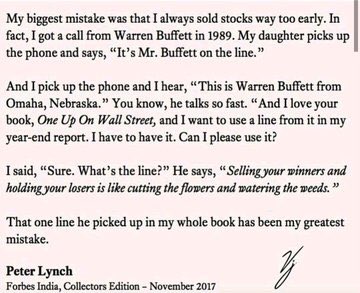

It is true that you may not become wealthy in the next couple of months or years if you just began. However, if you maintain the proper mindset and attitude, you will eventually see a piece of that success.

It is true that you may not become wealthy in the next couple of months or years if you just began. However, if you maintain the proper mindset and attitude, you will eventually see a piece of that success.

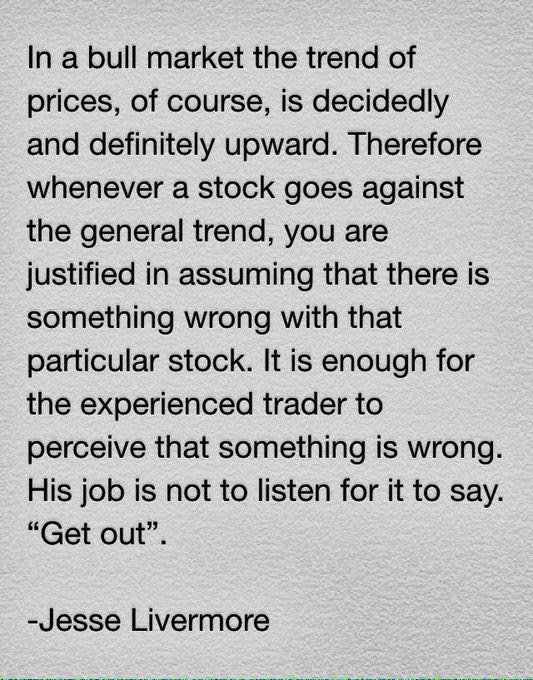

Having patience is all about trading.

It is unfortunate but true that you will not become wealthy immediately, or even in the next few years if you are just beginning. However, if you maintain the proper mindset and attitude, you will eventually see a portion of that accomplishment.