Latest Posts

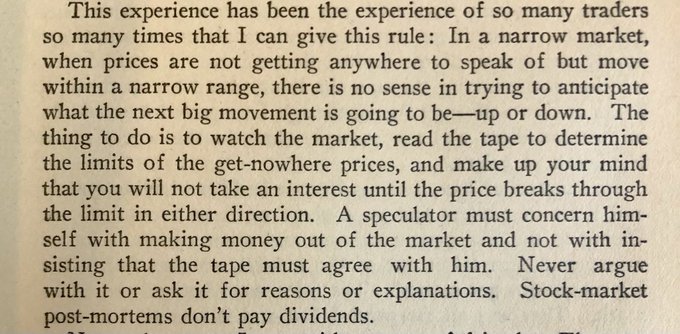

rssConfirmation vs anticipation. From ‘Reminiscences of a Stock Operator’

Every trader makes mistakes – and many of them. Just make sure it’s not a Million Dollar Blunder. From ‘How To Trade In Stocks’ – Livermore

Just a reminder from O’Neil’s book HTMMIS.

SZSE CHINEXT PRICE INDEX extends gains to 2%, led by the Semiconductors sector.

The rule of 72.

The rationality of the market.

US Indices close lower on FOMC decision but off the lows

Fed ups inflation expectations and said thinking about thinking about tapering

The US stocks are closing lower on FOMC decision, but well off the lows. The Fed up there expectations for inflation in 2021, but still see inflation rates moving back toward just over 2% in 2022. The US 10 yield is up about eight basis points to 1.579%. That is still off the high yield for the year 1.774%.

- Dow posts a three-day losing streak

- S&P NASDAQ low close lower for the second straight day

- Dow S&P have worst day in a four weeks

The final numbers are showing:

- S&P index is down -22.85 points or -0.54% at 4223.74. The low reached for 4202.45, down -1.05%

- NASDAQ index closed down -33.18 points or -0.24% at 14039.68. The low reached 13903.73, down -1.33%

- Dow fell -265.66 points or -0.77% at 34033.67. The low reached 33917.11, down 111% at the lows.

- Russell 2000 fell -5.38 points or -0.23% at 2314.69. The low price reached 2296.21.

Brazil’s central bank hikes rates by 75bp, indicates it may do so again next meeting

Banco Central do Brasil hikes its benchmark interest rate to 4.25%, as polls expected.

Headlines via Reuters:

- sees continued normalization of policy at next meeting

- sees another policy adjustment of the same magnitude at the next meeting

- deteriorating inflation expectations may require a more forceful reduction of monetary stimulus

- base-case scenario is for normalisation of policy towards neutral rate

- a rate hike at next meeting depends on the evolution of economic activity, the balance of risks, inflation expectations

- future monetary policy steps may be adjusted to ensure compliance with inflation goals

- accompanying current inflation shocks and their potential secondary effects

- adjustment towards neutral rate necessary to “mitigate the dissemination of the temporary shocks to inflation”

- decision was unanimous

- persistence of inflationary pressure more intense than expected

- outlook for electricity rates keeping inflation under pressure in the short run

Thought For A Day