Latest Posts

rssEurozone May final services PMI 55.2 vs 55.1 prelim

Latest data released by Eurostat – 3 June 2021

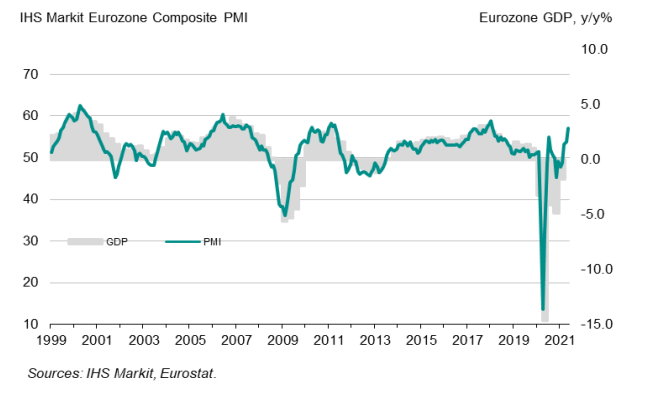

- Composite PMI 57.1 vs 56.9 prelim

The preliminary report can be found here. The composite index is the highest since February 2018 and this reaffirms a strong May month for the euro area as looser virus restrictions bolstered demand conditions and new businesses.

Employment conditions were also seen improving for a fourth month so that is encouraging but cost inflation remains a problem that is likely to persist further in the months ahead. Markit notes that:

“The eurozone’s vast service sector sprang back into life in May, commencing a solid recovery that looks likely to be sustained throughout the summer.

“Businesses reported the strongest surge in demand since the start of 2018 as covid restrictions were eased and vaccine progress boosted confidence.

“After covid fighting measures were tightened to the harshest for a year in April, restrictions eased considerably in May on average. These measures are on course to moderate further at least until the autumn, assuming further significant covid waves are avoided. This should facilitate the further return to more normal business conditions as the summer proceeds. Business optimism for the year ahead has consequently hit the highest for over 17 years.

“The service sector revival accompanies a booming manufacturing sector, meaning GDP should rise strongly in the second quarter. With a survey record build-up of work-in-hand to be followed by the further loosening of covid restrictions in the coming months, growth is likely to be even more impressive in the third quarter.

“A growing area of concern is capacity constraints, both in terms of supplier shortages and difficulties taking on new staff to meet the recent surge in demand. This is leading to a spike in price pressures, which should ease as supply conditions improve, but may remain an area of concern for so

Russia’s Novak: OPEC+ to consider all factors, make ‘balanced’ decisions

Remarks by Russian energy minister, Alexander Novak

- Some Iranian oil may be on the market this summer but not certain

Iran remains the big wildcard for OPEC+ but you can bet that Russia will be looking at any which ways to increase their market share as soon as possible, especially with prices continuing to keep higher as they are now.

US Indices give up most of the earlier gains but still close higher

Major indices little changed

The US stocks gave up most of their earlier gains but still found some buying near the close and are closing higher on the day.

- The Dow industrial average has extended its winning streak to 5 trading days.

- The Dow is 2% from its all-time high

- The S&P is up 4 of the last 5 trading days.

- The S&P is less than 1% from the all-time high

- The up one day, down the next for the Nasdaq index is on day 10.Today was an up day (tomorrow lower?).

- Energy is a best-performing sector as crude oil rallies to the highest level in 2 1/2 years.

The Meme frenzy continued today with:

- AMC shares up 95% on the day

- Bed Bath & Beyond rose 62.11%

- Blackberry rose 31.92%

- GameStop up 13.34%

The closes for the day are showing:

- S&P index rose 6.10 points or +0.15% at 4208.14

- NASDAQ index rose 19.85 points or 0.14% at 13756.33.

- Dow rose 25.07 points or 0.07% at 34600.38

- Russell 2000 rose 3.09 points or 0.13% at 2297.83

At the highs and lows for the day,

- The S&P was up 15.32 points and down -3.78 points

- The Nasdaq was up 39.41 points and down -46.74 points

- The Dow was up 131.34 points and down -29.35 points

Thought For A Day

Beige Book: Economy expanded at a somewhat faster rate

Highlights of the Fed’s anecdotal report on the economy:

- Beige book from early April to late May

- Several Districts cited the positive effects on the economy of increased vaccination rates and relaxed social distancing measures, while they also noted the adverse impacts of supply chain disruptions

- Selling prices increased moderately, while input costs rose more briskly.

