Latest Posts

rssJapan – Jibun Bank/Markit Manufacturing PMI (final) for June: 52.4 (prior 53.0)

From the report:

- softer expansions in both production and new orders

- the headline Manufacturing PMI was at its lowest reading since February

- “Manufacturers continued to note concern regarding ongoing supply chain disruption, which has induced sharp rises in the price of raw materials amid severe shortages. Cost burdens faced by businesses rose at the sharpest pace since March 2011, which has partially translated to higher charges for clients to cover margins.

- “That said, Japanese manufacturers commented that the degree of optimism regarding the outlook for output over the coming 12 months strengthened in June. Confidence about the outlook reached the highest level since the series began in July 2012, as hopes of an end to the pandemic gathered pace. This is broadly in line with the IHS Markit forecast for industrial production to grow 8.8% in 2021, though this does not fully recoup losses from the pandemic.”

USD/JPY continues to trade in a very small range. It has traded above 111.16 to its highest since March of 2020.

—

South Korea manufacturing PMI 53.9 from 53.7 previously. Out at the same time.

BOJ Tankan Q2: Large Manufacturers Index 14 (vs. expected 15)

The Bank of Japan Tankan survey for March – June 2021

Large Manufacturers Index 14

- expected 15

- previous 5

Large Non-Manufacturing Index 1

- expected 3

- previous -1

- the September outlook is 3

Large All Industry Capex 9.6%

- expected 7.2%

- prior 3%

Large Manufacturing Outlook 13 for September

- expected 18

- prior 4

USD/JPY has ticked a little higher in early Asia trade but the response to the release of the BOJ’s Tankan is barely discernible.

US Indices end the session mixed

S&P closes at a record high

The US stocks are ending the session mixed with the Nasdaq down, and the Dow and S&P higher. The S&P closed at a record high.

Today is month end, quarter end and the end of the 1st half of the year. The numbers for each are showing:

- S&P is higher for the fifth straight month. the S&P rose 2.3% for the month. It rose 8.17% for the quarter. For the year the index is up 14.3%

- Dow Jones closed near unchanged for the month. The index rose 4.6% for the quarter and is up 12.7% for the year

- Nasdaq closed the month up 5.49%. It is up 9.49% for the quarter. For the year the index is up 12.54%.

For today, the NASDAQ lagged, while the Dow led

- Dow rose 210.2 to points or 0.61% at 34502.52.

- S&P index rose 5.7 points or 0.13% of 4297.50

- NASDAQ index fell 24.38 points or -0.17% at 14503.95

- Russell 2000 rose 1.7 points or 0.07% at 2310.55

Thought For A Day

European shares end the session lower.

German DAX -0.9%.

The major European indices arre ending the session lower on the day. The provisional closes are showing:

- German DAX, -0.9%

- France’s CAC, -0.8%

- UK’s FTSE 100, -0.5%

- Spain’s Ibex, -0.95%

- Italy’s FTSE MIB, -1.0%

For the month:

- German DAX, +0.7%

- France’s CAC, +0.95%

- UK’s FTSE 100, +0.2%

- Spain’s Ibex, -3.58%

- Italy’s FTSE MIB-0.3%

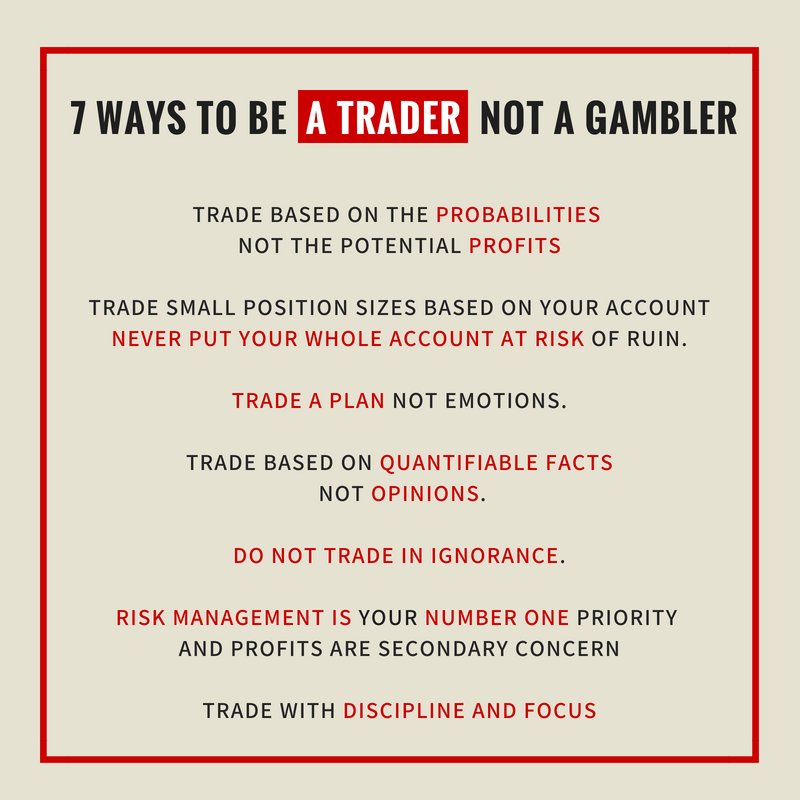

Thirsty TRADERS must Read….

US dollar legs higher into the London fix

Fresh dollar buying into the fix

It’s the final day of the month, quarter and half-year and dollars are in demand. I think this will prove to be a selling opportunity once the dust settles.

The demand for dollars this week has been relentless.

EURUSD, USDJPY, and USDCHF trade to new extremes for the day

USD moves higher vs those pairs

The USD has moved to new session highs vs the EUR, JPY and CHF.

EURUSD: The EURUSD finally showed some additional downside momentum and has increased the day’s trading range in the process, the range is up to a more respectable 53 pips (was only 26 pips at the start of the NY session). The average over the last 22 trading days (about a month of trading), is 65 pips. The low has reached 1.18552 so far. The swing lows from June 18 to June 21 come between 1.18452 to 1.18507.

USDJPY: The USDJPY is up testing the topside trend line on the hourly chart. The high for the week at 110.978 would be the next target on a break to the upside. Earlier the price moved above the 200 and then 100 hour MAs (green and blue lines) as buyers retook control from a bearish tilt earlier in the day (below the MAs). (more…)

US weekly oil inventories -6718K vs -4686K

Weekly oil inventory data

- Prior was -7614K

- Gasoline +1522K vs -886K

- Distillates -869K vs +486K

- Refinery utilization +0.7% vs +0.5% exp

API data from late yesterday:

- Crude -8153K

- Gasoline +2418K

- Distillates +428K

- Cushing -1318K

WTI was trading at $73.73 just before the report and is slightly lower afterwards. The headline is a bit lighter than API data but the gasoline and distillates numbers are more bullish. There are no big surprises here and the market will get right back to focusing on tomorrow’s OPEC+ meeting.