Latest Posts

rssUS stocks close mixed. S&P 3 day win streak is broken

Nasdaq modestly lower. Dow higher

It is a mixed market in the US equities today.

- The Dow close higher for the fourth consecutive day

- The S&P index snapped its three day winning streak and closes near session lows. The index got within four points of its all-time intraday high

- The Nasdaq close lower

- energy sector closes 4% higher

- Russell 2000 up three of the last four trading days

The final numbers are showing:

- S&P index fell -2.05 points or -0.05% at 4202.05

- Nasdaq index fell -12.26 points or -0.09% at 13736.48

- Dow rose 46.25 points or +0.13% at 34575.70.

- Russell 2000 index rose 25.77 points or 1.14% at 2294.74

Big winners today included some of the typical meme stocks:

- AMC, +22.47%. Shares are up 1400% since the beginning of the year. They raised $230 million of capital.

- Blackberry +14.7%

- GameStop, +11.89%

- Nio, +9.68%

- Koss, +4.33%

Other winners included:

- Schlumberger, +5.46%

- Tencent, +3.53%

- Roblox, +3.33%

- Corsair, +3.17%

- Boeing, +3.12%

- Box, +2.87%

- Goldman Sachs, +2.8%

- AirBnB, +2.73%

Looking at the Dow30, the top 5 winners are:

- Boeing, +3.12%

- Goldman Sachs, +2.8%

- Chevron, +2.75%

- American Express, +2.24%

- Bank of America, +1.25%

The top five losers are:

- J&J, -2.29%

- Amgen, -1.86%

- Procter & Gamble, -1.5%

- Nike, +1.44%

- UnitedHealth, -1.25%

Thought For A Day

UK says no one died from covid-19 yesterday

Great news in the UK

What a wonderful headline.

Medicine and vaccines are an absolute marvel. The UK is getting closer to normal every day and aside from today’s blip, GBP has reflected that.

I expect more upside in the coming years in GBP as it emerges from the clouds of covid and Brexit.

More than 128,000 people in the UK have been killed by covid but the daily average over the past seven days has fallen to just 8.

European shares in the day higher. German Dax closes at record high

France’s CAC closes at the highest level since 2000.

The German DAX is closing up about 1% and in doing so is closing at a new all-time high. The France’s CAC is also closing higher and at the highest level since August 2000. Below is a look at the daily chart of the German Dax.

A look at the provisional closes shows:

- German DAX, +1.0%

- France’s CAC, +0.7%

- UK’s FTSE 100, +0.9%

- Spain’s Ibex, +0.6%

- Italy’s FTSE MIB, +0.7%

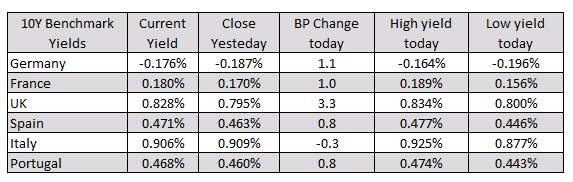

In the European debt market, the benchmark 10 year yields are closing mostly higher with the UK yield up 3.3 basis points.

In other markets as Europe/London traders look to exit for the day:

- Spot gold is trading down seven dollars or -0.37% at $1899.70.

- Spot silver is trading unchanged at $28.03

- WTI crude oil futures are up $1.49 or 2.23% at $67.81. The high price extended to $68.87. That was the highest level since October 2018.

US stocks are trading mixed with the NASDAQ lower. The Dow and S&P are higher but well off the session highs:

- S&P index up 5.24 points or 0.12% at 4209.30

- NASDAQ index -15.67 points or -0.11% at 13732.20

- Dow up 137 points or 0.4% at 34666.90

$AMC had giant options volumes this week, only second to $SPY. at one point it was up 180% on the week!

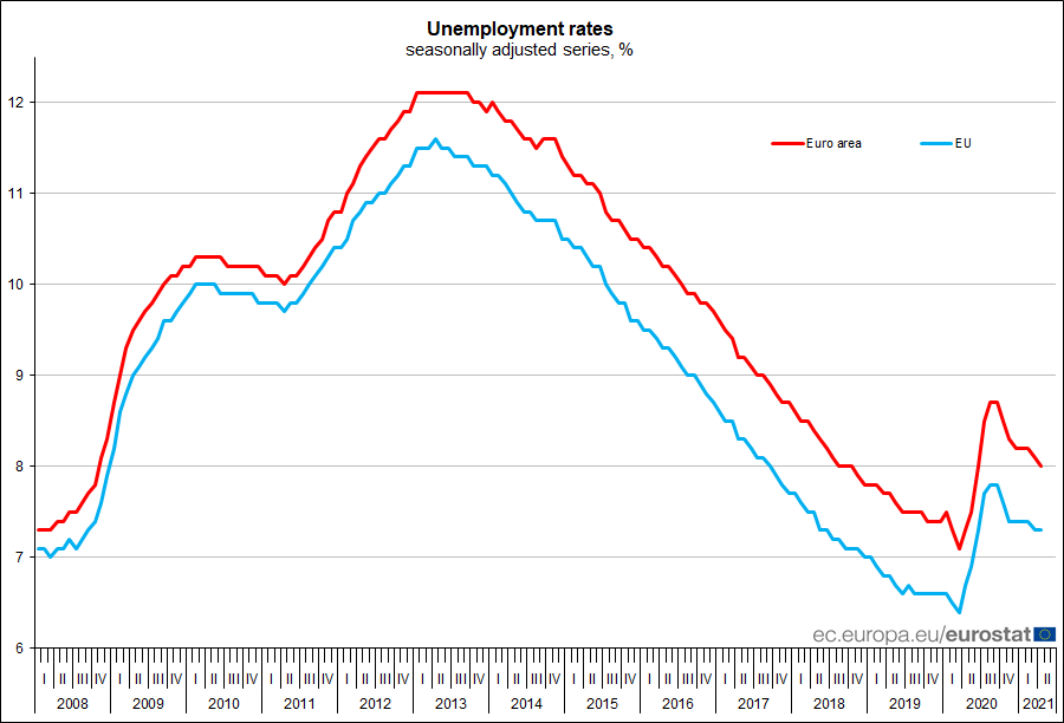

Eurozone April unemployment rate 8.0% vs 8.1% expected

Latest data released by Eurostat – 1 June 2021

- Prior 8.1%

A slight tick lower in the jobless rate but considering the furlough programs in the region, it is tough to draw much conclusions from the reading above.

