Latest Posts

rssMajor indices snap 5 day winning streak

No record closes for major indices

The major US indices have snapped their five day winning streak ahead of the key earnings including Alphabet, Apple, Microsoft, AMD, Starbucks.

- Microsoft is trading down $3.11 at $285.94

- Apple is trading down $2.42 at $146.57

- Google is trading down $-48.99 at $2631.71

- AMD is trading down $-0.92 at $90.89

- Starbucks is trading down eight cents at $125.98.

highlights today

- NASDAQ on pace for worst the day since May 12

- Dow was down -266 points at the session low

- NASDAQ was down 337 point at the session low

- S&P was down -50 point at its session lows

- utilities/real estate the biggest gainers

- tech consumer discretionary the biggest laggards

- new highs 54 new lows 239

The final numbers are showing:

- S&P index -20.6 points or -0.47% at 4401.70

- NASDAQ index -180.14 points or -1.21% at 14,660.58

- Dow felt -84.67 points or -0.24% at 35,059.64

- Russell 2000-25.09 points or -1.13% at 2191.83

Thought For A Day

WSJ. China appears to be building new silos for nuclear missiles

“Researches” are saying

The Wall Street Journal is reporting that China appears to be building new silos for nuclear missiles. The discovery comes from commercial satellite imagery. The satellite imagery follows another US at think tank analysis appearing to identify a separate missile silo field under construction.

Researchers at the Federation of American Scientists, said they found what they characterize as ongoing efforts to build a missile silo field in China’s North Western frontier region of the Xinjiang. The images apparently show 14 silo construction sites. There are also 19 other sites where soil appeared to have been cleared in preparation for building work.

The article adds that the recent report comes weeks after experts from a US think tank said they detected signs that China was building a field of potentially 120 missile sites near the city of Yumen in the northwestern province of Gansu.

The think tank estimates that China has about 350 nucllear warheads compared to nearly 4000 warheads at the US and Russia each maintain.

China news has certainly started to become more of an impact of late. Internally, the country has clamped down on regulations and on China companies outside of their borders. That has led to sharp declines in Chinese indices over the last few days. There is also increasing tension between US and China on relations. This is just another story for the markets to worry about.

PRICE IS NOT THE ANSWER.

It’s all quite deceptive, really – I mean, they are called the markets, after all, and things are bought and sold there and not much else happens at all. So how can the markets not be about price, when price is all there is?

Here is my solution. The stock market is not the place for bargain hunting. It’s not a shop that has discounts. It’s not about value at all – it’s about price movement. It’s all in the moves. The trick is to discover just how you want the price action to look before you take the plunge and risk your cash.

This is by no means an easy thing to do. It can be extremely hard to buy a share that has just risen 30% from its lows, because we automatically tell ourselves that we missed a bargain. However, it’s vitally important to hear what that kind of price action is telling us. To me, that share is hollering that something very cool is going on. People are buying it – in fact way more people are buying it than selling it. And if there are more buyers than sellers, it’s gonna go up.

Now that is simple.

Major European indices end with declines today

Selling/profit-taking send indices lower

The major European indices are ending the day with declines. Global stocks have moved mostly lower with China getting hammered overnight once again. The NASDAQ index is sharply lower as well with declines close to 2% ahead of big tech earnings after the close including Alphabet, Apple, and Microsoft.

The provisional closes are showing:

- German DAX, -0.6%

- France’s CAC, -0.7%

- UK’s FTSE 100, -0.4%

- Spain’s Ibex,-0.76%

- Italy’s FTSE MIB, -0.8%

Looking at other markets as London/European traders look to exit:

- Spot gold is trading at $1801.30. That’s up $4.86 or 0.27%.

- Spot silver is down $0.58 or -2.37% at $24.59

- WTI crude oil futures are trading down the $0.78 or -1.08% at $71.41

In the US stock market, the NASDAQ index is gettingg hammered and down nearly 2%. The Dow industrial average and S&P index are also lower. The major indices have been up for five consecutive days and all three major indices have closed at record levels for the last three trading days.

- S&P index -37 points or 0.84% at 4385.03

- NASDAQ index -287 points or -1.94% at 14552.08

- Dow industrial average -200 points or -0.57% at 34942.29

US health officials to recommend some vaccinated people resume wearing masks

NYT report

- The US will recommend some vaccinated people resume wearing masks indoors under certain circumstances

From the NYT:

Reversing a decision made just two months ago, the Centers for Disease Control and Prevention is expected to recommend on Tuesday that people vaccinated for the coronavirus resume wearing masks indoors under certain circumstances.

This shift could be hurting sentiment today. We’ll wait for the CDC release for more details.

