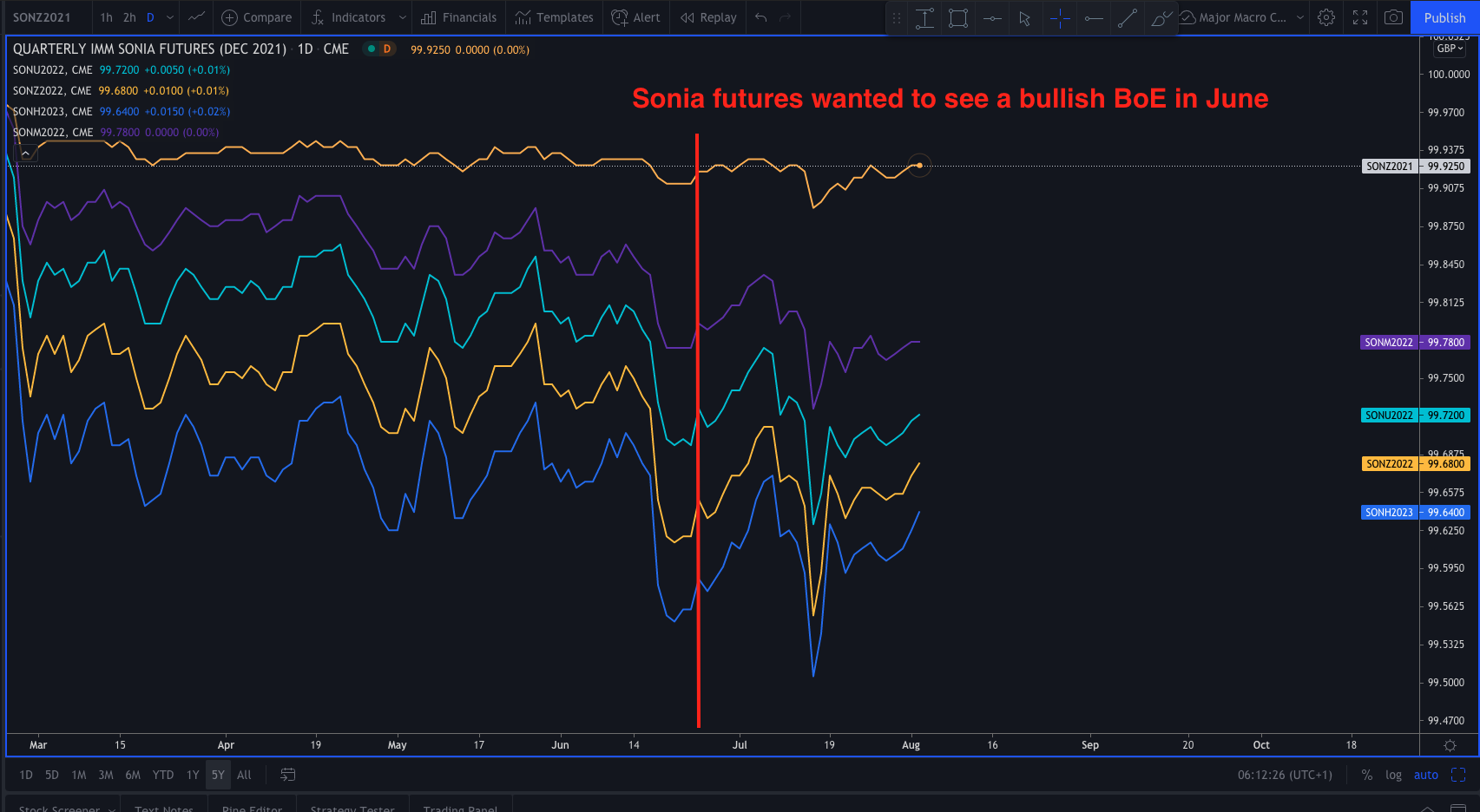

BOE lowers policy rate threshold to unwind QE

The pound is little changed after the announcement following a bit of a small whipsaw but before we dive into price action and implications for the currency, let’s take a look at what the BOE served up in its August monetary policy meeting.

Saunders the sole dissenter

A 6-2 vote on QE was expected with Ramsden and Saunders pinned for the dissenting camp but instead it was only the latter that really walked the talk. While 7-1 seems more dovish on paper, it really isn’t since that this wasn’t a game changer whatsoever.

QE taper?

Well, with no change to gilts purchases, any tapering even starting from September until the year-end would be relatively small so this would be more for the optics rather than any actual implications on adding to the balance sheet really.

Growth forecasts maintained, inflation seen as ‘transitory’

In essence, there is no change to the economic outlook by the BOE for the most part. They see inflation running as high as 4% in Q4 and responds with “some mild tightening of monetary policy is likely to be required”.

Although, they are still viewing that such price pressures are temporary.

UK banks are ready for negative rates, if it comes

Well, this scenario is basically a non-factor at this point but good to know I guess.

BOE to unwind QE when bank rate hits 0.50%

That is lower from the previous threshold of 1.50% and that means policymakers are going to lean more towards quantitative tightening to do the heavy lifting.

While the bank rate will also gradually be lifted should economic conditions allow for it, the BOE seems more focused to reduce its balance sheet and I don’t see that as being an overbearingly bullish signal from the central bank honestly.

A lower threshold means they could keep rates more anchored while leaning on quantitative tightening, so there’s that possibility to consider when viewing the situation.

And as we all know, rate differentials are a key element in currency trading.

What does this do for the pound?

I don’t think it does much really. The BOE is sticking with its plan for the most part for now and we will have to see how economic developments progress in the months ahead to be certain of the pace and conviction of the central bank’s tightening plans.

QE will naturally come to an end by year-end and a rate hike is surely to follow after that.

But how much more beyond that largely depends on the sustainability of the UK’s economic recovery, even if inflation is testing policymakers’ patience.

We are already getting a sense that growth expectations on the reopening have peaked at the end of Q2. So, can the UK sustain a more robust recovery until year-end? And the more pressing question, can it carry over to next year to support more rate hikes?