Latest Posts

rssYou don’t get setups like this very often

Here is what’s on the economic calendar in Asia today – China trade data

2245 GMT New Zealand Food Price (inflation) for June

- expected +0.1% m/m prior +0.4%

2301 GMT UK BRC Sales like-for-like for June

- expected +24.0% y/y, prior +18.5%

- like-for-like sales data strips out the impact of changes in store size.

0130 GMT Australia NAB business confidence and business conditions for June

- priors 20 and respectively 37

- National Australia Bank Business survey

China’s trade balance data, there is no firmly set time for this, some time after 0200GMT is usually the safe bet.

China trade balance: expected CNY 271bn, prior was CNY 296bn

- Exports y/y: expected 29.6%, prior was 18.1%

- Imports y/y: expected 32.3%, prior was 39.5%

USD terms

- China trade balance: expected $44.2bn, prior was $45.53bn

- Exports: expected 23.1%, prior 27.9%

- Imports: expected 30.0%, prior was 51.1%

Another day, another record for US equities

US stocks close near the highs

- S&P 500 up 15 points to 4384 (+0.3%)

- Nasdaq +0.1%

- DJIA +0.4%

- TSX -0.1%

It wasn’t the most-thrilling day or most-volatile day but a steady bid emerged for US stocks after a soft open. The dip buyers don’t need much prompting after passing last week’s test.

Thought For A Day

Trading appears easy & effortless on paper. But it’s far from it. There’s a reason why mastery takes time. What seems effortless now has been years of pain, tears, hardwork, setbacks & persistence.

same concept with the plateau of latent potential, your hardwork being stored.

US sells 10-year notes at 1.371% vs 1.374% WI

Results of the $38B 10-year reopening

- Prior was 1.497%

- Stop through of 0.3 bps

That might bit a bit of downward pressure on Treasury yields. The appetite for bonds is remarkable. We’ve seen a bit of follow through in the cash market with 10s down to 1.3695%.

OPEC+ yet to make progress in closing divisions – report

Reuters report

An OPEC+ policy meeting this week is less likely after the group failed to make progress on closing divisions with the UAE.

Russia is attempting to broker a deal between Saudis and the UAE, according to Reuters sources but a meeting this week was not expected.

WTI crude is down 97-cents to $73.59 today, giving back most of Friday’s gain.

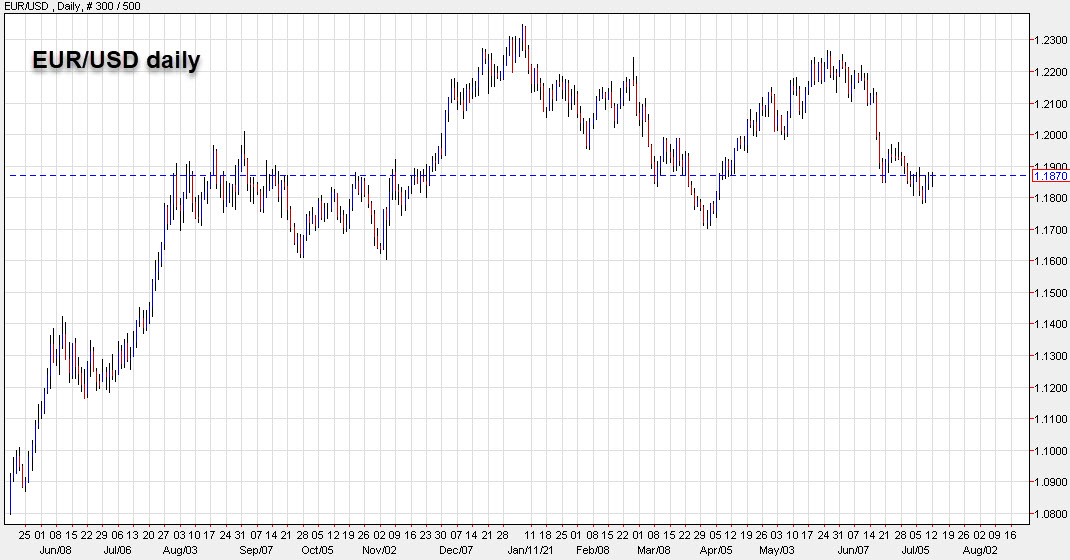

June FOMC meeting marked a turning point for USD – CIBC

CIBC sees more dollar strength

CIBC is out with its latest dollar forecasts and sees the dollar broadly higher in the next six months, with gains against EUR, JPY and CAD.

“The June FOMC meeting marked a turning point for the USD. Prior to the meeting, positioning and sentiment on the greenback was largely bearish,” analysts at CIBC write. “Going forward, we now envisage a higher floor for the USD against other currencies. The Fed’s pivot marks a transition away from the old reflation narrative towards a new one whereby real yields underperform relative to nominals. That should continue to push USD shorts to exit given the relatively higher yields in the US to other developed markets.”

In Q4, they see EUR/USD falling to 1.15, USD/CAD rising to 1.27 and USD/JPY climbing to 112.

Exceptions are in the antipodeans and sterling, which they see as moderately stronger against the dollar. They’re particularly constructive on NZD/USD, seeing it climb to 0.7200 in the near term and 0.7600 at the end of 2022.

“Support for NZD/USD is now apparent in the mid-0.6900 range, and should the RBNZ validate the hawkishness of market pricing at their meeting on July 14th, we expect to see NZD/USD regaining ground, potentially toward 0.7200,” they write.