- Contacts expected that labor demand will remain strong, but supply constrained, in the months ahead

- Overall, wage growth was moderate, and a growing number of firms offered signing bonuses and increased starting wages to attract and retain workers

- Overall, expectations changed little, with contacts optimistic that economic growth will remain solid.

- Full report

Here is the full commentary on prices:

On balance, overall price pressures increased further since the last report. Selling prices increased moderately, while input costs rose more briskly. Input costs have continued to increase across the board, with many contacts noting sharp increases in construction and manufacturing raw materials prices. Increases were also noted in freight, packaging, and petrochemicals prices. Contacts reported that continuing supply chain disruptions intensified cost pressures. Strengthening demand, however, allowed some businesses, particularly manufacturers, builders, and transportation companies, to pass through much of the cost increases to their customers. Looking forward, contacts anticipate facing cost increases and charging higher prices in coming months.

That’s certainly inflationary.

It’s tough to read any of this though and believe that it changes Fed thinking. They expect a flood of workers to come back and that supply bottlenecks will eventually ease. There’s some pricing pressure now but they don’t believe it will be persistent. If we’re still seeing this kind of commentary in 5 months, that will be a different story.

European shares end mostly higher. Spain’s Ibex is the exception

German DAX closes at a new record high

The European shares are ending the day mostly higher. Spain’s Ibex is the exception.

The provisional closes are showing:

- German DAX, +0.2% (a new record close)

- France’s CAC, +0.5%

- UK’s FTSE 100, +0.4%

- Spain’s Ibex, -0.2%

- Italy’s FTSE MIB, +0.2%.

In other markets as London/European traders look to exit:

- Gold is up $5.70 or 0.3% at $1906.12

- Silver is up $0.18 or 0.67% $28.08.

- WTI crude oil futures are up $0.76 or 1.12% at $68.48

- Bitcoin is up $1700 or 4.68% at $38,034

In the US stock market, the major indices are higher. The Dow is working on its fifth straight day to the upside. The S&P is up for the last five trading days. The Nasdaq is trading near its highs for the day:

- S&P index +14.2 to points or 0.34% at 4216.33

- NASDAQ index up 37.11 points or 0.28% at 13773.50

- Dow up 93 points or 0.27% at 34668

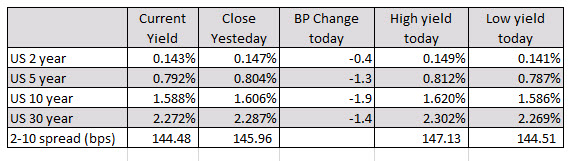

In the US treasury market, yields are lower with the tenure yield down around 1.9 basis points.

The current situation is atypical.

Some predictions on the future of computing from 1999: (8 years before the iPhone release)

Economic data coming up in the European session

Major currencies are keeping steadier after a bit of a middling day yesterday where the dollar stormed back following early weakness, with equities also paring their early advance with US stocks ending up near little changed on the day.

The market seems to still be struggling for direction in general and will have to wait further on more clues with regards to the inflation debate.

That sets up a lot more expectations or at least some anticipation that Friday’s US job numbers will at least provide some catalyst for a short-term move at least.

Oil remains a standout performer as it knocks on the door of a push above $68 after having traded to its highest levels since 2018 yesterday. For now, the $68 is still limiting gains but is one to watch through the remainder of the week.

0600 GMT – Germany April retail sales data

Prior release can be found here. After the bump in March, retail sales activity is expected to moderate in April. Base effects will ensure a strong year-on-year reading but with tighter restrictions still in place during April, consumption had been affected though at least the outlook towards 2H 2021 remains optimistic.

0830 GMT – UK April mortgage approvals, credit data

Prior release can be found here. Mortgage activity is expected to keep robust amid the strong UK housing market while credit conditions are still estimated to be more subdued and will take some time before turning around.