Ifo releases its latest forecasts for the German economy

- 2021 GDP growth cut from 3.7% to 3.3%

- 2022 GDP growth lifted from 3.2% to 4.3%

- 2021 inflation to jump to 2.6%

- 2022 inflation seen easing to 1.9%

The bottom line is that no change is expected tonight in terms of interest rates or bond tapering. However, the interesting part of tonight will be on the economic and inflation forecasts along with the interest rate projections. Here is what a survey of51 economists expect who were surveyed between June 04-June 10.

Bloomberg Economists

Labour targets?

The Economists surveyed expect the Fed to be generally upbeat about the robust economic rebound this year. However, bond tapering is expected when unemployment is around 5% and inflation is at 3% as measured by the personal consumption expenditure price index. The April core PCE deflator reading came in at 3.1% y/y, the highest since 1992, but unemployment is still too high. There have been two main reasons that labour supply is weak. Firstly,

Risk of overheating

Higher inflation numbers have shifted the risks to the economic outlook with 65% of those surveyed seeing a risk of the US economy overheating due to an accelerating US vaccination program and fiscal stimulus set to rise with Joe Biden’s infrastructure and jobs plan.

The takeaway

The USD is trying to bottom and the Fed should signal a slightly better picture. The obvious USD buy trade would be if bond tapering is announced or a timescale hinted at. A shift in the dot plot will also likely help lift the USD too. Risk looks asymmetric for USD strength and the USDCAD pair looks due for some retracement. Let’s see what we get. If the Fed remain dovish then more USDZAR looks compelling.

+6.5% y/y

Used as a capex indicator for Japan in the 6 – 9 months ahead

Trade balance adjusted +43.1bn yen

Exports 0.0% m/m and +49.6% y/y

Imports +0.7% m/m and +27.9% y/y

Industrial Production y/y

Industrial Production YTD y/y

Fixed Assets (excluding rural) YTD y/y

Retail Sales y/y,

Retail Sales YTD y/y

A look at the final numbers shows:

The major European indices are ending the session with mixed results. Spain and Italy tilt more to the downside.

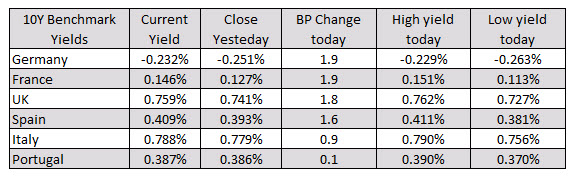

In other markets as European/London traders look to exit:

In other markets as European/London traders look to exit: