Thought For A Day

US stocks are back to June levels while the Dax has a long way to go. Of course, in Europe they’re paying about 10x more in the forward power market.

The Wall Street Journal (gated) with this on the latest on the talks:

Oil traders are watching the negotiations. If agreement is cemented it’ll (eventually) mean more Iranian oil flowing back to global markets. Both the US and Iran would be in favour of this.

Stay tuned I guess.

Oil update:

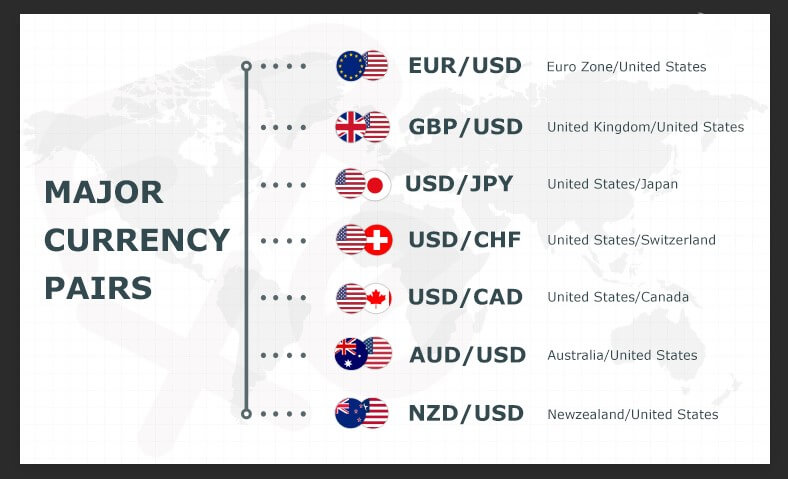

EUR traders will be keeping an eye on Italian politics ahead of the September 25 election.

Italian politics are volatile, an alliance formed late last week has been called off already:

China’s economy continued to recover from lockdowns earlier in the year through July, the best growth in exports will be welcome. Less welcome of course is the miss on imports, this will be read as a sign that domestic demand in the country continues to lag. Consumers in China are wary of the imploding property sector being crushed by heavy loads of debt, a repayment strike from homebuyers not seeing promised homes delivered by developers, and widespread contagion. Government economic support is helping cushion the blows, but not entirely.

China’s economy continued to recover from lockdowns earlier in the year through July, the best growth in exports will be welcome. Less welcome of course is the miss on imports, this will be read as a sign that domestic demand in the country continues to lag. Consumers in China are wary of the imploding property sector being crushed by heavy loads of debt, a repayment strike from homebuyers not seeing promised homes delivered by developers, and widespread contagion. Government economic support is helping cushion the blows, but not entirely.