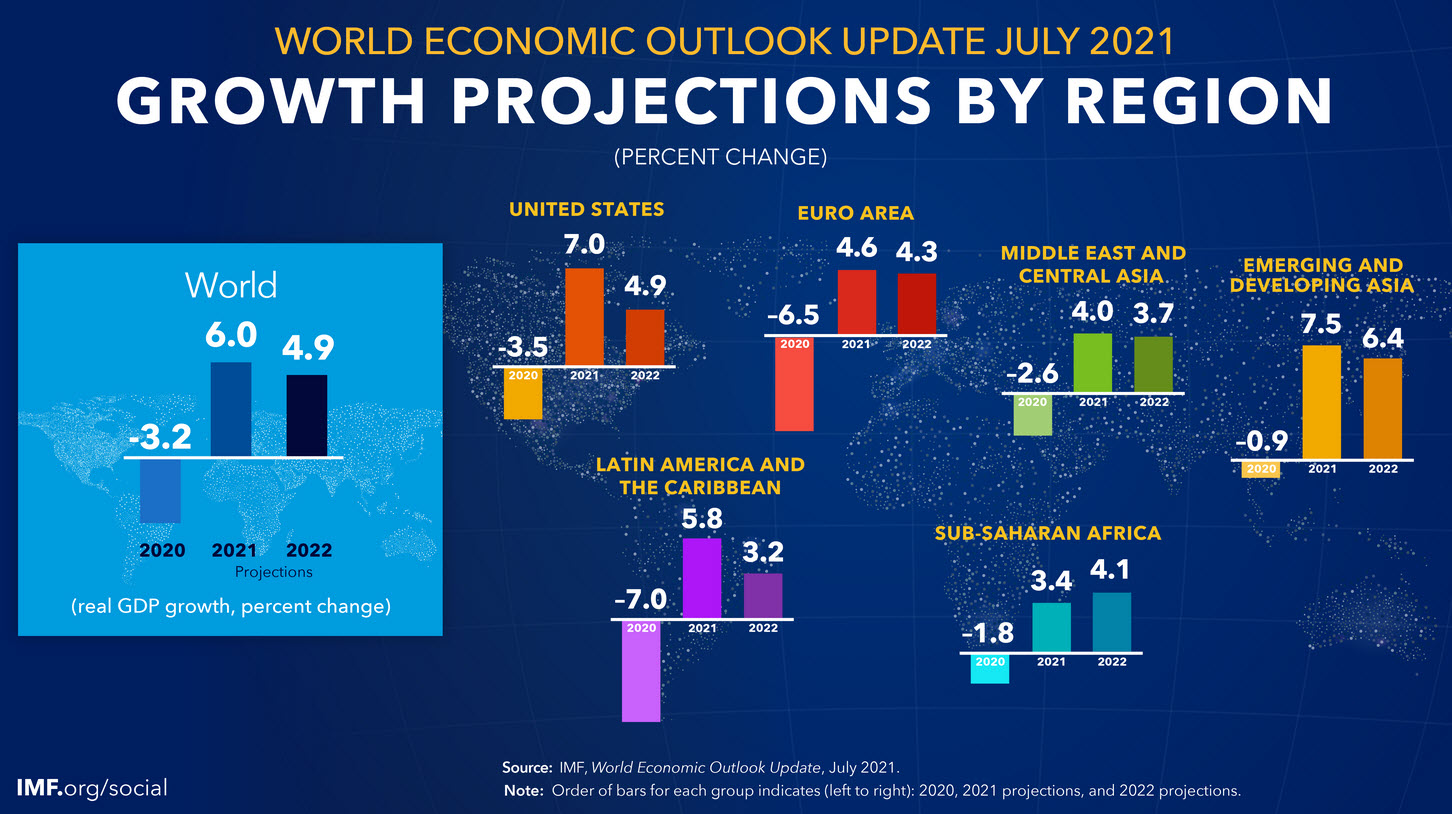

IMF leaves 2021 global GDP forecast at +6.0% with stronger US growth but weaker EM

The latest growth estimates from the IMF

- 2021 will be the strongest year since 1976

- 2022 GDP to 4.9% from 4.4%

- US growth to 7.0% vs 6.4% in April forecast; 2022 at 4.9% vs 3.5% prior

- Eurozone growth 4.6% vs 4.4% in April forecast; 2022 at 4.3% vs 3.8% prior

- Japan 2.8% vs 3.3% in April; 2022 3.0% vs 2.5% prior

- Canada 6.3% vs 5.0% prior; 2022 4.5% vs 4.7% prior

- China 8.1% vs 8.4% in April; 2022 at 5.7% vs 5.6% prior

- India 9.5% vs 12.5% in April; 2022 at 8.5% vs 6.9% prior

- UK 7.0% vs 5.3% in April; 2022 at 4.8% vs 5.1% prior

- Recent prices pressures reflect pandemic-related developments and transitory supply-demand mismatches

- New variants and lockdowns could shave 0.8 pp form 2021 and 2022 GDP growth

- Risks around the global baseline are to the downside due to vaccines rollout and inflation

- Full report

The IMF said divergences in developed and emerging economies primarily reflects access to vaccines and continued fiscal support. The headline from the report was ‘fault lines widen in the global recovery’.

Here’s a comment on inflation:

Despite a recent uptick in wage growth in the United States, wages of individuals-observed 12 months apart in the Atlanta Federal Reserve’s Wage Growth Tracker-do not indicate broader pressure in the labor market. Data from Canada, Spain, and the United Kingdom show similar patterns of broadly stable wage growth this year

They see three reasons that inflation will diminish:

- labor market slack remains substantial

- Inflation expectations are well anchored

- Structural factors

Offshore yuan weakens to fresh three-month lows, hurt by equities selloff

USD/CNH breaches the 6.50 barrier

The high today hit just over 6.52 as the offshore yuan falls to a low last seen since April against the dollar, hurt by the equities selloff in Hong Kong and China to start the week.

The sharp move in the yuan is likely the cause for some extended moves in FX to start the session, with the kiwi and aussie in particular weaker across the board.

AUD/USD is down 0.5% to 0.7430 while NZD/USD is dragged down 0.8% to 0.6950.

Amid the sharp selloff in Chinese equities, I don’t see officials tolerating a continued drop for too many days. That said, when you put things into context, even with the bloodbath this week the CSI 300 index is still 36% higher than its pandemic low.