German Dax lags (unchanged on the day)

The major European indices are closing the day with gains. The exception is the German DAX which is closing near unchanged levels. The provisional closes are showing:

- German DAX, unchanged

- France’s CAC, +0.3%

- UKs FTSE 100, +0.3%

- Spain’s Ibex, +0.9%

- Italy’s FTSE MIB, +0.2%.

In other markets as European traders look to exit:

- Spot gold is down $-13.82 or -0.73% at $1864

- spot silver is up one cent or 0.04% at $27.92.

- WTI crude oil futures are up $0.46 or 0.65% at $71.36. That is off the intraday high of $71.78, but above the low at $70.65.

- Bitcoin remains above the $40,000 level at $40,713.35

In the US stock market, the Dow industrial average is moving lower. The latest casualty is J.P. Morgan which is now down -2% after comments from CEO Jamie Dimon.

- Dow -220 points or -0.63% at 34261.54

- S&P -11 points or -0.26% at 4236.31

- NASDAQ +33 points or 0.24% at 14102.43

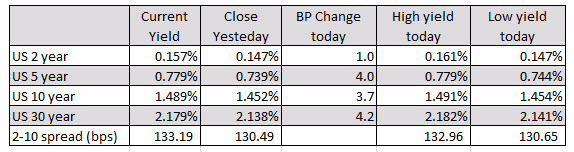

In the US debt market, yields are higher with the 10 year up 3.88 basis points and

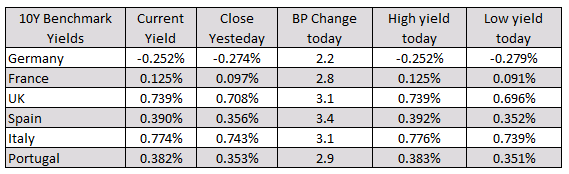

The benchmark 10 year yields in Europe are also higher with Spain 10 year up 3.4 basis points leading the way:

IN the forex, the NZD remains the strongest and the JPY is the weakest. The USD is mixed with gains vs the JPY and CHF, and declines vs the EUR, CAD, NZD and AUD. The USD is near unchanged verse the GBP.