Latest Posts

rssThe decline of the dollar.

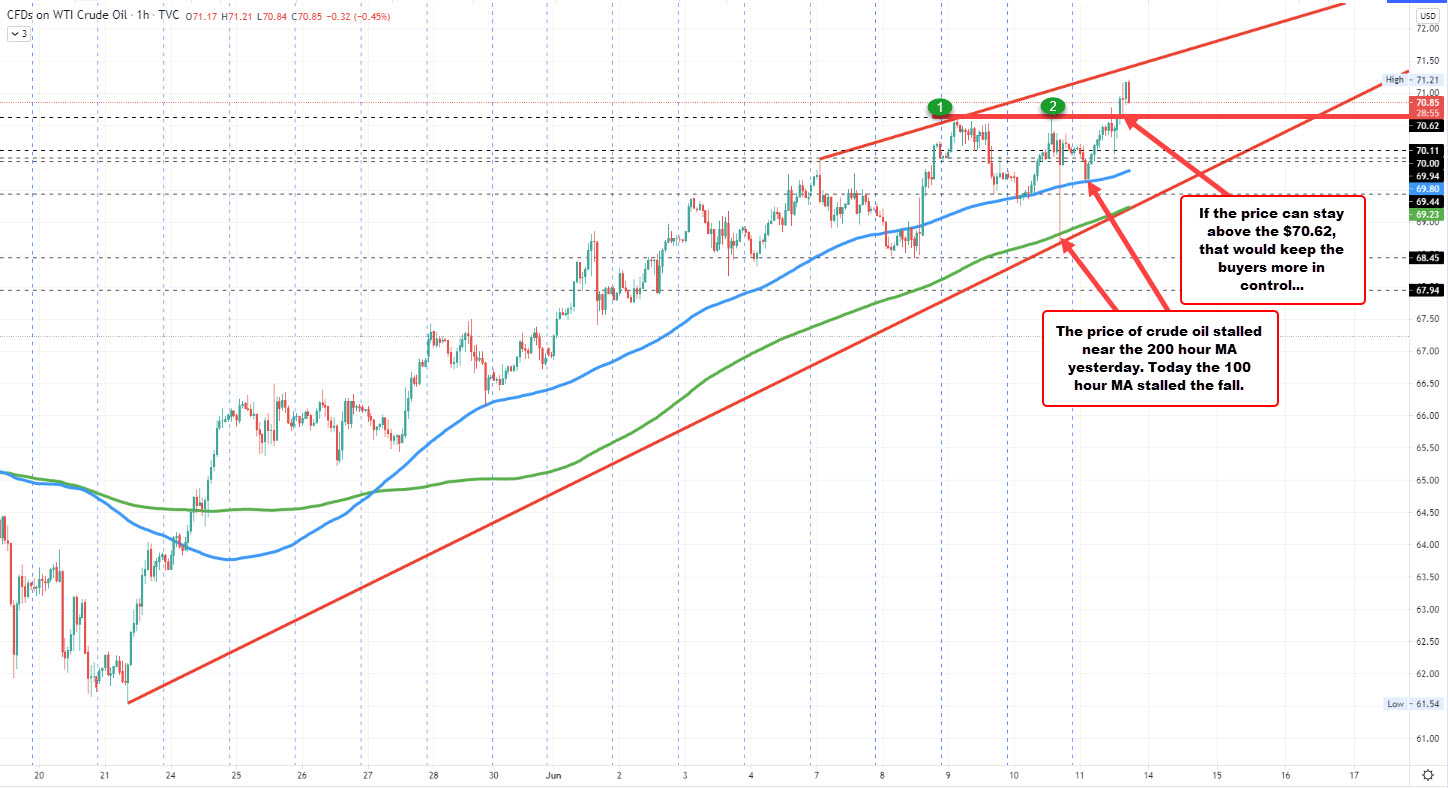

Crude oil comes off highest level since October 2018

high price reached $71.24

The price of crude oil futures extended to a cycle high of $71.24. That is the highest level since October 2018. The current price trades around $71.

The price of crude oil is up for the 3rd week in a row. The price closed around $69.40. This week, the price traded above the $70 level, but also saw moves above and below that key barometer during the week. So there has been some apprehension/anxiety.

That anxiety was shown yesterday,when the price fell sharply after reports that the US was easing sanctions on an Iran individuals. The US state department later said that the action was not reflective of overall easing of Iran sanctions but a normal review of past sanctions. As a result, the price moved back higher.

From a technical perspective, the fall yesterday stalled near the 200 hour MA (green line on the hourly chart above). Not crashing below was a bullish clue. Today, the corrective low stalled at the 100 hour MA (blue line) before moving higher, also a bullish clue.

Ultimately, it would take a move below the rising 100 hour MA at $69.80 and the 200 hour MA at $69.23 to hurt the bullish bias. Until then, the upside might have some anxious moments, but the buyers would remain in control.

European indices end the session higher. Higher on the week as well.

European indices show gains for the week.

The major European indices are ending the session higher.

The provisional closes are showing:

- German Dax, +0.8%

- France’s CAC, +0.8%

- UKs FTSE 100, +0.7%

- Spain’s Ibex, +0.8%

- Italy’s FTSE MIB +0.4%

For the week, the major indices are also higher (German Dax is unchanged)

- German Dax, Unchanged

- France’s CAC, +1.33%

- UK’s FTSE 100, +0.9%

- Spain’s Ibex, +1.2%

- Italy’s FTSE MIB, +0.6%

A look at the markets as London/European traders look to exit shows:

- Spot gold down $17.75 or -0.93% at $1880.80.

- Spot silver is up five cents or 0.18% at $28.02.

- WTI crude oil is up $0.54 or +0.77% at $70.84

- Bitcoin is up $326 at $36800

IEA says global oil demand to surpass pre-pandemic levels by end of next year

IEA remarks in its latest oil market report

- Total oil supply from OPEC+ set to increase by 800k bpd based on existing policy

- OPEC+ needs to open the taps to keep oil market adequately supplied

- Oil demand should surpass pre-pandemic levels by end of next year

This just reaffirms the more bullish sentiment towards the oil market in general at the moment, as the pandemic is gradually being put in the rearview mirror. Though IEA does point out that the rise in oil demand also underscores the enormous amount of effort needed for the world to achieve climate goals.

$spx real earnings

PBOC sets USD/ CNY mid-point today at 6.3856 (vs. yesterday at 6.3972)

The People’s Bank of China set the onshore yuan (CNY) reference rate for the trading session ahead.

- USD/CNY is permitted to trade plus or minus 2% from this daily reference rate.

- CNH is the offshore yuan. USD/CNH has no restrictions on its trading range.

- The previous close was 6.3928

- Reuters estimate from their survey was 6.3860, Bloomberg 6.3847 …. (A rate that’s significantly stronger or weaker than expected is typically considered a signal from the PBOC).

PBOC injects 10 billion yuan liquidity via 7-day reverse repo

- 10bn mature today

- thus a net neutral day

US stocks close higher led by the NASDAQ index. S&P record close

Russell 2000 index does close lower

The major market indices are closing higher with the S&P posting a record close. The gains were led by the NASDAQ stocks. The Dow lagged but still closed positive on the day.

The final numbers are showing:

- S&P index up 19.63 points or 0.47% at 4239.18

- NASDAQ index up 108.58 points or 0.78% at 14020.33

- Dow rose 19.10 points or 0.06% at 34466.24.

The Russell 2000 index of the small-cap stocks did not fare as well. In fact it declined on the day. It is showing a decline of -15.72 points or -0.68% at 2311.40.

Thought For A Day