Latest Posts

rssA few strategies that Roppel follows that the ones before him also implemented. From ‘How Legendary Traders Made Millions’

US jobs report next week highlights the week’s key events and releases

ISM data and jobs reports highlight the events next week

Monday will be the August 2nd and the start of a new month. That means the traditional ISM data, ADP employment, the US and Canada jobs reports.

Highlights on the economic calendar.

Monday (bank holiday in Canada)

- Japan consumer confidence 36.0 versus 37.4 last month

- German retail sales, estimate 1.9%

- German PMI final, 65.6 est

- UK PMI final, 60.4 est

- France PMI, 58.1 est

- Italy PMI final, 62.5 est

- US ISM manufacturing 60.8 versus 60.6 last month

Tuesday

- RBA rate statement. No change expected

- Spain’s unemployment change. Last -166.9 K

- Canada manufacturing PMI, last 56.5

- US factory orders, estimate 1.2% versus 1.7% last month

Wednesday

- New Zealand employment change, 0.7% quarter on quarter versus 0.6% last quarter. Unemployment rate 4.4% versus 4.7%

- Australia retail sales, -1.8% estimate versus -1.8% last month

- German final services PMI, 62.2 estimate

- France’s final services PMI 57.0 estimate

- UK’s final services PMI 57.8 estimate

- US ADP nonfarm employment change, 680K estimate versus 692K last month

- US ISM services PMI 60.5 versus 60.1 last month

Thursday

Major indices close lower led by Amazon and concerns about Covid variant

Stocks close near session lows

Highlights for the day:

- Dow S&P close lower for the third day in four sessions

- Major averages post weekly losses

- S&P has six straight monthly gain

- NASDAQ snaps two day win streak

- Dow S&P, NASDAQ post gains for July

Hurting the indices and market today was Amazon which fell -7.5% or $-269.94 after revenue shortfall and expectations towards lower revenue growth ahead.

Airlines also fell sharply with American Airlines down -3.73% and United Airlines down -3.63%. Concerns about Covid and restrictions starting to weigh on the airlines more.

The final numbers for the day are showing:

- Dow -149.45 or -0.43% at 34935.08

- S&P -23.88 points or -0.54% at 4395.27

- NASDAQ -105.59 points or -0.71% at 14672.68

- Russell 2000 -13.70 points or -0.62% at 2226.24

For the week:

- Dow fell -0.36%

- S&P index fell -0.33%

- NASDAQ index fell -1.11%

For the month:

- Dow rose 0.87%

- S&P index rose 1.8%

- NASDAQ index rose 1.04%

Thought For A Day

European major indices end the week in the red for the day

Down day for most indices today

Today, the major European indices are ending the week in the red. Looking at the provisional closes:

- German DAX, -0.5%

- France’s CAC -0.2%

- UK’s FTSE 100 -0.6%

- Spain’s Ibex, -1.25%

- Italy’s FTSE MIB, -0.6%

For the week,

- German DAX, -0.75%

- France’s CAC, +0.7%

- UK’s FTSE 100, +0.1%

- Spain’s Ibex, -0.5%

- Italy’s FTSE MIB, +1.1%

In other markets as London/European traders exit for the day:

- Spot gold is trading down $5.80 or -0.32% at $1821.60

- Spot silver is up to censor 0.08% at $25.52

- WTI crude oil is up $0.36 or 0.49% $73.75

- Bitcoin is trading at $39,040. That’s down $660 on the day

“If there is any proof that the Bundesbank legacy is dead, it is this: the last time inflation was 3.8%, the interest rate was 6%; today, it remains at 0% levels.”

Economic data coming up in the European session

Major currencies are mostly little changed to start the new day as the market stuck with the post-Fed narrative in trading yesterday. With month-end being a factor to consider today, we might not get much poise for market participants to really move the needle.

As such, the post-Fed tones may yet continue for the time being.

The greenback is experiencing its worst week since May and it has been a rough week overall but amid a retreat in risk sentiment on the day, the dollar may find a bit more of a footing going into the weekend.

Tech stocks in particular are not faring well after Amazon warned that its stellar growth during the pandemic is starting to wane. Nasdaq futures are down over 1% with S&P 500 futures down 0.7% as we look towards European trading.

Dow futures are also down 0.3%, so there is a broader retreat in risk so far today.

The resumption of the sharp fall in Hong Kong and Chinese stocks today also isn’t helping with the mood, as the latter is down by another 2% currently.

Looking ahead, there will be a slew of euro area data for the market to digest but they should all mostly reaffirm what we already know about economic conditions in the region.

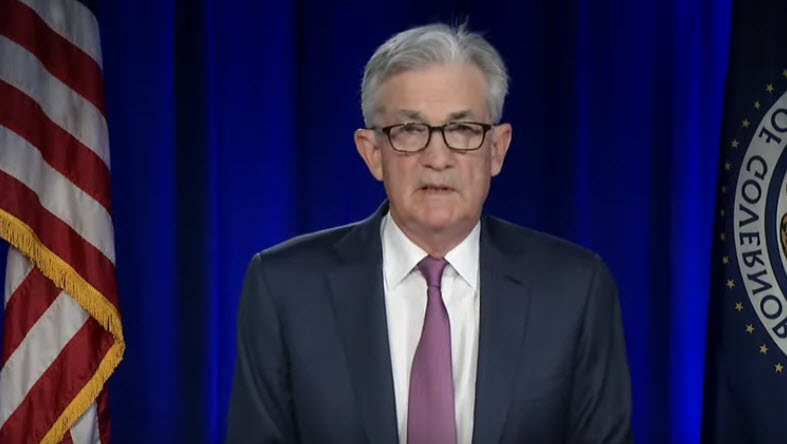

JP Morgan – FOMC seems to further reduce the chances of a September taper announcement

A snippet from JPM’s assessment of the FOMC statement and Powell’s news conference comments this week:

- the statements reference to ‘meetings’ (plural) would seem to further reduce the chances of a September taper announcement. In 2013. the FOMC statements didn’t begin to acknowledge progress toward their labour market goals until September, two meetings before the December taper announcement That template would seem to suggest that tapering could be announced at the November meeting.

- We continue to expect a December announcement, though we see a risk it could occur in November instead

Also, JPM says the developments from the meeting and presser:

- may have been a little more hawkish on tapenng, the overall message about the path of rates remains quite dovish

—

Earlier via Goldman Sachs on the FOMC this week, also tipping a December taper announcement.

Some of China’s key fertilizer companies to suspend exports

Chicken poo news via a statement from China’s National Development and Reform Commission (NDRC).

OK, kidding on the chicken poo.

Reuters with the report:

- temporarily suspend exports to assure the supply in the domestic market

- the fertilizer firms, which are not named, were summoned by the NDRC for a discussion against hoarding and speculation