Latest Posts

rssDo the right thing.

Failures become lessons if you learn.

Major earnings releases next week include Alphabet, Facebook, Apple, AMD, Microsoft, Amazon

… Tesla, Boeing, Starbucks, Ford, McDonald’s, PayPal, MasterCard, etc

Next week is a huge week for earnings and the major indices are near or making new highs into the week. Anyone and everyone (besides financials and Netflix) are on the schedule for release.

Tuesday and Wednesday will be the biggest days, but Amazon will be released on Thursday highlighting that day’s schedule.

Below are a sampling of some of the major earnings on the calendar

Monday, July 26:

- Checkpoint software

- Tesla

Tuesday, July 27

- 3M

- Alphabet

- Apple

- AMD

- GE

- Stryker

- Raytheon technologies

- Starbucks

- Microsoft

- Corning

- Xerox

Wednesday, July 28

- O’Reilly automotive

- Bristol-Myers Squibb

- Boeing

- Ford motor

- McDonald’s

- Lam research

- General Dynamics

- Hess corporation

- PayPal

- Qualcomm

- Shake shack

- Pfizer

- ServiceNow

- Xilinx

- Shopify

- Spotify

Thursday, July 29

- Amazon

- Altria

- Merck

- US Steel

- First Solar

- Gilead Sciences

- MasterCard

- Hilton

- Martin Marietta

- T-Mobile

- Twillio

Friday, July 30

- Procter & Gamble

- Exxon Mobil

- Caterpillar

- Colgate-Palmolive

- Weyerhaeuser

- Chevron

CFTC US dollar positioning switches to net long

Net dollar value is long for the first time since the pandemic began

The chart isn’t yet updated but the net dollar value of USD longs is now +$399.69m. That’s the first net-long USD position on aggregate since the pandemic began.

Primarily USD/JPY longs with some AUD/USD longs account for the overall net positioning.

Major indices all close at record levels

Big earnings week next week

The major indices are closing at record levels.

- Dow 238.34 points or 0.68% at 35,061.69. The previous record close was at 34987

- S&P rose 44.33 points or 1.02% at 4411.81. The previous record close was at 4384.64

- Nasdaq rose 152.39 points or 1.04% at 14,836.99. The previous record close was at 14733

- Russell index rose 10.17 points or 0.46% at 2209.65

Other highlights for today:

- The energy sector is the only sector lower today. Energy and utilities were lower this week

- Facebook closes above $1 trillion market capitalization for the first time ever

- Major indices rose for the fourth consecutive day

- Dow closes above 35,000 for the first time ever

Next week is a huge week for earnings.

Companies expecting to announce include:

- Amazon

- Apple

- Alphabet

- Microsoft

- Starbucks

- Tesla

- AMD

- McDonald’s,

- PayPal

- MasterCard

- Etc.

For the week, month and year to date:

- Dow rose 1.09% for the week. For the month the Dow is up 2.54%. Year-to-date 14.57%

- NASDAQ rose 2.83% for the week. For the month the NASDAQ is up 3.24%. Year-to-date 15.11%

- S&P rose 1.96% for the week. For the month the S&P is up 3.41%. Year-to-date 17.47%

Thought For A Day

JOHN KENNETH GALBRAITH ON STOCK MARKET MEMORY LOSS

Where else but in the markets can short term memory loss be both beneficial and profitable?

John Kenneth Galbraith, an economist, says the financial markets are characterized by…

“…extreme brevity of the financial memory. In consequence, financial disaster is quickly forgotten. In further consequence, when the same or closely similar circumstances occur again, SOMETIMES IN A FEW YEARS, they are hailed by a new, often youthful, and always extremely self-confident generation as a brilliantly innovative discovery in the financial and larger economic world. There can be few fields of human endeavor in which history counts for so little as in the world of finance.” [emphasis mine].

Major European shares end the session higher.

Indices rebound from Monday’s plunge

The major European indices are ending the session higher. With the exception of the FTSE 100, the indices have risen for 4 consecutive days and all erased Monday’s sharp declines.

The provisional closes are showing:

- German DAX, +0.99%

- France’s CAC, +1.41%

- UK’s FTSE 100, +0.93%

- Spain’s Ibex, +1.1%

- Italy’s FTSE MIB, +1.23%

EUrope’s STOXX 600 index increased 1.14% to an all-time high of 461.75.

In other markets as European traders look to exit for the week:

- Gold continues to trade above and below the $1800 level. It is currently trading at $1800.85 that’s down $-4.55 -0.25%.

- Silver is trading down $0.14 -0.55% $25.24

- WTI crude oil futures are trading marginally lower at $71.83. It’s high price reached $72.11 while the low extended to $71.42

- Bitcoin is trading up about $170 or 0.53% $32,400. The high price reached $32,915. The low extended to $32,056

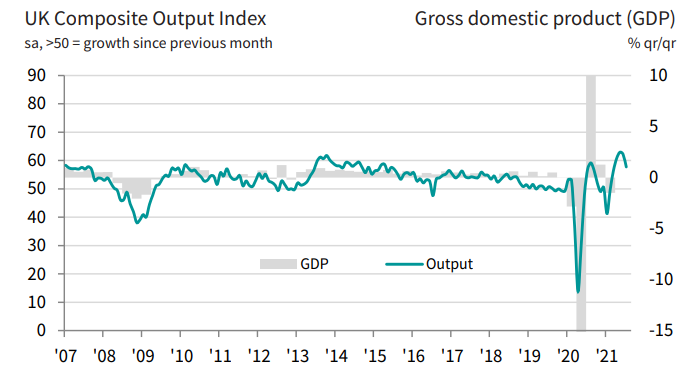

UK July flash services PMI 57.8 vs 62.0 expected

Latest data released by Markit/CIPS – 23 July 2021

- Prior 62.4

- Manufacturing PMI 60.4 vs 62.5 expected

- Prior 63.9

- Composite PMI 57.7

- Prior 62.2

UK business activity miss on expectations and decline quite considerably from June as firms widely report that staff and raw materials shortages dampened conditions, hindering the recovery pace after the reopening in April.

This is certainly a spot to watch now for the UK and will likely dampen any hopes of a more hawkish tilt by the BOE as we look towards the August meeting.

Markit notes that:

“July saw the UK economy’s recent growth spurt stifled by the rising wave of virus infections, which subdued customer demand, disrupted supply chains and caused widespread staff shortages, and also cast a darkening shadow over the outlook.

“Although business activity continued to grow, aided by the easing of lockdown restrictions to the lowest since the pandemic began, the rate of expansion slowed sharply to the weakest since March.

“Transport, hospitality and other consumer-facing services companies were the hardest hit, though manufacturing also saw growth weaken markedly during the month.

“Although the July flash survey only covered three days of the full easing of covid restrictions, any imminent re-acceleration of growth in August looks unlikely due to a steep slowing in overall new order growth recorded during July.

“Concerns over the Delta variant have meanwhile overshadowed the passing of “freedom day”, and were a key factor alongside Brexit and rising costs behind a sharp slide in business expectations for the year ahead, which slumped to the lowest since last October.

“The PMI indicates that GDP growth will likely have slowed in the third quarter, after having rebounded sharply in the second quarter.

“Firms’ costs rose at a rate unprecedented in over 20 years of survey history as supply shortages pushed up the price of goods, suppliers of services hiked prices and employee pay continued to rise.”