Latest Posts

rssSatoshi Nakamoto’s rough draft of the #Bitcoin source code called it the “timechain”, not “blockchain”.

If you look at 15 min, 1h, 4h, daily chart $DXY looks bearish, but if you ZOOM OUT. You can see that $DXY looks bullish. .

What now FED? Print more? Taper? Mfers are trapped.

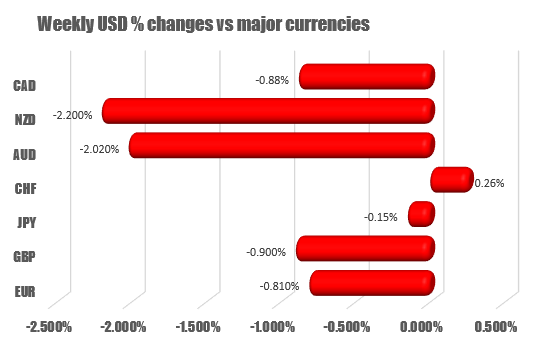

The USD falls vs all the major currencies this week except one

USD falls the most vs the NZD

The USD fell versus all the major currencies is weeks with the exception of one…the CHF.

The US dollar fell the most versus the NZD and AUD as those currencies benefited from risk on sentiment, somewhat improving China and expectations that as Covid spread slows, central banks would start to look toward reversing some of the expansionary policy.

After trading sideways on Monday, the NZDUSD rose on each successive day this week. The pair has risen 9 of the last 11 trading days.

Versus the AUDUSD, the pair was modestly lower on Monday, before also rising on each successive day this week.

For the USDCHF, last Friday, the pair closed near the low for the week. After trying to extend lower early in the session on Monday, the pair moved sharply higher. That moment it was reversed on Tuesday before rallying up to the weeks high on Wednesday and moderating lower on Thursday and again today. Overall, the week was full of up and down price action with only an 88 pip trading range.

The US stocks close mixed. Nasdaq close today is yet another record

&P and NASDAQ close lower

The major indices are closing mixed with the Dow and S&P lower, while the NASDAQ close higher and at a another record. The gain in the NASDAQ was the third gain in a row.

- S&P and NASDAQ have the second straight weekly gain

- Russell 2000 snapped a three day win streak

- Dow lower for the fourth time in five sessions this week

The final numbers are showing:

- S&P -1.44 points or -0.03% at 4535.50

- Dow -74.73 points or -0.21% at 35369.09

- NASDAQ up 32.34 points or 0.21% at 15363.50

- Russell 2000 fell-11.97 points or -0.52% at 2292.05

Looking at the S&P sectors,

- Technology +0.4%

- Healthcare, +0.1%

- Communications unchanged

- Real estate unchanged

The decliners today included:

- Utilities -0.8%

- Materials -0.7%

- Industrials -0.6%

- Financials -0.6%

For the week,

- Dow industrial average fell -0.24%

- S&P index rose 0.59%

- NASDAQ index rose 1.55%

Thought For A Day

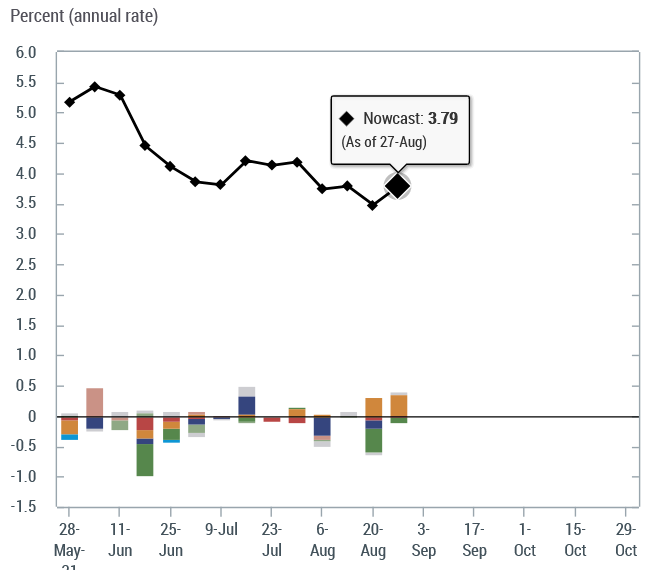

New York Fed suspends GDP Nowcast model

Blames volatility in the data

After forecasting 3.8% GDP growth in last week’s report, the NY Fed has suspended the data tracker — likely because it would have shown something much lower this week.

The uncertainty around the pandemic and the consequent volatility in the data have posed a number of challenges to the Nowcast model. Therefore, we have decided to suspend the publication of the Nowcast while we continue to work on methodological improvements to better address these challenges.

There’s no word on when it will resume.

European equity close: Weak finish leads to a flat week

Closing changes for the main European bourses:

- UK FTSE 100 -0.4%

- German DAX -0.4%

- French CAC -1.0%

- Italy MIB -0.5%

- Spain IBEX -1.8%

On the week:

- UK FTSE 100 -0.15%

- German DAX -0.5%

- French CAC +0.1%

- Italy MIB +0.3%

- Spain IBEX -0.7%

The DAX looked like it was going to go on another run a month ago but it’s flatlined since. Weekly chart:

FDA tells White House to scale back plans to offer boost shots

FDA wants more time to review data

The New York Times reports that officials have told the White House to scale back plans to offer covid booster shots to the general public by Sept 20.

The FDA warned it might only recommend boosters for Pfizer vaccine recipients and possibly only some of them to start. On Moderna, the report says this:

Among the reasons for delaying is that regulators need more time to decide the proper dosage for a possible third Moderna shot. The company’s application asking the F.D.A. to authorize a booster shot contains insufficient data, one federal official familiar with the process said.

The FDA hasn’t received the raw data from Israel, which is already delivering third doses to everyone.