Latest Posts

rssOil sits lower on the day after first test of $70 falls short

WTI down by 0.9% to $68.60 currently

The $70 level is a key psychological resistance and that is keeping a lid on the latest bullish in oil over the past two to three weeks.

Price is backing away from the figure level to $68.60 currently but it surely will not be the last time oil runs up against said resistance level over the next few months.

The upside run looks to be running into some profit-taking but in the big picture, it is tough to handicap oil market sentiment at the moment.

The Iran issue is still a wildcard but with OPEC+ playing their cards right and the virus situation improving globally across major economies, the outlook is still solid.

There are a lot of punters pinning oil for a move to $100 in the year ahead and given how things are shaping up at the moment, it isn’t too far-fetched to be honest.

Sure, there will be risk factors evolving along the way but as things stand, the fundamentals are still working in favour of oil bulls at the moment and there’s no reason to turn the other cheek just yet.

Watch out for a test of $68 as that might attract some dip buyers before the next swing region closer to the $67 level.

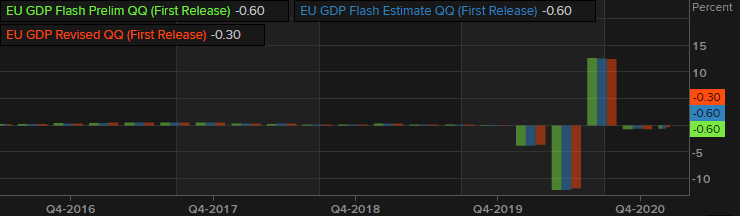

Eurozone Q1 final GDP -0.3% vs -0.6% q/q second estimate

Latest data released by Eurostat – 8 June 2021

- Q1 GDP -1.3% vs -1.8% y/y second estimate

The second estimate report can be found here. That is a modest upside revision as the euro area economy show much more resilience than anticipated in Q1. The outlook for the summer looks optimistic and we’ll see how that shapes up in the weeks ahead.

Eurostoxx futures -0.1% in early European trading

Tepid tones observed in early trades

- German DAX futures -0.1%

- UK FTSE futures flat

US futures are also not showing much poise on the day with S&P 500 futures flat and Dow futures down 0.1%. Nasdaq futures are up slightly by 0.1%.

In Asia, The Nikkei closes down 0.2% while the Topix climbed 0.1% with Chinese equities a little more subdued as the Hang Seng is down 0.3% and Shanghai Composite down 0.7% going into the closing stages of the day.

Overall, risk sentiment is not suggestive of any major tilt for now as tech saw some inflow overnight with bond yields keeping on the lower side after Friday’s payrolls.

China state media advise Australia to diversify its iron ore exports away from China

Those lovable buffoons at the Global Times with a tweet this time:

There is a kernel of truth in this forecast, and there are developments underway in China that’ll likely mean reduced reliance on Australian iron ore even prior to 2030, perhaps from as soon as 2025. China is scouring the world for other sources, and there are proposed changes to Dalian iron ore futures deliverable grades, from 62% (minimum 60%) to 61% (allowable range down to 56%) (Westpac the source for those numbers). This opens up delvieries from countries such as South Africa.

“Peak production” panic surrounding copper (and other commodities) is “overblown”

A piece from the Peterson Institute on rising prices and rising concerns of running out of critical resources.

The article argues that:

- Peak arguments resurface over and over because they both seem intuitively plausible and play on humanity’s fundamental fear of scarcity.

- But they are almost always wrong.

Its an interesting piece, worth a read. I guess the critical bit is that “almost” word 😀

This is the change in household debt globally last year. It takes a keen, hawklike eye to spot it, but see if you can find China on this graph.

Nicolas Darvas on the only reason you need to buy a stock.

Japan GDP final for Q1 2021 -1.0% q/q (prior +2.8%)

Finals:

- GDP sa -1.0% q/q – if you check out the prelim numbers you’ll see this revised figure is not as bad.

- GDP annualised sa -3.9% q/q

- GDP nominal -1.3% q/q

- GDP deflator (an inflation indication) % y/y

- Private consumption -1.5% q/q

- Business spending -1.2% q/q

Some background if you find useful:

- state of emergency curbs to combat the coronavirus pandemic are sapping GDP growth, weighing on consumption.

- Export growth is robust, which is a positive

- rising energy and commodities prices could worsen terms of trade (Japan is heavily reliant on raw material imports)

US report says theory that COVID-19 virus leaked from a Chinese lab in Wuhan is plausible

The Wall Street Journal cite a report from May 2020 by the Lawrence Livermore National Laboratory.

- People familiar with the study said that it was prepared by Lawrence Livermore’s “Z Division,” which is its intelligence arm. Lawrence Livermore has considerable expertise on biological issues. Its assessment drew on genomic analysis of the SARS-COV-2 virus, which causes Covid-19, they said.

The actual report remains secret. Which, of course, makes it impossible to assess.

Here is the link to the Journal piece, sure to be a source of contention given the politicisation of the origin question. Journal, of course, may be gated.