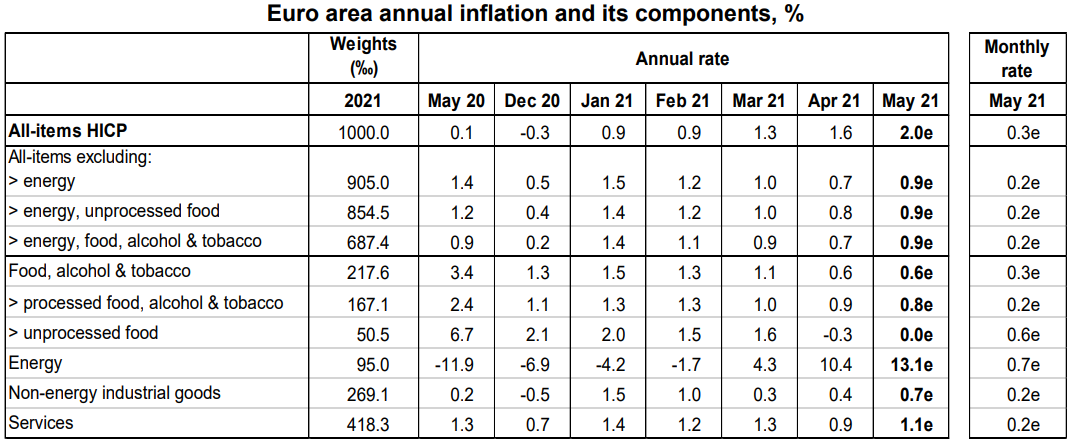

Eurozone May preliminary CPI +2.0% vs +1.9% y/y expected

Latest data released by Eurostat – 1 June 2021

- Prior +1.6%

- Core CPI +0.9% vs +0.9% y/y expected

- Prior +0.7%

The headline reading is the highest since November 2018 as it reaffirms stronger inflation pressures, which could owe to some part in base effects and also higher input cost inflation across the region/globe.

Core inflation meets estimates and is keeping just under 1%, so that might not raise too many eyebrows at the ECB just yet but watch for the trend in the months ahead.

Oil climbs to highest level since October 2018 ahead of OPEC+ meeting

WTI up by 2.8% to $68.20 currently

Oil is searching for a break to the topside as price now extends to its highest since October 2018 with buyers pushing price action above $68 at the moment.

The bullish run in oil so far this year is staying the course and there is still little to suggest the momentum from being derailed – even from a technical perspective.

It remains to be seen if buyers can keep with the break above $68 before the day ends with OPEC+ still a key risk factor to the equation.

The bloc is expected to stick with the status quo for now but there might be hints on what they may do later in the year if demand conditions continue to pick up globally.

The restart of production may temper with sentiment a little but I still don’t imagine that to totally outweigh the bullish sentiment on the reopening and the reflation narrative.

Even if gains may be reined in briefly during the short-term, there is still much to be bullish about oil in the long-term; at least for the time being.

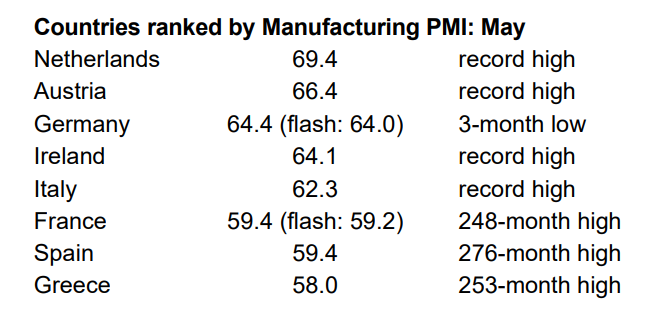

Eurozone May final manufacturing PMI 63.1 vs 62.8 prelim

Latest data released by Markit – 1 June 2021

The preliminary report can be found here. The slight revision higher fits with the revisions to the French and German readings earlier as it reaffirms the strongest reading in the survey’s history, with robust performances across the region:

Markit notes that:

“Eurozone manufacturing continues to grow at a rate unprecedented in almost 24 years of survey history, the PMI breaking new records for a third month in a row. Surging output growth adds to signs that the economy is rebounding strongly in the second quarter.

“However, May also saw record supply delays, which are constraining output growth and leaving firms unable to meet demand to a degree not previously witnessed by the survey.

“High sales volumes are consequently depleting warehouse stocks and backlogs of uncompleted work have soared at a record pace. While these forward-looking indicators bode well for production and employment gains to persist into coming months as firms seek to catch up with demand, the flip-side is higher prices. The combination of strong demand and deteriorating supply is pushing up prices to a degree unparalleled over the past 24 years.

“The survey data therefore indicate that the economy looks set for strong growth over the summer but will likely also see a sharp rise in inflation. However, we expect price pressures to moderate as the disruptive effects of the pandemic ease further in coming months and global supply chains improve. We should also see demand shift from goods to services as economies continue to reopen, taking some pressure off prices but helping to sustain a solid pace of economic recovery.”