetary and credit easing is also required for the US Federal Reserve, the Bank of Japan, the Bank of England, and the Swiss National Bank. Inflation will soon be the last problem that central banks will fear, as renewed slack in goods, labor, real estate, and commodity markets feeds disinflationary pressures. (more…)